The NYMEX February natural gas contract expired Monday at $3.63 per MMBtu, the highest expiration for a contract we have seen since January 2017. Now the prompt month, March gas saw a net gain of nearly 27 cents from January 23-30, but has retracted due to warmer forecasts and a round of selling amid sentiment of overbought conditions. March gas has dropped below $2.90, pretty much where we were before the Polar Vortex 2.0 and “bomb cyclone” ravaged in the first week of January and pushed prices to $3.06.

Indeed, the outlook has shifted to negative for gas. Perhaps the main reason why February gas prices surged over the past two weeks was the expectation of a new Polar Vortex forming around the Great Lakes region and descending further south into the U.S. in the first week of February. Recent NOAA weather maps, however, indicate far less extreme cold in the region and even some average temperatures in the heating center of the Midwest.

In addition, at 99 Bcf, the U.S. Energy Information Administration on Thursday reported a gas storage withdrawal that was well below the five-year average of 164 Bcf. This very low first withdrawal for the March contract helped dropped prices 15 cents in the morning, and is especially bearish after the two record withdrawals that surged the February contract, 359 Bcf on January 5 and 288 Bcf on January 19. Storage, however, does hold the primary bullish sign for natural gas at this point: inventories now stand 16 percent below the five-year average, compared to 1-2 percent below average a month ago. Related: Goldman: Oil To Top $80 Within Six Months

Total U.S. gas demand in recent days has been fairly typical for this time of year, averaging 95-100 Bcf/d. This could rise to 105-110 Bcf/d in the next two weeks but still well below the 143 Bcf/d all-time record we set during the Polar Vortex 2.0 on January 1. And March is the final winter contract, so the psychology of the winter coming to an end will continually creep into the market and keep the bulls at bay. As shoulder months, April and May are the lowest gas demand months because heating needs have subsided and cooling demand has not fully kicked in.

(Click to enlarge)

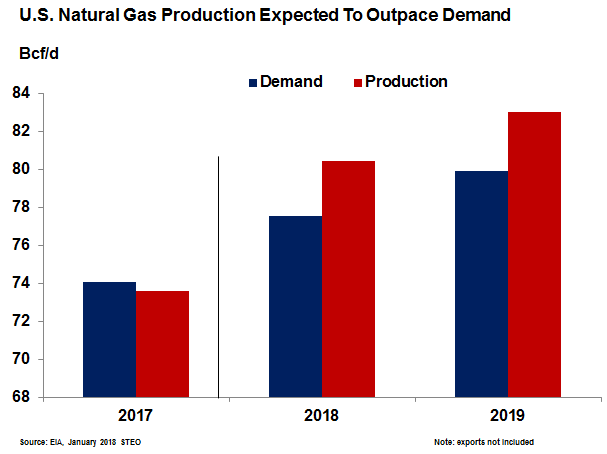

Moreover, one of the reasons why deferred contracts did not jump in price as much as prompt month February is the flood of gas expected to arrive as the year progresses. After dropping 8 percent or so to 71 Bcf/d during the extreme cold seen in early-January, total U.S. gas production has risen back to the record levels seen in December and surpassed 78 Bcf/d in recent days. Driven by Appalachia, U.S. gas production is expected to average nearly 81 Bcf/d this year, a 6-7 Bcf/d gain from 2017 that will be the largest yearly increase in history.

Even more bearish, production is also expected to surpass domestic demand in 2019 as well (see Figure). For example, our largest demand market that accounts for a third of total usage, gas for electricity is expected to only increase 1.5 Bcf/d this year to over 27 Bcf/d but still below 2016 levels. And as for exports, our largest incremental demand market, huge potential is not expected to materialize quite yet. LNG exports will only rise to 3 Bcf/d this year, up from 1.9 Bcf/d in 2017, while piped gas to Mexico should surpass 5 Bcf/d but only up 0.8 Bcf/d from 2017.

By Jude Clemente for Oilprice.com

More Top Reads From Oilprice.com:

- Tesla Looks To Get Ahead In Lithium Battle

- Are Canadian Oil Prices Set To Rebound?

- Three Factors That Could End The Oil Rally