Disappointing economic data out of China weighed on oil prices on Tuesday morning, with markets unsure if current government intervention is enough to rejuvenate the country's economy.

Chart of the Week

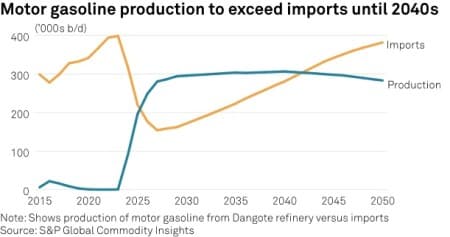

- In the three months since Nigeria’s President Bola Tinubu scrapped the country’s $10 billion fuel subsidy, the African country’s gasoline demand has halved to 35-40 million liters amidst tripling gas prices.

- With this, one of the key gasoline export outlets of European gasoline has greatly shrunk in volume and the upcoming launch of the 650,000 b/d Dangote refinery will exacerbate the arbitrage even more.

- Dangote, so far mired in delays and cost overruns, will become by far the largest refinery on the African continent once it is commissioned in late 2023, eliminating Nigeria’s need for imported fuel.

- Nigeria’s gasoline imports declined to a "mere” 230,000 b/d last month according to Kpler data, down from 480,000 b/d in February, and should fall to zero once Dangote reaches full capacity and produces 330,000 b/d of the light distillate.

Market Movers

- The UAE’s national oil company ADNOC indicated it’s prepared to boost its takeover offer for German chemicals giant Covestro (ETR:1COV) to almost $13 billion, a premium of 25% to the company’s value.

- US natural gas producer Chesapeake (NASDAQ:CHK) sold its remaining Eagle Ford assets to SilverBow Resources (NYSE:SBOW) for $700 million, completing its exit from the basin after $3.5 billion worth of divestments.

- China’s national oil company CNPC (SHA: 601857) secured a $200 million drilling contract with Iraq to boost production at the country’s largest oilfield Rumaila, the largest upstream deal the Chinese firm had in 5 years.

Tuesday, August 15, 2023

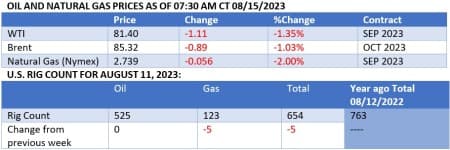

The middle of August usually sees the lowest level of crude oil trading, both on the physical and paper sides. This month is no exception, with very little in the way of strong pricing signals and the key benchmarks mostly trending sideways. China has provided some bearish sentiment, however, with a further slowdown in industrial output weighing on oil prices on Tuesday morning. The Chinese Central Bank’s cutting of corporate lending rates to 2.5% helped to offset some of that downward pressure, but both WTI and Brent had fallen by more than 1% on Tuesday morning.

US Shale Set to Decline Again in September. The US Energy Information Administration expects oil and natural gas production from the country’s shale-producing regions to 9.41 million b/d and 98.3 billion cubic feet per day, respectively, the second month-on-month decrease in a row.

Hormuz Strait Set for Tensions Flare-up. The US Navy warned vessels transiting the Strait of Hormuz they should steer clear of Iranian territorial waters to avoid possible seizures in the key passageway, home to 21% of global flows, with four tankers already detained by the Iranians in 2023 so far.

UN Averts Red Sea Environmental Catastrophe. The United Nations completed the removal of more than 1 million barrels of oil from the decaying supertanker Safer, idled off Yemen’s Red Sea coast, averting a catastrophe after it managed to raise $120 million for the operation.

Summer Demand Keeps Chinese Runs High. Data from China’s National Bureau of Statistics shows refinery throughputs came in at 14.87 million b/d in July, up 17.4% year-on-year and the third-highest reading on record, as robust summer travel kept domestic demand elevated.

Mountain Valley Pipe Clears Last Roadblock. A US Circuit Court of Appeals in Virginia rejected an environmentalists’ challenge to federal approvals for the $6.6 billion Mountain Valley natural gas pipeline built by Equitrans Midstream (NYSE:ETRN), paving the way for a final regulatory blessing.

Diesel Becomes Hedge Funds’ Favourite Bet. Buoyed by low stocks, money managers and other portfolio investors have bought middle distillates in 12 of the most recent 14 weeks, adding another 10 million barrels of futures and options in US and European diesel in the week ending August 08.

Shell Resumes Key Nigerian Project’s Exports. Following a month-long disruption to oil exports from Nigeria’s key crude terminal Forcados, liftings have resumed again as project operator Shell (LON:SHEL) managed to contain to what appears have been an oil leak at the export facility.

Oxy Becomes the US’ DCC Champion. The US Department of Energy pledged $1.2 billion in federal grants to two direct carbon capture projects in Texas and Louisiana that could remove up to 2 million tonnes of emissions, one of which is Occidental’s (NYSE:OXY) South Texas DAC Hub.

India Starts Paying for Crude in Rupees. For the first time on record, an Indian refiner settled the purchase of crude oil from the United Arab Emirates in the local currency, the Indian rupee, with India’s national oil company IOC (NSE:IOC) paying ADNOC for a 1-million-barrel delivery.

Risks of High Hurricane Activity Increasing. The US National Oceanic and Atmospheric Administration revised its outlook for the 2023 Atlantic hurricane season, saying there’s a 60% likelihood of an above-normal season with as many as 21 named storms popping up between June and November.

Chinese Market Sees EV Race to the Bottom. Several producers of electric vehicles have lowered their EV prices in China, with Tesla announcing a two-month $1,100 subsidy for its Model 3 car as its sales fell to 64,000 units in the country last month, a whopping 31% decrease from June numbers.

Libya Wants to Spur Domestic Upstream Bonanza. Libya’s national oil company NOC wants to offer local Libyan firms upstream licenses to develop already discovered small fields that it doesn’t have the capacity to work on, seeking to boost production capacity to 2 million b/d.

Iran Fires Up South Pars Phase 11. Apart from ramping up crude oil production to 3.2 million b/d, Iran also stated it had launched production from the long-delayed phase 11 of the super-giant South Pars gas field, with initial flows coming at a rate of 10-12 million cubic meters per day.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Carbon Capture Financing Is Finally Taking Off In The U.S.

- U.S. Steel Stock Skyrockets After Declining Major Merger Proposal

- UK Oil Boiler Ban Sparks Debate