Angola, Africa’s second largest oil producer, has ramped up its financial ties with Beijing, but perhaps to its own detriment, The country’s state newspaper Jornal de Angola said on Wednesday that the country had secured $2 billion in Chinese funding from the China Development Bank for infrastructure projects. Angolan President João Lourenco secured the financing during his first visit to Beijing, the report added.

Details of the deal were not released, according to various media outlets. A Reuters report said on Wednesday that Angola is in the process of trying to diversify its economy since a fall in the price of crude in 2014 plunged it into recession. Inflation is running at more than 20 percent per year and at least one in five of workers in the country are unemployed.

News of the funding deal comes just a week after Fitch Ratings released negative news for the African oil producer. It said that Angola is expected to have a GDP growth rate of 1.5 percent in 2018, given the growing tendency for its declining trend witnessed in oil production, down from a previous 2.8 percent growth rate predicted earlier.

The ratings agency also trimmed its GDP growth projection figures for the country 2019 but increased that projection for 2020 from a previous growth rate projection of 2.2 percent to 2.6 percent.

The Chinese cash infusion also comes as President Lourenco solidifies his power in order to help push through reform measures, promising to oversee a so-called “economic miracle” by opening up the country of 29 million people to foreign investment as well as opening up the tourism sector and prioritizing agriculture.

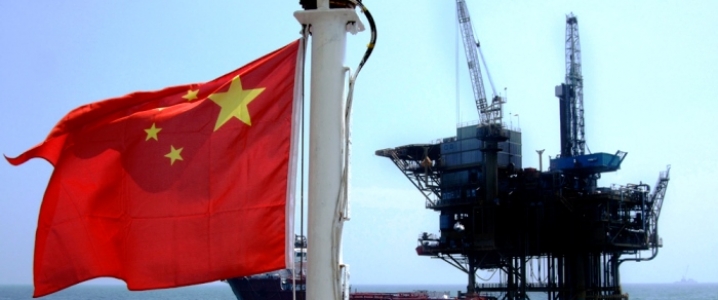

China’s string of pearls

Angola is the latest in a line of countries stretching from Asia, to the middle east and Africa that are inking massive infrastructure deals with China.

Related: EIA: Market Tightens As Outages From Iran, Venezuela Pile Up

One of the staunchest critics of China’s infrastructure loan model strategy has been the Trump Administration. U.S. Vice President Mike Pence said last week that Beijing was using "debt diplomacy" to expand its global influence in countries ranging from Asia to Africa to Europe to even Latin America. He cited the Sri Lankan port as an example of massive Chinese funding, which he said could soon become a forward military base for Beijing's growing blue-water navy.

Pence said that the terms of Chinese “loans are opaque at best, and the benefits flow overwhelmingly to Beijing," adding that "China uses so-called 'debt diplomacy' to expand its influence.”

"Just ask Sri Lanka, which took on massive debt to let Chinese state companies build a port with questionable commercial value. Two years ago, that country could no longer afford its payments – so Beijing pressured Sri Lanka to deliver the new port directly into Chinese hands. It may soon become a forward military base for China's growing blue-water navy," Pence said.

It appears, however, that other countries may be finally waking up to the dangers of over reliance on Chinese debt to fund massive infrastructure projects. Sierra Leone nixed plans this week to build a controversial, $318 million airport outside the capital of Freetown with a Chinese company and funded by Chinese loans, the BBC reported on Wednesday.

Its cancellation comes as both Pakistan and Malaysia also put on the brakes over Chinese infrastructure loans in recent months. Sierra Leone's decision, however, is the first time an African government has canceled an already announced, major China-backed deal.

Swimming in Chinese debt

However, it appears that Angola may have already been in over its head even before agreeing to the recent $2 billion infrastructure deal. The government said earlier this year its debt will rise to $77.3 billion, or 70.8 percent of GDP, by the end of 2018. Of that amount, the country already owes China $21.5 billion.

