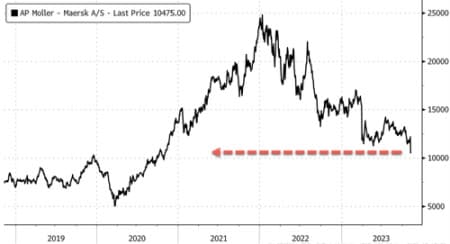

The shipping giant A.P. Moller-Maersk A/S reported a slide in profit and revenue for the third quarter, forcing the company to take a defensive position by eliminating upwards of 10,000 jobs as falling container rates and waning demand batter the global shipping industry, which could last through 2026. However, the shipper maintained its full-year guidance at the lower end of the previously stated guidance.

"If you look at the order book and what is going to come over the next couple of years, I think we're probably settling in for a very subdued and pressured environment for two to three years ahead," Chief Executive Officer Vincent Clerc told Bloomberg TV's Mark Cudmore and Tom MacKenzie on Friday morning.

Maersk, which controls about 17% of global container trade, started reducing its workforce from 110,000 in January and will be below 100,000 by the end of the year - this will result in a $600 million cost savings. Clerc said about 6,500 positions have already been eliminated.

Maersk is considered a bellwether of global trade. Container lines are already seeing earnings drop after record profits in 2021-22 when demand for consumer goods during Covid surged.

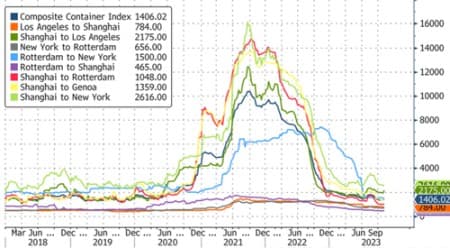

As per the World Container Index and the Baltic Dry Index, global shipping rates of major routes have already plunged by 75%-85% from their 2021 peaks.

"Our industry is facing a new normal with subdued demand, prices back in line with historical levels and inflationary pressure on our cost base," Clerc said in a company press release, adding, "Since the summer, we have seen overcapacity across most regions triggering price drops and no noticeable uptick in ship recycling or idling."

Maersk shares fell as much as 14% to 10,485 kroner, the lowest in three years in Copenhagen. Other shippers have slid on the news, including Hapag-Lloyd -6%, DSV -2.4%, and Kuehne + Nagel -1.8%.

Goldman Sachs analysts issued a cautionary note to clients, suggesting the global shipping industry could be in a more prolonged downturn, and recommended selling Maersk shares. Bloomberg Intelligence warned that Maersk might not see an upturn in earnings until 2025. And Morgan Stanley said the outlook is disappointing.

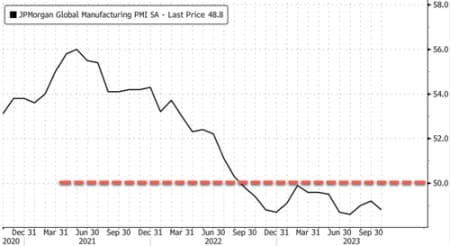

Meanwhile, JPM's Global PMI Manufacturing Index has been stuck below 50 (contraction) for the entire year.

This is all a cautionary signal for the global economy...

By Zerohedge.com

More Top Reads From Oilprice.com:

- Oil Prices Plunge Below $80 As Near-Term Demand Worries Grow

- The Oil Market Crisis Sparked By Russia’s Invasion Is Nearing Its End

- Russian Crude Oil Exports Plummeted At The End Of 2022