Breaking News:

Chinese Mining Operations in Tajikistan Spark Environmental Backlash

Chinese mining and agricultural companies…

Physical Oil Market Hints at Potential Upswing

Oil prices could break to…

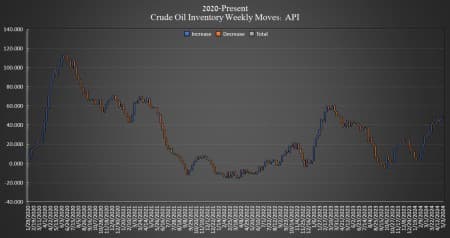

API Reports Small Builds in Crude, Fuel Inventories

Crude oil inventories in the United States rose this week by 509,000 barrels for the week ending May 3, according to The American Petroleum Institute (API). Analysts had expected a 1.430 million barrel draw.

For the week prior, the API reported a 4.906 million barrel build in crude inventories.

On Tuesday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 0.9 million barrels as of May 3. Inventories are now at 367.2 million barrels—the highest point since last April, but well below the 656 million barrels in inventory in June 2020.

Oil prices were trading relatively flat ahead of the API data release on Tuesday as the market weighs the possibility that OPEC will continue its production cuts beyond June against uneventful economic data and geopolitical risks.

At 4:16 pm ET, Brent crude was trading down $0.04 on the day at $83.29—more than $4 per barrel lower than this time last week. The U.S. benchmark WTI was trading slightly up on the day at 0.09% to $78.55—down roughly $3 per barrel from this time last week.

Gasoline inventories rose this week by 1.46 million barrels, countering last week’s 1.48 million barrel drop. As of last week, gasoline inventories were about 3% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories also rose this week, by 1.713 million barrels, mostly offsetting last week’s 2.187-million-barrel dropoff. Distillates were 7% below the five-year average for the week ending April 26, the latest EIA data shows.

Cushing inventories rounded out the builds this week, according to API data, gaining 1.339 million barrels after increasing by 1.479 million barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- A Beginner's Guide to Geoengineering

- Large Crude Inventory Build Rocks Oil Prices

- OPEC Resolves Compensation Plans for Overproducing Members

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B