Related: Will Big Oil Ever Win Back Investors’ Trust?

Another worry is that if Angola is unable to repay its massive debt to China, Beijing could gain control over the country’s oil production, in a possible repeat performance of what has been happening in debt-laden Venezuela.

In April, a report from the Washington-based Center for Strategic & International Studies (CSIS) said that as Venezuela comes apart at the seams, it will hand over more and more control of it natural resources to China, and even more power over its institutions.

The report alleges that Venezuela's economic problems have been made worse by China. Taking advantage of Venezuela's desperation, China has managed to convince Caracas to sign "one-sided financial agreements" that perpetuate the economic malaise afflicting the country, the report claims.

By Tim Daiss for Oilprice.com

More Top Reads From Oilprice.com:

- The Perfect Storm Bringing China And Russia Together

- Trump Sides With Farmers In Battle Against Refiners

- U.S. Drillers Add 11 Rigs Despite Oil Price Correction

This policy is part and parcel of China’s One Belt One Road initiative (BRI) seeking to bolster existing trade routes through Southeast, South and Central Asia, right through to Europe through infrastructure projects. The Chinese say that if you want to get rich, build roads first.

Critics have described the plan as neo-colonialism, as a strategic ploy to enhance China’s military power outside its borders or as a plot to ensnare countries in debt traps that eventually force them to hand over territory and strategic assets.

China retorts by declaring that the primary focus of the BRI is to build much-needed infrastructure in places where such investment has long been neglected. China contrasts the intentions of the BRI with those of the post-second war Marshall Plan, which had clear geopolitical and ideological objectives. In contrast, the BRI is an initiative for international economic co-operation.

So far, more than 130 countries have signed agreements or memoranda of understanding with China on the BRI, even though China’s initial plan involved only a few dozen countries that straddle the trade routes between China and Europe.

Of course, there are mutual benefits to China and countries receiving its largess. China’s economy is being enhanced by expanding trade with these countries and they grow economically faster.

China is spending more than $100 bn in south Asia: The two biggest recipients are Pakistan and Bangladesh.

In Pakistan, China has pledged $62 bn upgrading its southern neighbour’s infrastructure, ostensibly to secure a trading route to the Gwadar port on Pakistan’s south east.

The China-Pakistan Economic corridor is one of the biggest and most important schemes under the BRI umbrella. Chinese money is being used to build 21 power plants, a port and international airport at Gwadar, motorways and railways lines.

China has also financed the China-Myanmar oil pipeline. The 479-mile-long oil pipeline runs from the port of Kyaukpyu on Myanmar’s west coast and enters China at Ruili in Yunnan Province thus bypassing the Straits of Hormuz and Malacca.

One of the staunchest critics of China’s infrastructure loan model strategy has been the Trump Administration accusing Beijing of using "debt diplomacy" to expand its global influence. They cite Venezuela as a case where they claim that under the burden of Chinese loans, the country is handing over more and more control of it natural resources to China.

Nothing is further from the truth. Venezuela’s economy was in the decline long before China came on the scene partly because of mismanaged domestic policies and partly because of US destabilizing policies towards it. China’s and Russian’s loans have kept the economy afloat rather than collapsing altogether.

Another case is Africa. Driven by a desire to obtain sources of energy and raw materials for its continuing economic growth and open up new export markets, China’s expansion into Africa has attracted more and more attention from policy-makers in the West.

However, an analysis of China’s strategy in Africa needs to be balanced and avoid the hyperbole that has characterized some accounts. In the short term, China’s trade with and investment in Africa are of assistance to the development of the continent, if for no other reason than that little investment is forthcoming from other sources. Partly as a result of China’s interest in Africa – particularly in African oil – the continent’s growth rate has averaged more 4.5% annually since 2005 according to World Bank data. This is an achievement to which Western countries have hardly contributed.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

Don't write about subjects unless you've researched them yourself, and you haven't researched Chinese loans. If you wish to, just google Debra Brautigam...