Breaking News:

Oil Moves Higher on Crude, Fuel Inventory Draw

Crude oil prices ticked higher…

Venezuela Has a Natural Gas Problem

Venezuela's natural gas production has…

Lack Of Wind Leaves UK Turbine Investors Short-Changed

It’s been a stifling summer of disappointment for investors in the UK’s wind farms, which a heatwave has put at a standstill that’s seen a major drop in power generation eat away at millions of pounds in profits.

As a prolonged ‘wind drought’ ensues, British energy giant SSE has announced an £80-million (around $104 million) reduction in quarterly profits, with both offshore and inland wind farms experiencing 15 percent lower output than originally anticipated.

SEE also said that electricity output from hydropower stations was 20 percent lower than expected.

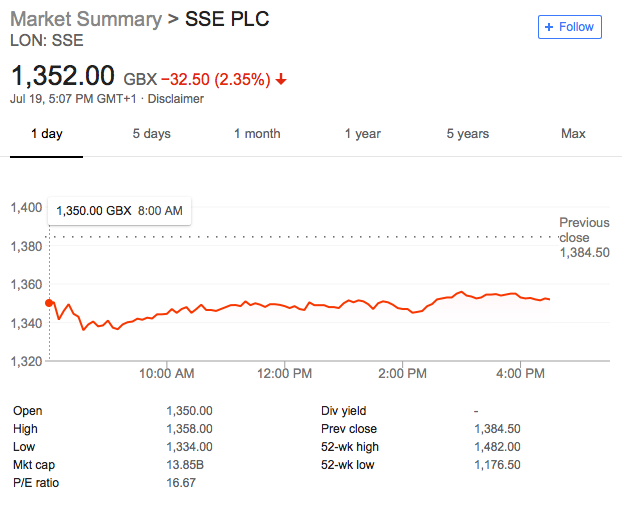

The dismal numbers from the company’s first fiscal quarter indicated to investors that the full-year results may also take a hit, prompting share prices to plunge more than percent to £13.50 on Thursday.

"This new financial year has so far been characterised by lower than expected output of renewable energy and persistently high gas prices, but looking ahead, we are very focused on fulfilling our obligations to energy customers and delivering on our key priorities,” SEE CEO Alistair Phillips-Davies said, as reported by the BBC.

The country’s National Grid noted a 30-percent drop in wind generation in recent weeks.

“Between 4th June and 15th July wind generation was around 30 percent lower compared to the same period last year. Electricity demand is low and we’re comfortable with the level of spare generation we have available,” grid authorities said in a statement.

Related: Oil Prices Rebound As Saudis Expect Reduced Exports In August

While the SSE financials and the stifling, windless weeks that have highlighted the intermittent nature of generating electricity by wind have revived criticism in the UK of subsidies for these projects, recent surveys still show that a majority of Britons support the renewables push.

Onshore wind farms have been a cause of debate, with government policies rendering the construction of onshore turbines highly bureaucratic, with reports saying that new applications for wind farms have dropped by 94 percent since new rules were introduced in 2015.

But offshore, things are booming. So much so that the UK offshore wind energy industry is expected to see total investment between 2017 and 2021 hit £18.9 billion (about $24.6 billion), according to RenewableUK. That would place the country ahead of Germany, China, and the United States for offshore wind.

In the meantime, the price of natural gas has increased as more is being burned to fill in the gap from less wind power, Reuters reported.

By Damir Kaletovic for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Sector Under Fire In Libyan Corruption Crackdown

- Trump Tariffs Could Delay Permian Relief

- China Just Doubled Oil Shipments To North Korea

Damir Kaletovic

Damir Kaletovic is an award-winning investigative journalist, documentary filmmaker and expert on Southeastern Europe whose work appears on behalf of Oilprice.com and several other news…

-

UK has some of the highest electricity costs on the planet thanks to wind and solar. High cost electricity means fewer jobs and a poorer population.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B