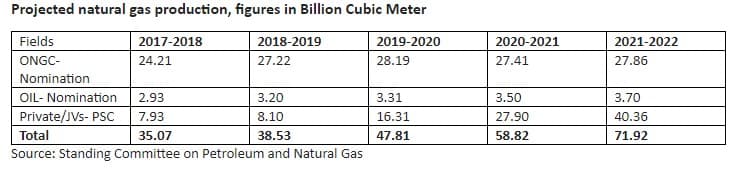

India’s natural gas production is projected to double in the next four years, according to a statement by the country’s oil ministry. If growth continues as predicted, natural gas production will hit a whopping 2 billion cubic meter (bcm) by 2022 (an impressive number, especially when compared to the 35 bcm of natural gas the nation produced in the last financial year). This development is thanks in large part to a sweeping government plan to shift the subcontinent away from its accolade as the world's third biggest oil consumer, instead moving in the direction of a gas-based economy.

In addition to a major spike in production and usage, experts are also predicting a major shift in the makeup of India’s major producers themselves. Until now, the natural gas extraction industry has been dominated by Indian state-owned exploration company Oil and Natural Gas Corporation (ONGC). In fact, this single company accounted for a staggering 24.2 bcm, or 68 percent, of India’s total natural gas production in the last fiscal year. By comparison, private firms and their joint ventures were only responsible for 7.9 bcm. However, going forward, this dynamic is expected to flip by a dramatic margin. By 2022, private and joint ventures may account for as much as 40.3 bcm, thereby taking the lead over ONGC in a historic upset.

(Click to enlarge)

The Indian government is currently racing to construct and improve infrastructure such as pipelines and import facilities in order to incorporate larger amounts of natural gas usage. The country is preparing to sharply raise the amount of natural gas in its energy mix from 6.5 to 15 percent over next few years.

Just this month one of the country’s single biggest oil consumers (currently clocking in at about 3 billion litres of diesel per year), the national railway system, signed a preliminary agreement with GAIL, India’s largest state-owned natural gas processing and distribution company. The agreement stipulates that public transportation monolith Indian Railways will start shifting away from dirty diesel toward cleaner fuels, primarily natural gas. Thanks to the infrastructure boost and the state-sponsored push away from oil, using natural gas will be about 25 percent cheaper than other alternatives fuels used by the railways. A spokesperson for Indian Railways said that the company aims to waste no time in transitioning all 54 of its workshops to use natural gas by June 2019, with a first phase of 23 workshops already transitioning by the end of this year.

Related: IEA: Oil Market To Tighten Toward Year-End

GAIL has also begun to open its already massive and rapidly expanding pipeline network to the public, allowing outside interests to book surplus space online to ship gas across the subcontinent. The state-owned company controls 70 percent of the nation’s network, with 11,400 kilometers (7,084 miles) of natural gas pipelines, and an additional 5,000 km (an investment of 50 billion rupees, or $3.6 billion) coming down the pike. Shared infrastructure at a massive scale will help to facilitate quicker trading and utilization of natural gas, as well as taking full advantage of the company’s gargantuation capacity, which is currently only running half-full. As an added effort, GAIL is gearing up to build a distribution hub to set natural gas prices in India.

Though it will allegedly remain cheaper than other alternative fuels, natural gas prices in India are predicted to rise sharply along with demand. Some local news sources are reporting that the Indian government is planning to raise gas prices by a steep 14 percent in October of this year in order to increase earnings for producers like the state’s own ONGC, which currently monopolizes the market. Such evaluations of natural gas prices occur every six months in India, when they re-determine the price based on average rates from gas-surplus countries like the U.S., Russia and Canada.

With a nationwide push for gas usage and a likely hike in prices, we’re heading into a record-breaking decade for Indian natural gas. What’s more, if the world’s third largest oil consumer can possibly redirect enough energy usage toward natural gas to shed that title, we can expect waves across the energy industry, and across the globe.

By Haley Zaremba for Oilprice.com

More Top Reads From Oilprice.com:

- Aramco To Lose ‘Forever-Right’ To Saudi Oil Resources

- Iran Claims It Has Full Control Over The World’s Most Important Oil Chokepoint

- Oil Jumps On Bullish EIA Data