Last year, the U.S. energy sector emerged as the class valedictorian after it finished strongly in the green, the only of the country’s 11 market sectors to pull off the feat. Indeed, the sector’s popular benchmark, the Energy Select Sector SPDR Fund (NYSEARCA: XLE) finished the year with a 53% gain, with most Big Oil stocks putting up impressive returns. For instance, Exxon Mobil Corp. (NYSE: XOM) rocketed 73.6%; Chevron Corp. (NYSE: CVX) returned 50.5% while ConocoPhillips (NYSE: COP) was up 68.8%.

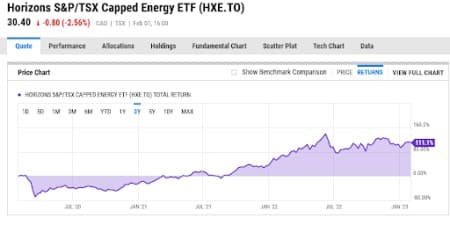

But Big Oil’s neighbor to the north was not a slouch either, with Canada’s energy sector also shining: the country’s energy benchmark, Horizons S&P/TSX Capped Energy ETF (HXE.TO), finished with a 51% gain, marking the second straight year it returned more than 50%. Among the top-performers were Tourmaline Oil (TSX:TOU) +63%, Element Fleet Management (TSX:EFN) +58% and Cenovus (TSX:CVE) +56%. All three stocks benefited from robust earnings growth as well as vastly improved balance sheets.

Source: Y-Charts

Over the past few years, a vicious one-two-three punch that started with a gloomy long-term future outlook due to rampant fossil fuel divestments, climate change policies and decarbonization as well as shorter-term, but severe shocks from the COVID-19 crisis, threw Canada’s most important exports industry into an existential crisis.

Meanwhile, the drumbeat of exits by foreign oil firms bailing on the unprofitable tar sands added an extra layer of gloom for an industry that’s responsible for a fifth of Canada’s exports. But the ongoing energy boom has proven to be a rare boon for Canada’s long-suffering sector, with plenty of bargains to be found amongst the TSX Energy sector.

Related: LNG Prices May Have Plunged, But A Rebound Is On The Horizon

And, just like its American peer, TSX Energy has kicked off the new year on a positive note, and could be headed for another bumper year. Here are a few reasons why we believe this could be the case.

Production Discipline

After years in the doghouse, Canada’s famous Oil Patch is enjoying a rare oil boom with oil and gas revenues expected to reach record levels.

Typically, during past oil booms after a downturn, Canada’s OilPatch went through a predictable pattern of new startups setting up shop; soaring land prices and companies cranking up production. But things are playing out differently during the current boom cycle. A recent report by BMO Capital Markets says the North American oil and gas sector is enjoying its strongest financial position in years but the excess cash will largely be distributed to shareholders instead of going to drilling new wells.

"I've never seen this kind of response to demand increases before--ever," Tamarack Valley Energy (OTCPK: TNEYF) CEO Brian Schmidt has marveled.

Canadian Natural Resources (NYSE: CNQ), Suncor Energy (NYSE: SU), Cenovus Energy and Imperial Oil (NYSE: IMO) have all raised their capital spending and oil production expectations. However, a big difference this time around compared to past years is that the companies are opting to spend on dividends, share buybacks, and squeezing more barrels out of existing assets, instead of taking on new, large expansion projects. BMO has tapped Bonterra Energy Corp. (OTCPK: BNEFF) and Canadian Natural Resources as good buys. In addition to these, we recommend Arc Resources (OTCPK: AETUF), Enbridge Inc. (NYSE: ENB) and Cenovus Energy.

That said, Canada’s Oil Patch is poised to grow production again in 2023 despite producers planning to stay the course with modest spending, “I think it will nudge a little higher because of projects already in place. But I don’t think you’re going to see the 'drill, baby, drill' mentality of decades ago,’’ Philip Petursson, chief investment strategist at IG Wealth Management, has told Bloomberg. Further, completion of the Trans Mountain pipeline expansion is expected to offer additional transportation capacity for oil companies thus increasing the potential for export growth. Mike Belenkie, CEO of Advantage Energy Ltd. (OTCPK: AAVVF) has told Bloomberg that said his company plans to grow at a rate of 10 to 12 per cent annual clip over the next couple of years, "Over the last decade, most of the companies that were weak have died off and fallen away. And the companies that are left behind are fairly strong and have the ability to weather a lot of volatility," Belenkie has said.

Rewarding Shareholders

After a bumper year of share buybacks and dividends, BMO Capital Markets analysts have predicted that debt-light Canadian oil and gas producers are poised to reward shareholders even more in 2023 thanks to their ability to generate ample cash, less debt obligations coupled with their diminished appetite for acquisitions.

BMO estimates that the top 35 energy companies will generate C$54 billion ($39.7 billion) in free cash flow in 2023, 16% lower than the previous year. However, analysts say that the portion of the cash that flows to shareholders is likely to be higher this year because companies will spend less on debt repayments. According to the analysts, most large- and mid-size producers expect to be net-debt-free in the second half of 2023. Net debt represents a company's gross debt minus cash and cash-like assets.

Overall, the Canadian Oil Patch is in a good place right now, and barring major black swan events should continue being an attractive sector for long-term investors.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Russian Urals Traded At $49.48 in January, But The Kremlin Isn’t Worried

- Germany’s Largest Gas Storage Facility Can’t Store Gas

- Germany’s $2 Trillion Economic Miracle at Risk