Breaking News:

5 Highest Paying Oil & Gas Dividend Stocks for This Summer

Income investors hunting for a…

Grid-Enhancing Technologies: The Answer to Growing Power Needs?

Grid-enhancing technologies offer interim solutions…

Is The Virus-Induced Oil Price Slide Finally Over?

Oil prices rose slightly on Tuesday, changing course after a brutal few days in the wake of the deadly Coronavirus that has threatened the markets the world over.

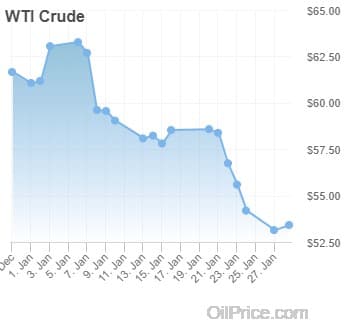

Oil prices slid for five straight days, with WTI falling $5 per barrel from $58.58 a week ago Monday, to $53.14 yesterday. But the US benchmark price inched up slightly on Tuesday, to $53.40, suggesting that the worst of the market selloff courtesy of the Coronavirus could possibly be behind us.

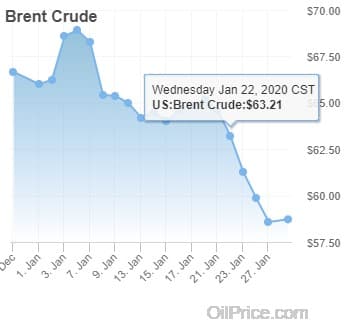

Brent prices fell nearly $7 per barrel, from $65.20 a week ago Monday, to $58.58 yesterday.

While oil prices appear to have stopped falling, the virus is still on a tear, reaching more than 10 countries with over 100 lives lost, nearly 5,000 infected, and travel severely restricted in and out of certain regions in China—a fact which has sparked fear that oil demand could be dented as a result of the subdued economic activity and plethora of canceled flights.

And on Tuesday, the CDC announced that in conjunction with the US State Department, that travelers avoid “unnecessary travel to China.”

Oil demand concerns were already at the forefront of the oil market for most of last year, and this new hitch has been more than major outages in Libya could offset. Until now, demand for jet fuel in China has remained healthy.

Some oil stocks had also stopped this week’s brutal slide on Tuesday, with ConocoPhillips, Phillips 66, EOG Resources, Exxon, Total, Chevron, and Occidental all clawing back some of their previous losses.

BP, Shell, and Hess, however, were still trading down on the day as of Tuesday afternoon.

In a press conference on Tuesday, the CDC’s Health Secretary Alex Azar warned Americans that “This is a very fast moving, constantly changing situation,” adding that “part of the risk we face right now is that we don’t know everything we need to know about this virus.”

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- The Fight For Venezuela’s Oil Is Heating Up

- Traders Increase Short Interest In Big Oil Stocks

- 5 Niche Energy ETFs You’ve (Probably) Never Heard Of

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

There are, however, suspicions that among those making frenzied claims about global oil demand and loss of 0.5%-1.0% of China’s GDP as a result of the outbreak are some commodities traders and investment banks who are fast buying crude at reduced prices to make a kill later when oil prices recoup all their recent losses.

Before the outbreak, the fundamentals of the global oil market were positive pushing oil prices upward particularly in the aftermath of the signing of Phase 1 of the trade deal between the U.S. and China. The proof is that China’s crude oil imports broke all previous records and hit 11.76 million barrels a day (mbd) in December.

The outbreak is therefore an aberration. Oil prices will soon recoup all their losses and resume their surge.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London