|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 12 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 19 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 19 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 19 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 19 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

A Volatile Week for Oil Prices

A very volatile week for…

Physical Oil Market Hints at Potential Upswing

Oil prices could break to…

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

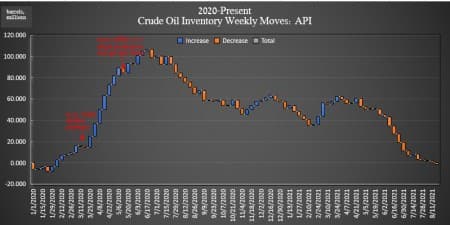

Disappointing Crude Draw Threatens Shaky Oil Rally

By Julianne Geiger - Aug 24, 2021, 3:39 PM CDTThe American Petroleum Institute (API) on Tuesday reported a draw in crude oil inventories of 1.622 million barrels for the week ending August 20, bringing the total 2021 crude draw so far to more than 58 million barrels, using API data.

Analysts had expected a loss of 2.367 million barrels for the week.

In the previous week, the API reported a draw in oil inventories of 1.13 million barrels—a loss smaller than the 1.259 million barrel draw that analysts had predicted.

Oil prices began to rise on Monday and continued on Tuesday, staunching the bleeding from the previous seven-day streak of losses as concerns about demand began to deescalate.

WTI gained more than 3% on Tuesday afternoon leading up to the data release.

At 3:20 p.m. EST, WTI was trading at $67.75 a more than $1 gain on the week. Brent crude was trading up 3.58% for the day at $71.21.

While U.S. crude oil stocks continue their decline, U.S. oil production rose for the second week in a row to 11.4 million bpd—an increase of 100,000 bpd for the week.

The API reported a draw in gasoline inventories of 985,000 barrels for the week ending August 20—compared to the previous week's 1.1979-million-barrel draw.

Distillate stocks saw a decrease in inventories this week of 245,000 barrels for the week, compared to last week's 502,000-barrel increase.

Cushing inventories fell this week by 485,000 barrels, after last week's 1.735-million-barrel decrease.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Europe Faces LNG Supply Crunch

- Brent Climbs Back Above $70 On Major Production Outage

- ‘Skimming Stones’ Pattern Shows Wall Street Is Wrong About Oil

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com