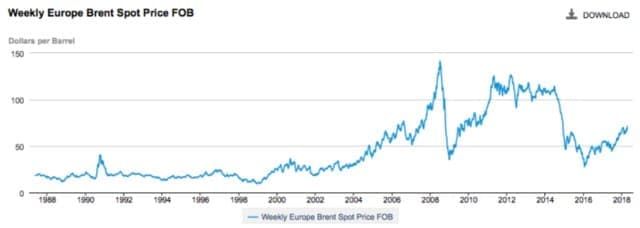

Oil prices are now as high as they have been for three years. At this writing, Brent is $74.14 per barrel and West Texas Intermediate is at $68.76. These prices aren’t really very high, if a person looks at the situation from a longer-term point of view than the last three years.

(Click to enlarge)

Figure 1. EIA chart of weekly average Brent oil prices, through April 13, 2018.

There is always a question of how high oil prices can go, and for how long.

In fact, we have many resources, of many kinds, whose prices of extraction keep rising higher. For example, obtaining fresh water for the world’s population keeps getting more and more expensive. Some parts of the world need to resort to desalination.

The world economy cannot withstand high prices for any of these resources for very long. Certainly, it cannot withstand high prices for a combination of necessary resources, because people need to cut back on other purchases, in order to afford the necessities whose prices are rising. This article is a guest post by another actuary, who goes by the pseudonym Shunyata. He explains in a different way why high resource prices cannot last, whether they are for oil, or natural gas, water, or even fresh air.

Dear Readers:

As you are no doubt aware, Gail has created a fantastic portfolio of blogs that explore our energy/financial/economic system, blogs that reveal many hidden or misunderstood aspects of our situation. I have found these discussions invaluable and share them wherever I am able; to solve our societal problems we need to develop a societal understanding of these issues.

Related: The Bullish And Bearish Case For Oil

The problem I face is helping other people, like my grandparents, get a foothold in this complex discussion. They can understand why oil might “run out,” but trying to understand the problematic financial situation is more difficult. I like metaphors to explain things – metaphors that allow my grandparents understand the major elements of the situation. The metaphors I am using are to the oil industry. My grandparents have been following the oil situation for a long time. If a person has been following the oil industry, they may be helpful.

Below you will see how I explain Gail’s detailed writing to my grandparents in three short chapters. I hope you find this outline helpful in your own discussions, and I welcome your suggestions for improving the transparency of the story.

PRODUCTION COST

What if air had to be produced from wells and purchased by businesses and families to conduct their normal affairs?

If air is readily available in the ground, we can always extract what we need, making it easy for businesses and families to operate, or even to grow.

What happens if air becomes harder to extract? Perhaps the easy air is gone and we are increasingly looking at extracting deep water air, or air dissolved in shale stone.

Technology may be able to help; sometimes it can help a lot. But there is an immediate production cost shock in funding the development of that technology. This cost shock occurs whether we are talking about conventional air or solar-based renewable air.

There is a lower but permanent increase in production cost, both to fund the complexity of the technology (a deep-water air rig just costs more to operate than a land rig) and to pay off any debt needed to build the new technological infrastructure. This cost increase occurs whether we are talking about conventional air or solar-based renewable air.

This cost increase is a permanent drag on the economy. Wages don’t rise to compensate for the higher cost of air. There is no substitute for air, and air simply isn’t available in the quantities the economy previously enjoyed – unless we stop doing things that we were doing before and redirect those resources toward producing the same amount of air we used to have.

DEBT

In a modern financial system, we use “money” as a proxy for economic activity. In a barter system, I can obtain goods and services by trading my work product for your work product. But carting around packages of finished goods is unwieldy, so we use “money” as a medium of exchange. If you and I are both willing to trade our finished goods for a symbolic piece of paper, then I can trade my goods and services for paper, bring that paper to you and trade it for your goods and services. This medium of exchange makes it easy to trade complex goods and services over long distances, or at different points in time.

How would lending work in this barter system? Someone could produce many finished goods, trade it for symbolic paper, but not immediately trade it for other goods, and “save” their paper for later. Debt is a process of borrowing someone else’s saved symbolic paper to purchase goods and services for themselves. This is helpful when I need to build a deep-water air rig but don’t have the money myself. I can borrow someone else’s money and pay them back later, after my rig is bringing in revenue.

