“How’s the Canadian oil and gas industry doing?” a friend recently asked me.

People on the sidelines expect a positive answer, knowing that a barrel of oil now trades above $70 on global markets and 65-ish in Texas.

“Not bad,” I reply. “The top line numbers are improving.”

In fact, as a whole, the upstream oil and gas business is doing better than before. Added up, Canadian producers should pull in about $2 billion Canadian dollars a week in 2018, for a yearly total of CA$105 billion. That’s up 9 percent from last year, and 27 percent from the recent 2016 low of CA$82 billion (see Figure 1).

(Click to enlarge)

But I’m quick to point out that broad statistics about industry health are misleading and need qualifying.

“Yet it depends,” I continue to say, “on what you’re selling; where you’re located; who you’re selling to; and what your discounts are. And it depends on how you are deploying innovation to handle cost competition.”

After a brief pause, I muse, “It sounds a lot like the retail business, doesn’t it?” And then I add the drama: “It depends if you are talking about Amazon, or Sears Canada.”

As a side note, retail sales in Canada were close to CA$590 billion, up 7 percent year-over-year in 2017. But again, the big numbers are misleading.

Let’s face it, if you’re Amazon you’re smiling ear-to-ear. If you’re a hip boutique, selling high-margin clothing, you may be doing OK. If you’re selling cheap shoes on perpetual sale at the back of an expensive mall, you’re in trouble … and if you don’t have any online presence, you may as well put on a pair of those cheap sneakers and run.

That’s how it is in the oil and gas business: Just because headline prices are rising into the clouds doesn’t mean everything is universally peachy. Variations in performance are wide. For one thing, there are a lot of January sales. Price discounts in oil and gas are rife due to too much product being pushed out narrow doors. Related: Why Is The Shale Industry Still Not Profitable?

Lighter oils and condensates are the place to be in Canada. Productivity has increased dramatically over the past three years, helping to lower costs. Temporary price discounts in the three to five percent range are bothersome, but are being offset by rising global prices. Three-quarters of this year’s total CA$44 billion in spending — about CA$32 billion — will be spent on these high value plays.

On the other side of the oil business, heavy barrels are being heavily discounted. Depending on the day of the week, the market price for Western Canada Select (WCS) is trading 25 percent below normal. The discounts are due to another slug of oil sands production that’s come on line, clogging up pipelines, especially those that carry the heavy grades.

Heavy oil discounts should narrow once rail cars debottleneck the glut (again). Extra capacity from approved but yet-to-be-constructed pipelines like Keystone XL and Trans Mountain will help avoid congestion over the longer term. For now, it’s like waiting for another mall to be built.

What about natural gas? It’s a great Canadian product. In fact, our rocks are so good — among the best in the world — that we’re able to produce more volume than fidget spinners in a dollar store.

At the moment, too much gas is coming out of the ground from companies that are in the right, low-cost postal codes. Fire-sale market prices around CA$1.50/GJ represent a discount of 35 percent off the label. So, if you are a high-cost natural gas producer in the back of the basin with no contracted pipeline access — well, you may as well be selling shoes in the mall.

Historically, regional price discounts in oil and gas have always been temporary. Arbitrages don’t last when there are big dollars involved, so sale season will eventually end. In the meantime, discounts are painful. Yet, learning how to make a buck under price pressure is a skill that’s needed in this era of deflating manufacturing costs. Related: Tesla Looks To Get Ahead In Lithium Battle

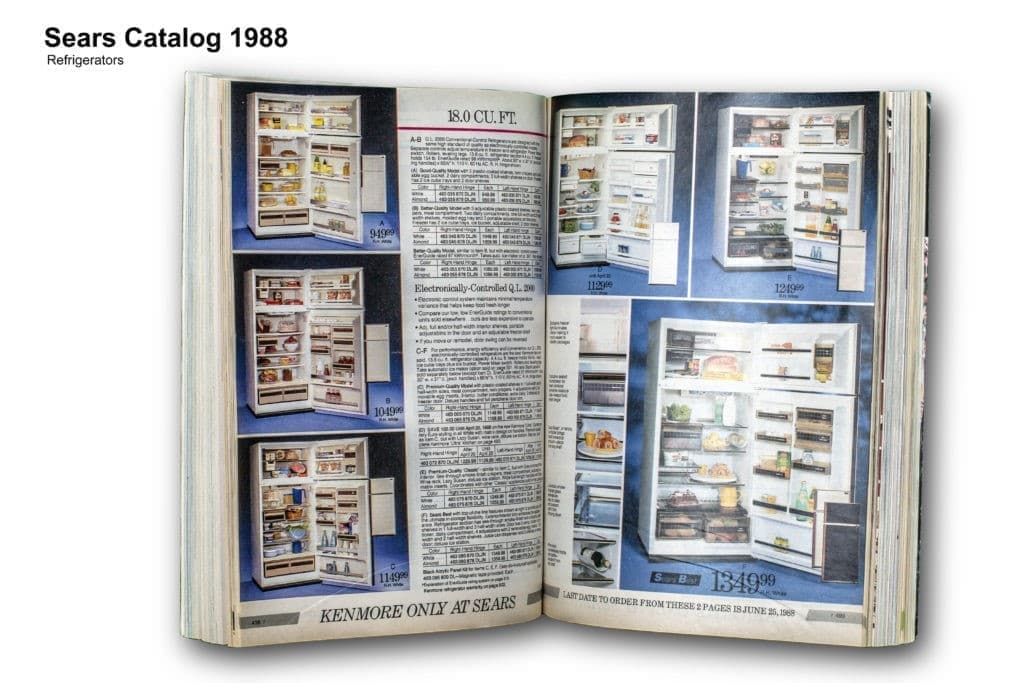

Deflation is pervasive. Producing more stuff at progressively lower prices is happening everywhere. For fun, I picked up a 30-year-old Sears Canada catalog at a used bookstore. I flipped to the durable goods section and pointed out refrigerators to my friend. “Check it out,” I said, “a high-quality, 18-cubic foot fridge used to cost $1,249 in 1988.”

(Click to enlarge)

I challenged him to go to the Amazon website and find a similar fridge. With a few smartphone swipes, he replied, “An 18-cuber is still priced at $1,249 after three decades.”

“Sounds like the natural gas business;” I said, “little price appreciation since the 1980s,”

Price pressure. New technology. Changing processes. Changing market access and sales channels. Changing locations. Changing customers. And of course, changing regulations.

How is the oil and gas industry really doing? Like any other industry, the answer depends on who you ask.

By Peter Tertzakian for Oilprice.com

More Top Reads From Oilprice.com:

- Iran, Qatar Crude Exports To Asia Are Tanking

- The Biggest Threat To U.S. Oil Exports

- Oil Prices Fall After Strong Crude Inventory Build

Over producing