The discovery of the giant gas field Tamar of the coast of Israel in 2009 was the beginning of a new period for the Eastern Mediterranean as an energy hot spot. More recently Exxon and Qatar Gas have discovered another giant gas field off the coast of Cyprus, and Italy’s Eni found more energy deposits off the coast of Egypt. To put the numbers into perspective, the Eastern Mediterranean contains approximately 2,100 billion cubic meters of gas compared to the EU’s consumption in 2017 which was 410 bcm. It shows that the recoverable reserves are more than sufficient to supply the entire EU for a couple of years.

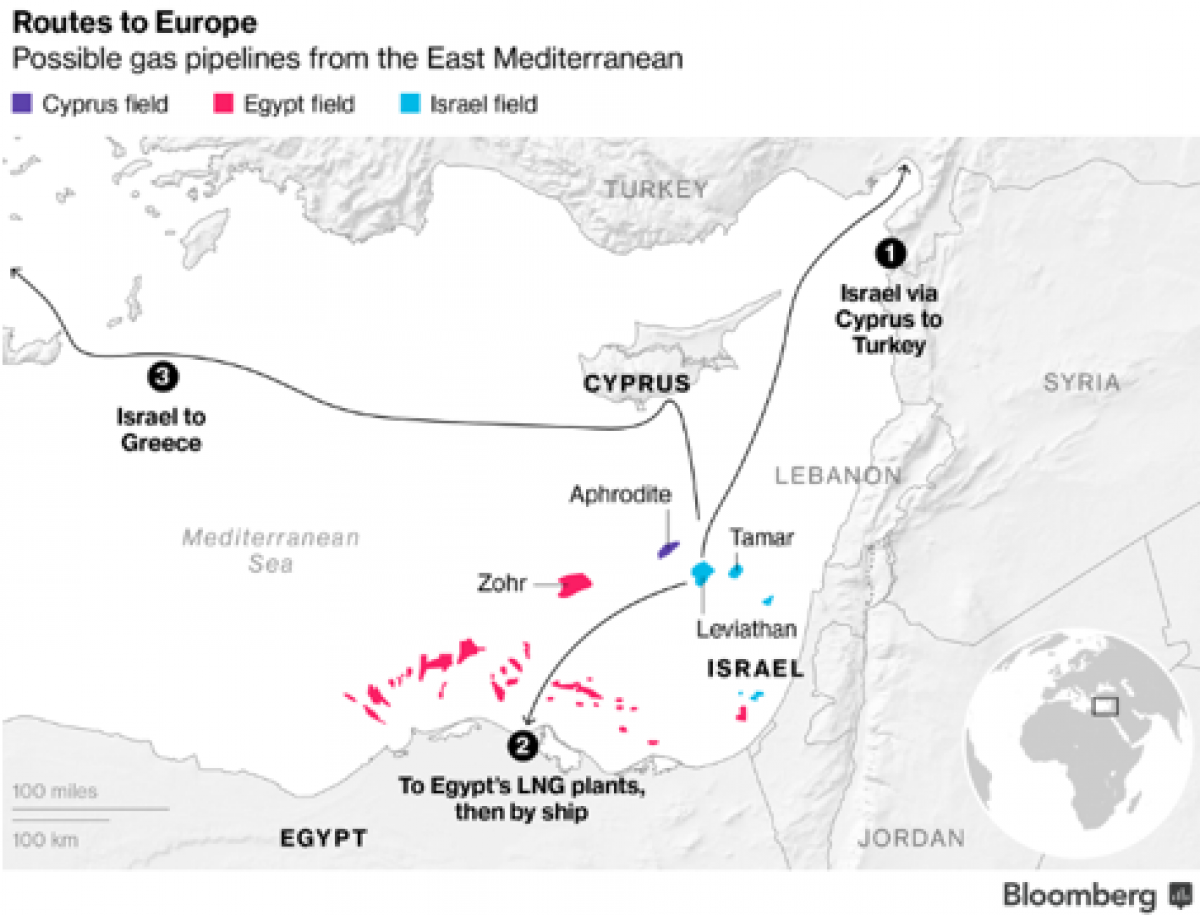

Despite the significant discoveries, technical difficulties and geopolitical tensions could raise barriers for infrastructure projects that would connect producers with customers. Furthermore, several alternatives are being considered by the littoral states Egypt, Cyprus and Israel to transport the energy to markets in Europe. One of two competing options will likely materialize: the relatively expensive and technologically tricky EastMed pipeline or Egypt’s LNG facilities including a subsea pipeline.

(Click to enlarge)

Israel is pushing for the EastMed pipeline to reap maximum political and economic dividend by having a physical connection with mainland Europe. For this purpose, Israel, Cyprus, and Greece agreed in December to conduct a multimillion feasibility study concerning the subsea pipeline with financial support from the EU. The project would require more than $7 billion to accomplish and presents technical challenges due to the involved depth.

Egypt’s energy and mineral resources minister Tarek el-Molla has been quick to respond and promote an alternative plan with Egypt’s LNG industry at its centre. The Minister said that the study would take up to two years “which in itself is a luxury the region can’t afford any more.” Egyptian companies have already struck a $15 billion deal for the import of Israeli natural gas. Cairo's intends to attract additional resources such as Cypriot gas to become the energy and LNG hub of the region. Related: Oilfield Services Might Not Fully Recover Till 2025

Cyprus’ geographic location offers flexibility concerning the island nation’s participation in either Israeli or Egyptian leg initiatives which suggests an advantage and creates risks. In this context, Tel Aviv and Cairo have been courting Nicosia to participate in the EastMed project or the construction of a subsea pipeline to liquefication plants on Egypt’s coast. Furthermore, Cyprus has tense relations with its large northern Turkish neighbour due to obvious historical reasons. More recently the Turkish navy has disturbed exploration activities in areas which it claims are ‘contested’. It could have influenced Nicosia's decision to cooperate with other regional and international players to offset the threat coming from its much larger Turkish neighbour.

