Breaking News:

Harris Presidency Will Be Bad News for Oil

In the case of a…

Palestinian Political Factions Agree to Reconciliation Government

Palestinian factions Hamas and Fatah…

Borr Drilling Looks To Buy Paragon Offshore

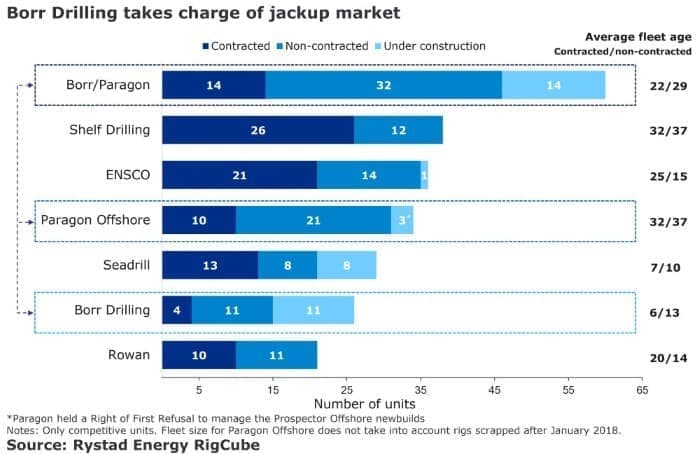

Borr Drilling announced its intention to acquire Paragon Offshore after inking a binding tender agreement to purchase all outstanding shares for US$232.5 million. With the acquisition, Borr gets their hands onto 31 jack-ups and one semisubmersible unit. With these and its existing fleet of 26 jack-ups, Borr will become the largest jack-up owner in the world, with 57 jack-ups in total. The company will also be the second-largest provider of offshore rigs, measured in fleet size, just four units behind the newly-merged Ensco-Atwood. This move brings together the fourth and sixth largest jack-up providers to create an entity controlling 10% of the world’s jack-ups.

“It is remarkable what Tor Olav Troim has achieved in such a short amount of time. Going from two jack-ups in December 2016 to becoming the largest jack-up provider shows how Troim has been able take the lead and orchestrate the establishment of his second major drilling company. First it was Seadrill with John Fredriksen and now Borr,” says Oddmund Føre, vice president of oilfield service research at Rystad Energy.

However, Borr is not expected to keep all the acquired assets live. Several of the jack-ups in Paragon’s fleet are candidates to be scrapped as they are more than 40 years old and are already cold stacked. Paragon has an additional four rigs which are cold stacked and older than 35 years old. Eight jackups from Paragon’s fleet have been scrapped since January 2018 and it is likely that the remaining older units will follow. Paragon Offshore also held a Right of First Refusal to manage the three jackups from Prospector Offshore’s fleet which were in the shipyard at the time Paragon filed for bankruptcy.

Related: Has OPEC Been Too Successful?

“Borr’s strategy has always been to consolidate the jack-up market and focus on operating modern high-spec rigs. Hence, they put a very low value on the older rigs which is reflected in the transaction price,” says Føre.

Even though Borr might shed many of the rigs acquired, they will still be a leading provider of premium jack-ups, with 24 units built after 2000.

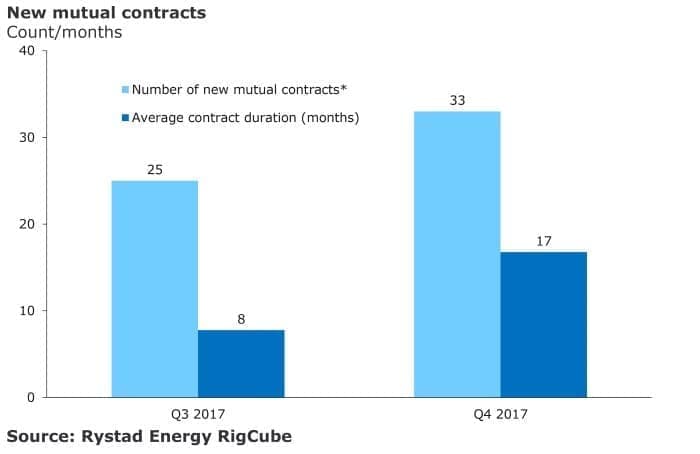

“The timing is perfect for Borr Drilling as the signs of a recovering market are starting to appear. Contracted utilization for jack-ups has been holding steady at the low to mid-50% level since early 2017, but during fourth quarter 2017 we saw an increase in new mutual contracts, contract durations, and leading edge day rates for premium jack-ups,” says Føre.

More Top Reads From Oilprice.com:

- Is Nigeria Breaking Its Promise To OPEC?

- Saudi Arabia Wants $70 Oil

- Frac Sand Shortage Threatens Shale Boom

Rystad Energy

Rystad Energy is an independent energy consulting services and business intelligence provider offering global databases, strategic advisory and research products for energy companies and suppliers,…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B