This simple borrowing process only works if some people aren’t consuming goods and services in the economy and are instead allowing others to “borrow” their ability to consume. What if there isn’t enough saving to make large borrowing possible? What if I want to maximize economic activity and don’t want people to defer their own individual consumption?

Related: IMF: Expect Oil To Fall Below $60

If we want more funding than barter can provide, this can be done in more than one way:

[a] Money can be loaned into existence. This happens every day, when people decide to buy a car, and take out a loan for that purpose. Or people buy something with a credit card, and decide to carry a balance, rather than pay it off immediately. Nearly all loans today represent new money to the system.

[b] Governments can also obtain money by issuing bonds. Or they can simply issue money certificates without having any backing for the money.

Let’s call the process of adding funding to the economy, over and above what would be available by debt, “money printing.” In each of these cases, symbolic paper is added to the economy without previous work having been performed.

[1] Money printing can be helpful when it represents an investment in growing the overall economy. Investment in deep water air rigs will make air more available in the economy and will spur an expansion of economic activity. In this case the goods and services in the economy eventually “grow into” the amount of money that has been printed and the extra economic activity in the future is used to repay the debt.

[2] Money printing is unhelpful when it simply becomes someone’s savings (i.e. growing wealth inequality). The economy is still obligated to repay the debt (usually through taxes) and economic activity becomes sequestered in wealthy people’s savings, without ever creating demand for someone else’s product.

[3] Money printing is also unhelpful when it is used to fund more air consumption without any investment in air production. For example, a family that borrows money for an air vacation (or for basic daily air subsistence):

- Now has a debt–repayment of which will reduce future air consumption

- Has created no permanent demand for air and does not require permanently expanding air production for the economy–so their vacation air demand tends to increase the cost of air for all other consumers.

PRICE

What happens when we put these two chapters together? When air becomes more difficult to extract:

[1] Production cost goes up permanently.

[2] Economic activity is redirected to maintain air production, and overall economic activity is reduced. With reduced overall economic activity there is a reduced need for air, resulting in excess air supply and a temporary reduction in air price.

[3] If air consumers spend their available money on air and defer other purchases, there is an additional reduction in economic activity, additional excess supply and further reduction in air price.

[4] Reduced price means less revenue to air producers.

[5] Owners of idled air rigs still have debts to pay (money borrowed to build air rig in the first place). They are willing to undercut the market price of air just to get revenue to pay their debts, even if they aren’t making a profit otherwise. This drives the price even lower.

So, air prices fall, even though the cost of air production continues to rise.

This begins to look like an economic crisis. A natural response of governments is to print money so that consumers have more money available to purchase air, without deferring other purchases.

This can work for a while, but ultimately fails when there is no overall growth in economic activity to match the increased money supply. The debt comes due (usually in the form of higher taxes). There isn’t enough productive activity in the economy to easily pay back the debt. As a result, consumers must defer even more of their consumption to repay debt, ultimately resulting in even lower air prices.

Eventually either the debt market or air market runs the risk of failing entirely.

[1] When economic activity falters, people can no longer repay their debts (or earn enough income to pay taxes toward government debt). Either of these outcomes is bad both for borrowers and lenders.

[2] If economic activity falters, market forces push air producers to a zero-profit price point. At this point, producers have enough money to keep the rigs running and cover debt payments, but no more. Ultimately this cannibalizes the ability of air producers to maintain existing air supplies. They are unable to purchase replacement machines, if any one breaks. They cannot make new investments.

Clearly, this situation cannot continue. High prices cannot be passed on to consumers, or they will be unable to buy other necessities of life. At the same time, if the producers do not get high enough prices, they cannot continue to provide the air or other commodity that is needed.

By Gail Tverberg via Our Finite World

More Top Reads From Oilprice.com:

- Venezuelan Oil Enters The Disaster Zone

- Oil Prices Rise On Crude, Gasoline Inventory Draw

- Is Saudi Arabia Losing Its Asian Oil Market Share?

How high could oil prices go? I am projecting that they will rise to $75 a barrel this year, reaching $80-$85 next year and hitting $100 or higher by 2020 underpinned by the above-mentioned positive fundamentals.

OPEC members and other oil-producing nations around the world should be guided b one important economic principle. That is to maximize the return on their assets to whatever level the global oil market can tolerate.

Nobody can tell how sustainable high prices are. Only the fundamentals themselves can tell us and believe me they will not be shy in making their verdict loud and clear.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London