Oil prices started Tuesday down on gloomy economic news, with mounting fears that economic growth will slow in 2019

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

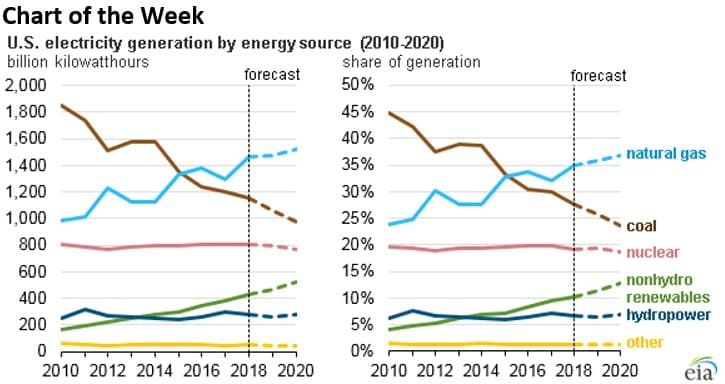

- The EIA expects renewable energy to be the fastest source of growing electricity generation for at least the next two years.

- Utility-scale solar will expand by 10 percent in 2019 and 17 percent in 2020, the EIA estimates. Wind will grow by 12 percent and 14 percent in 2019 and 2020, respectively.

- Meanwhile, total electricity generation will fall by 2 percent this year and will likely be flat in 2020.

- That means that renewables overall share of the pie will grow 10 percent in 2018 to 13 percent in 2020.

Market Movers

• Tellurian’s (NASDAQ: TELL) proposed Driftwood LNG project obtained an approval for an environmental assessment from the U.S. Federal Energy Regulatory Commission, clearing the way for the company to seek its last permit to proceed with construction.

• Consolidated Edison (NYSE: ED) was downgraded by Bank of America Merrill Lynch to Neutral from Buy with an $80 price target because the company owns renewable energy projects that sell power to PG&E (NYSE: PCG), the California utility that is facing bankruptcy.

• Schlumberger (NYSE: SLB) saw its shares jump more than 8 percent on Friday, the largest one-day gain for the company in eight years, after reporting an upbeat guidance for 2019.

Tuesday, January 22nd, 2019

IMF warns economy “weakening.” The International Monetary Fund warned on Monday that economic growth could slow this year. “While global growth in 2018 remained close to post-crisis highs, the global expansion is weakening and at a rate that is somewhat faster than expected,” the Fund said. The IMF lowered its global growth estimate to 3.5 percent this year, down 0.2 percent from its October estimate. The Fund said that the downward revision is modest, but that downside risks are rising. “While financial markets in advanced economies appeared to be decoupled from trade tensions for much of 2018, the two have become intertwined more recently, tightening financial conditions and escalating the risks to global growth.”

Oil prices pause on weak China data. After hitting a two-month high in recent days, oil prices have taken a breather on renewed concerns of an economic slowdown generally, and in China more specifically. On Monday, China reported its 2018 GDP growth rate at 6.6 percent, the weakest in nearly three decades.

Permian crude prices soar to highest since March. Oil price discounts in Midland have narrowed sharply, converging towards WTI in Houston. The discount is now at its smallest since March 2018. Discounts once traded nearly $20 per barrel below WTI in Midland, but the discount has now fallen to roughly $2.25. Some midstream capacity has been added in recent months, while production growth hit a rough patch this month because of cold weather.

Schlumberger: Shale growth slowing. Schlumberger (NYSE: SLB) saw its share price jump over the last few trading days after reporting upbeat guidance for 2019. However, the oilfield services giant also said that its fourth quarter revenue fell by 12 percent quarter-on-quarter, the result of slowing drilling activity in the U.S. shale patch. “We could be facing a more moderate growth in U.S. shale production in coming years,” Schlumberger’s CEO Paal Kibsgaard told investors on an earnings call. Related: U.S. Refiners Rush To Buy Heavy Oil As Trump Looks To Punish Maduro

Rig count plunges. On Friday, Baker Hughes reported a massive decline in the U.S. rig count, with oil rigs falling by 21 and natural gas-focused rigs falling by four. The huge drop off is the clearest sign yet that the oil price downturn that began in October is starting to wear down the shale industry. Oil prices firmed up on the news.

Energy industry expects to increase spending. The majority of top energy executives see an uptick in spending this year, according to a survey by DNV GL. The survey of 791 top energy professionals finds that 70 percent of respondents planned to either maintain or increase capex this year, compared to just 39 percent in 2017. “Despite greater oil price volatility in recent months, our research shows that the sector appears confident in its ability to better cope with market instability and long-term lower oil and gas prices,” said Liv Hovem, who heads DNV’s oil and gas division, according to Reuters. “For the most part, industry leaders now appear to be positive that growth can be achieved after several difficult years.”

Mexico pipeline explosion death toll rises. The death toll from the oil pipeline explosion in Mexico has jumped to 91 and could yet exceed 100. The incident has raised questions about why it took Pemex so long to shut off the pipeline after thieves ruptured it.

Government shutdown delays Atlantic exploration. A federal court judge ruled on Friday that the U.S. Department of Interior cannot process seismic testing permits for offshore oil exploration in the Atlantic Ocean while the government is shutdown.

Related: The World’s Most Geopolitically Charged Pipeline

Colombian pipeline hit by bomb attack. Ecopetrol SA, Colombia’s state-owned oil company, said on Sunday that its Transandino pipeline was hit by a bomb attack, causing a spill near the border with Ecuador. The 85,000-bpd pipeline was not operating at the time.

More signs of gasoline glut. European shipments of gasoline are having trouble finding a home, Bloomberg reports. The surge in U.S. shale production, a light oil that yields relatively high amounts of gasoline, has left the market well-supplied. “Shale oil production is going through a dream phase and the U.S. is going to make more gasoline,” said Olivier Jakob, managing director at Petromatrix GmbH.

South Sudan sees oil output increase 34 percent. South Sudan has increased its oil production by 34 percent after the Unity fields reopened, according to S&P Global Platts, pushing output up to 175,000 bpd.

LNG derivatives take off. The volume of derivatives based on LNG only represented about 2 percent of global LNG production at the start of 2017, according to Bloomberg. But by the end of 2018, derivatives trade ballooned to 23 percent of LNG supply. Volumes are still a fraction of those for Brent crude, for example, but the rising liquidity in trading is evidence that the market is maturing.

China funding coal projects worldwide. China is cutting the use of coal, but it is promoting coal abroad in order to develop markets for its product. Reuters reports that China has helped finance about a quarter of coal projects worldwide even as it seeks to curtail coal use at home due to environmental concerns. The top countries include Bangladesh, Vietnam, South Africa and Pakistan.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- This Is How Much Each OPEC+ Member Needs To Cut

- Low Oil Prices Are Not The Only Problem For The Permian

- Oil Prices Plunge On Fears Of Global Economic Slowdown