Israel, primarily, has been focussed on Cyprus' participation in the EastMed pipeline because of the increased economic viability of the infrastructure due to combined Israeli and Cypriot gas resources. Tel Aviv is aware of the competing and more favourable Egyptian offer compared to its relatively expensive and technically challenging proposal. Therefore, high-level talks between Cyprus and Egypt on gas exports create anxiety in Israel.

Despite ongoing negotiations with Cairo, Nicosia is also continuing its cooperation with Tel Aviv and Athens on what could become the EastMed pipeline. The countries are expected to sign an intergovernmental agreement concerning the project in Tel Aviv on Wednesday 20 March in the presence of U.S. Secretary of State Mike Pompeo. Cyprus could be spreading its chances when it comes to finding the best alternative for transporting its gas to customers. Another explanation could be the American support which strengthens Nicosia’s position when it comes to dealing with its Turkish neighbour.

Washington has on several occasions warned Turkey against further destabilizing the region and disturbing exploration work. The U.S. is in favour of the EastMed pipeline as it would provide an alternative source of energy to the EU where Russia’s gas giant Gazprom dominates the market. This would weaken Moscow’s influence in countries with high levels of dependency such as eastern Europe.

Nevertheless, the road to new energy infrastructure in the Eastern Mediterranean’s is long and arduous. And despite the difficulties and risks, the rewards are too big for the involved parties to ignore.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Is Beijing Losing Its Footing In South China Sea?

- Refiners Prepare To Profit From Dramatic Oil Product Switch

- Why OPEC’s Decision To Delay Makes Sense

Though Turkey and Egypt find themselves on opposing sides politically over the growing tension and conflict surrounding the gas discoveries in the Eastern Mediterranean, they still share two major strategic objectives. The first is Turkey’s ambition to become the energy hub of the European Union (EU) and Egypt’s ambition to also become the energy hub of the Eastern Mediterranean.

The other objective is that both oppose the proposed EastMed gas pipeline that is supposed to carry Cypriot and Israeli gas supplies under the Mediterranean to Italy and then the EU via the Greek mainland.

Turkey opposes it because it will compete with the Turk Stream gas pipeline which will bring Russian gas supplies once it becomes operational by the end of 2019 to Turkey and the EU under the Black Sea and also with the Southern Gas Corridor (SGC) bringing Caspian gas from Azerbaijan to Turkey and then to the EU via the Trans Adriatic Pipeline (TAP).

Egypt, on the other hand, would not welcome the EastMed gas pipeline since it hopes to get any Cypriot gas exports shipped by a subsea gas pipeline to its two LNG terminals in Damietta and Idku for conversion to LNG and re-exporting along with Egypt’s own LNG to the Asia-Pacific region.

However, it seems that the EastMed estimated to stretch over a distance of 1900 km and costing an estimated $7 bn is all but dead. Cyprus has yet to discover any sizeable gas fields like Egypt’s Zohr (30 tcf) and Israel’s Leviathan (18.9 tcf) other than the two relatively small gas fields: the 6-8 tcf Calypso, the 4.5 tcf Aphrodite and the recently ExxonMobil-discovered Glaucus-1 (5-8 tcf).

If we are to judge the viability of the EastMed on the current situation, there is only Calypso and Israel to fill the pipeline. Israel has already signed a deal worth $15 bn of Israeli gas exports to be sent to Egypt for conversion to LNG and re-exporting. Cyprus on its own couldn’t muster enough gas to fill the EastMed annual throughput capacity of 20 billion cubic metres (bcm). Moreover, Turkey will never allow the Greek Cypriots to produce more gas let alone export it without securing a share for the Turkish Cypriots. The other obstacle is that the price of shipped gas via the EastMed couldn’t compete with Russian piped gas to the EU once production costs and shipping have been added. It would seem the EastMed may never see the light of day.

Combining Cypriot and Israeli natural gas production with Egypt’s existing LNG infrastructure for exports to the Asia-Pacific region could prove to be a far better and more cost-effective option than the underwater EastMed gas pipeline to the EU.

Egypt has all the credentials to become the energy hub of the Eastern Mediterranean. It has the third largest proven reserves of natural gas in Africa, gas pipelines, proximity to Cypriot, Israeli and eventually Lebanese gasfields, the only LNG export plants in the East Mediterranean and the re-emergence of interest in its gas potential by the oil supermajors like Shell, ExxonMobil BP an ENI.

Moreover, Egypt’s gas reserves which doubled to 62.8 trillion cubic feet (tcf) with the discovery of the giant Zohr offshore field could be enhanced further by positive results from current exploration efforts in the offshore Noor field and other potential discoveries in the Red Sea.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

The gas is going to be moteized through the lowest cost (i.e., existing) infrastructure first. Moreover, the 7BCM Israel-to-Egypt transfer capacity could, with a relatively modest investment, be at least doubled in size (by increasing EMGs capacity by 2BCM though a direct tap from the Tamar processing platform which is located next to the pipeline’s route, by clearing bottlenecks in INGL’s pipeline network, plus additional shipments through Northen Israel and into Jordan and from there to Egypt through the Arab Gas Pipeline). All this could be achieved in a reliatively short timeframe.

Turkey will play the hub role for any gas found in Lebanon’s waters, would could involve significant amounts.

Also, in response to Dr Salameh... Note that the reservoir figures you are comparing are not all of the same type. Some are recoverable reserves while others are gas-in-place amounts. You can’t compare them that way without noting which is which.