The life of Middle Eastern national oil companies was just too good to continue as previously, raking in unbridled profits amidst triple-digit oil prices. September 2022 is unlikely to change anything in the grand scheme of things, however now more than ever this year, fears of demand destruction have been plaguing macroeconomic forecasts and consumption algorithms. With the United States already in technical recession and the European Union set to join it once Q3 ends, there is not much prospect for growth globally, as China, too, struggles to kick-start economic growth again. Falling outright prices have coincided with flattening futures curves, all the while Libya has come back (even if it turns out to be a temporary comeback) and Iran is drawing nearer to some semblance of a deal breakthrough. Hence, September pricing is most likely set to be the last month when Middle Eastern NOCs can still be assertive.

Chart 1. Saudi Aramco’s Official Selling Prices for Asian Cargoes (vs Oman/Dubai average).

Source: Saudi Aramco.

Saudi Aramco lifted all its Asian prices for September 2022 yet showed a great deal of caution whilst doing so. As the Dubai front-to-third-month spread added another $1.75 per barrel in July, the expectation was that the increases would be around that level, too. Of course, with recession fears becoming a staple of the global narrative and with Chinese demand taking its time to rebound from its lockdown woes, there were plentiful reasons pointing towards a potential downside. To which one would naturally object that Aramco is naturally assertive in its pricing, why would it deprive itself of potential revenue? However, it is exactly what the world’s largest NOC did, with month-on-month increases constrained at $0.30-0.80 per barrel, with the largest stream – Arab Light – only being hiked by $0.50 per barrel. Despite the caution, the September OSPs mark the highest formula prices on record for most grades sold into Asia, surpassing previous highs from May 2022.

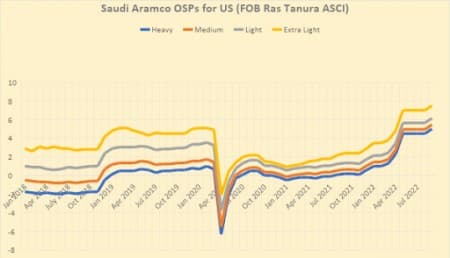

Chart 2. Saudi Aramco’s Official Selling Prices for US-bound cargoes (vs ICE Brent).

Source: Saudi Aramco.

European prices turned out to be quite confusing as by far the largest stream going into Europe, that of Arab Light, will see a decrease of $0.60 and $0.40 per barrel for NW Europe and the Mediterranean, respectively. This stands in contrast with Arab Medium or Arab Heavy, both of which were hiked across the continent vs August 2022, despite being in much lower demand in Europe generally. Perhaps even more interesting were changes in prices for US-bound cargoes, with Saudi Aramco bucking the trend of rolling over the same differentials since May 2022 and increased all formula prices by $0.50 per barrel. Insinuating that this might be another micro-episode in the ill-feeling between MBS and the Biden Administration, the ratcheting up of prices comes amid record lows in total Saudi flows towards US buyers, half of what they were in spring months at approximately 250,000 b/d. Related: Two Oil Price Crashes Later, Shale Investors Are Finally Being Paid

Chart 3. ADNOC Official Selling Prices for July 2022 (set outright, here vs Oman/Dubai average).

Source: ADNOC.

Following the marked sell-out of crude contracts and the concurrent drop in flat prices, the IFAD-set official selling price for Murban, the UAE benchmark, in September 2022 moved to $105.96 per barrel, almost $12 per barrel down month-on-month. Above and beyond recession fears, Emirati pricing is subjected to various pressures. On the one hand, exports have started to stagnate after almost a year of surprisingly consistent increments, only slightly below the 3 million b/d mark according to Kpler data, attesting to ADNOC’s stellar performance in keeping its OPEC+ commitments. On the other hand, the appeal of light sweet grades such as Murban is slowly waning in Asia, with the Murban-Dubai spread losing some $1.5 per barrel over July, a sign that difficult crudes are back in vogue as the light distillates lose steam. This can also be seen in a marginal reversal in medium sour Upper Zakum prices, which were increased $0.20 per barrel to a $3 per barrel discount to Murban.

