|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 11 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 18 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 18 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 18 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 18 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

China's Rare Earths Strategy, Explained

China's recent discovery of new…

What Does Von der Leyen’s Re-Election Mean for Europe’s Future?

Ursula von der Leyen, a…

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

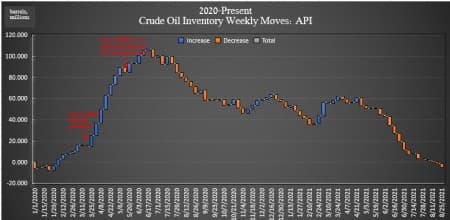

API Reports Larger-Than-Expected Crude Draw Ahead Of Key OPEC Meeting

By Julianne Geiger - Aug 31, 2021, 3:46 PM CDTThe American Petroleum Institute (API) on Tuesday reported a large draw in crude oil inventories of 4.045 million barrels for the week ending August 27, bringing the total 2021 crude draw so far to more than 62 million barrels, using API data.

Analysts had expected a loss of 2.833 million barrels for the week.

In the previous week, the API reported a draw in oil inventories of 1.622 million barrels—a loss smaller than the 2.367 million barrel draw that analysts had predicted.

Oil prices fell on Tuesday leading up to a critical OPEC meeting on Wednesday that will essentially decide the short-term fate of the oil market. OPEC will review the merits of its plan that calls for an additional 400,000 barrels of oil production per day to be returned to the market each month.

WTI fell 0.59% on Tuesday afternoon leading up to the data release.

At 12:28 p.m. EST, WTI was trading at $68.80—a $1 gain on the week. Brent crude was trading down 0.56% for the day at $73.00.

While U.S. crude oil stocks continue their decline, U.S. oil production stayed at 11.4 million bpd for the second week in a row.

The API reported a build in gasoline inventories of 2.711 million barrels for the week ending August 27—compared to the previous week's 985,000-barrel draw.

Distillate stocks saw a decrease in inventories this week of 1.961 million barrels for the week, compared to last week's 245,000-barrel decrease.

Cushing inventories rose this week by 2.128 million barrels, after last week's 485,000-barrel decrease.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Could Be Primed For Up To 50% Rally, Strategist Says

- Fujairah Oil Terminal To Upgrade As Crude Trade Is Expected To Surge

- Oil Stages Strong Recovery

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com