The mood in Vienna this week is considerably more chipper than it was in June. This is because the cartel appears - in the words of Charlie Sheen - to be #winning.

But it hasn't all been plain sailing. In fact, it's been decidedly choppy. From an export perspective, certain cartel members have made a concerted effort to keep crude off the market, while others have blatantly not. Saudi continues to lead the way in terms of compliance - and they have the most to #win.

Versus last October's reference level, OPEC exports have dialed back by an average of 300,000 barrels per day over the first three quarters of this year. Saudi Arabia is accountable for a large chunk of this, exporting around 260,000 bpd less over the period. While others have also reined in exports, increasing flows from the likes of Libya and Nigeria have offset these efforts.

Although Saudi exports have ticked higher in the last couple of months, exports have dropped from other members instead. This has been out of necessity, as opposed to complicity. As the Venezuelan economy descends into chaos, its exports have dropped as production falls to near 30-year lows. Meanwhile, Iraqi exports have come off amid a conflict in the Kurdish region of northern Iraq.

Elsewhere, Iranian and Libyan shipments have dropped amid production issues. All this activity (well, inactivity) has ushered November exports so far to their lowest monthly level since mid-last year.

(Click to enlarge)

As discussed on CNBC yesterday, while OPEC may be #winning, this is in large part due to Saudi Arabia, who has carried the burden of the cuts. This is illustrated rather splendidly by exports from the kingdom to the US in the last quarter. Related: Vienna Is The Ultimate OPEC Smokescreen

On a year-over-year basis, US imports of Saudi crude fell by 36 million barrels in Q3, as the kingdom slashed flows heading west of Suez to the most transparent, most timely, and largest crude market in the world (a.k.a., the U.S.). US crude inventories in Q3 correspondingly fell by an exceedingly similar 38 million barrels:

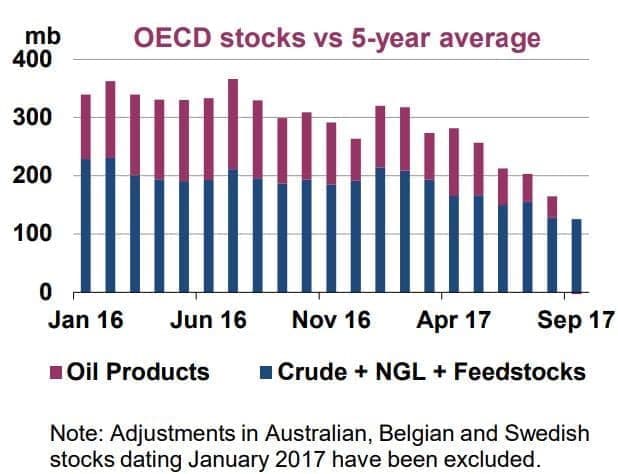

This drop in flows to the US has played a key role in helping OPEC on its way towards its ultimate target: the 5-year average for OECD crude and product inventories. According to the IEA, stocks in September declined versus the 5-year average for a fifth consecutive month, dropping to their lowest level in almost two years at 2.97 billion barrels.

Bearing in mind what we have seen in terms of OPEC exports in the subsequent two months since, OPEC - and Saudi in particular - have the right to feel like they are #winning.

By Matt Smith

More Top Reads From Oilprice.com:

- China's EV Plan Could Cause An Oil Price Crash

- BREAKING: OPEC Agrees To 9-Month Extension Of Oil Production Deal

- U.S. Oil Has One Fatal Weakness