As U.S. exports continue to rise, the price gap between WTI and Brent has sharply narrowed.

The premium that Brent traded at relative to WTI used to run in the double digits. The spread was the result of surging shale output that ended up trapped in the U.S. because of a ban on crude exports. The spread, however, shrank in recent years after the broader oil market meltdown in 2014, combined with the inauguration of U.S. crude exports at the end of 2015 and into 2016.

U.S. exports, however, really began to pick up last year. U.S. crude exports bounced around between 0.5 million barrels per day (mb/d) and 1 mb/d in the first half of the year, a level that jumped to a range between 1 and 2 mb/d in the third and fourth quarters.

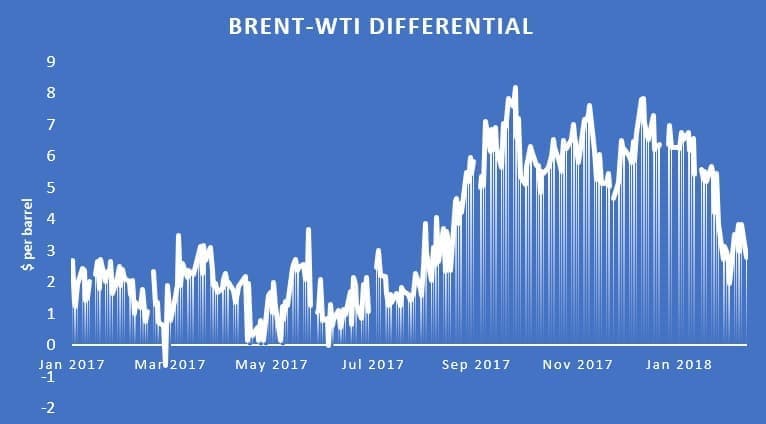

Hurricane Harvey interrupted a major portion of refining in the U.S. for a few months, leading to the Brent-WTI differential to open up once again as crude stocks built up along the Gulf Coast. That helped spark the higher levels of exports at the end of the year as the arbitrage opportunity played out.

But while the Brent-WTI spread jumped over $7 per barrel between September and December, it has sharply narrowed more recently.

(Click to enlarge)

There are several reasons for this. First, U.S. crude exports remain elevated, although down a bit from the fourth quarter. Meanwhile, the Keystone pipeline was temporarily knocked offline at the end of 2017 and is still operating below full capacity. That has trimmed volumes flowing into the U.S.

Moreover, new pipelines have increased connections around the U.S., easing bottlenecks and allowing more U.S. oil to reach its destination. For instance, the Diamond pipeline started up in December, opening a route from Cushing, OK to Memphis, TN. That has led to a sharper drawdown in crude inventories at Cushing, helping to push up the WTI benchmark.

Finally, the recent startup of the Louisiana Offshore Oil Port (LOOP), which is the only port capable of handling the oil industry’s largest oil tankers, has raised expectations of a flood of U.S. oil reaching the global market. LOOP can handle very large crude carriers (VLCCs), which can carry as much as 2 million barrels. Not only does LOOP mean that more volume can be moved, but using larger but fewer tankers could also cut transit costs, adding to the appeal of American crude.

That means rather than the U.S. becoming awash in oil once again as shale drillers ramp up production, much of the additional barrels could be shipped abroad.

"There could not be a better time to offer this service as domestic production surpasses 10 million barrels per day in the ever-dynamic global crude oil market," said LOOP LLC President Tom Shaw, according to Bloomberg. Related: What Is The Right Price For Oil In A Balanced Market?

All of that has helped push up WTI. Meanwhile, refinery maintenance in Europe has dampened demand for Brent, causing the two benchmarks to converge. The “price gap between the two oil types has narrowed to its lowest level in six months. This is due to the pronounced fall in crude oil stocks at Cushing, the delivery point for WTI,” Commerzbank wrote in a note on Tuesday. “For one thing, less crude oil is being transported from Canada to Cushing due to the restricted capacity of the Keystone pipeline. And for another, new pipeline capacities mean more crude oil is leaving Cushing.”

Prices for front-month contracts between Brent and WTI has shrunk to less than $4 per barrel, and the spread between spot prices recently dipped below $3 per barrel, the lowest since Hurricane Harvey.

However, the narrowing differential between WTI and Brent likely means that demand for American crude could slow a bit as WTI-linked cargoes become comparatively less attractive. It is a sort of self-limiting phenomenon: the wide price differential led to a surge in exports, which helped eliminate the huge price difference, which in turn could put a ceiling on exports.

That doesn’t mean U.S. crude exports will necessarily fall back to the old levels before last year, below 1 mb/d, for example. The export machine is here to stay in some form or another, particularly with new pipelines coming online, along with retooled export facilities capable of handling more shipments. Plus, surging upstream production doesn’t hurt. “If (as expected) U.S. shale production continues to increase during 2018, then exports will flow,” Sandy Fielden, director of oil and products research at Morningstar, wrote in a research note.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- Saudis Ready To Swing Oil Market Into Deficit

- Oil Prices Rise After EIA Reports Crude Draw

- Why The Next Oil Boom Will Be Fueled By Blockchain