Chart 4. Iraqi Official Selling Prices for Europe-bound cargoes (vs Dated Brent).

Source: SOMO.

The Iraqi state oil marketer SOMO has kept its Asian pricing policy in line with the Saudis, hiking the September OSP of Basrah Medium by $0.60 per barrel, taking it to a premium of $5.10 per barrel over the Oman/Dubai average. The Iraqi grade’s immediate peer Arab Medium saw an equivalent month-on-month increase, keeping the spread between the two at a hefty $2.65 per barrel. In fact, even heavier Arab Heavy is having a formula price higher than Basrah Medium, indicating that Baghdad seeks to build up a reputation of a more buyer-friendly Middle Eastern exporter. Meanwhile, Iraqi production continues to increase. According to SOMO self-reported figures, output rose to 4.584 million b/d in July, up 70,000 b/d compared to June figures. Despite the uptick in production, exports have gone down over the summer months, most probably due to higher crude burn rates recently as the country is trying to avoid aggravating its power cuts in peak summer demand.

Chart 5. Comparison of Middle Eastern Medium Sour Grades, to Europe (ICE Bwave/Brent Dated).

Source: SOMO.

Arguably the most notable deviation from the region-specific trend of replicating Saudi Aramco moves, Iraqi pricing into Europe continues to follow a separate path. The discount of Basrah Medium into Europe stands at $8.10 per barrel to Dated Brent, up $0.25/barrel from August – for reference, Arab Medium into the Mediterranean will be set at a $2.30 per barrel premium to ICE Brent. Now the difference in the pricing bases might have been significant in times of runaway backwardation – we had months when Dated was above the front-month of Brent futures by some $5 per barrel – yet the recent flattening of all curves puts Iraq in a way more beneficial light in the eyes of European refiners. Dated-to-frontline below $0.5 per barrel and a whopping $10 per barrel discrepancy between same-quality Iraqi and Saudi is a clear signal that Iraq is ready to take on ambitious goals.

Chart 6. Iranian Official Selling Prices for Asia-bound cargoes (vs Oman/Dubai average).

Source: NIOC.

Iran has become the most talked-about Middle Eastern country lately as the likelihood of an Iranian nuclear deal breakthrough became significantly higher after the latest round of negotiations. As things stand right now, all the issues connected to the lifting of oil sanctions are largely settled whilst non-energy-related political dilemmas dominate the narrative of the negotiations. Should the IRGC be scrapped from the US list of Foreign Terrorist Organizations, should Iranian assets held in other countries be unlocked (the $7 billion held in South Korean banks), should sanctions on Iranian banks be eased? These are all questions on the agenda, if they are to be settled within a new deal, either Washington or Tehran has to cede. Perhaps a reflection of an increasingly assertive Iran, the month-on-month changes of the Iranian state oil company NIOC see it going for bigger hikes than Saudi Aramco.

Chart 7. KEB Official Selling prices for Asian cargoes, compared with regional peers (vs Oman/Dubai average).

Source: KPC.

Kuwaiti national oil company KPC has had a relatively easy task for its two marketed grades, KEC and KSLC, and it has heeded the call of Saudi Aramco to exercise caution. The September OSP of KEC was increased by 65 cents per barrel to a $7.80 per barrel premium to Oman/Dubai, a slightly larger hike than its Arab Medium peer grade, probably because the physical availability of Kuwaiti exports is set to shrink as refinery operations of the Al-Zour refinery are ramping up. Even though China remains the largest buyer of Kuwaiti oil, refiners in the East Asian powerhouse are still yet to resume buying the way they did it before the almost never-ending streak of lockdowns started. The other Kuwaiti grade, Kuwait Super Light, was hiked by a further 30 cents per barrel to a $11.05 per barrel premium to Oman/Dubai, though with the flows themselves being less than 100,000 b/d in volume, the market impact of it seeing a record high, too, will remain more or less limited.

By Gerald Jansen for Oilprice.com

More Top Reads From Oilprice.com:

- Russia Considers Deeper Oil Discounts To Counter U.S. Price Cap Push

- Half Of UK Households Will Be In Fuel Poverty By January

- India Seeks Consensus Before Committing To Russian Oil Price Cap