Breaking News:

Tesla to Focus on Autonomy and AI as Earnings Disappoint

Tesla is facing a slowdown…

U.S. is Facing a Major Energy Crunch Due to AI's Insatiable Demand

The rapid growth of artificial…

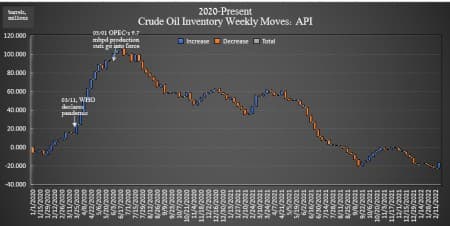

API Reports First Crude Build In Five Weeks

The American Petroleum Institute (API) estimated the inventory build this week for crude oil to be 5.983 million barrels after analysts predicted a build of 767,000 barrels.

U.S. crude inventories have shed some 73 million barrels since the start of 2021 and about 16 million barrels since the start of 2020. Global crude stockpiles are also low.

In the week prior, the API reported a draw in crude oil inventories of 1.076 million barrels after analysts had predicted a larger draw of 1.769 barrels.

Oil prices were mixed on Wednesday in the run-up to the data release on profit-taking after Tuesday's big price spike following Russia's official recognition of separatist regions of Ukraine as independence and subsequent movement of Russian troops into those regions. Ultimately, the United States slapped sanctions on Russia following those actions.

WTI was trading up 0.05% at $91.96 per barrel on the day at 1:23 p.m. EST—and flat on the week. Brent crude was trading down 0.12% on the day at $96.72 per barrel on the day—but up nearly $3 per barrel on the week.

U.S. crude oil production held steady in the most recent reporting week. For the week ending February 11—the last week for which the Energy Information Administration has provided data—crude oil production in the United States stayed at 11.6 million bpd. This is down 1.5 million bpd from the pre-pandemic era.

This week, the API reported a build in gasoline inventories at 427,000 barrels for the week ending February 18—compared to the previous week's 923,000-barrel draw.

Distillate stocks saw a decrease in inventory of 985,000 barrels for the week, after last week's 546,000 barrel decrease. Cushing saw a 2.066 million-barrel decrease this week. Cushing inventories stood at 25.8 million barrels as of February 11 and declining—down from 60 million barrels at the start of 2021, and down from 37 million barrels at the end of 2021.

At 4:47 pm, EST, WTI was trading at $92.26, with Brent trading at $97.00

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Russia Speaks Out Against High Oil Prices As Brent Nears $100

- Australia Eyes Key Role In Booming Asian LNG Market

- An Increase In Polysilicon Production Could Help Curb Solar Power Prices

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B