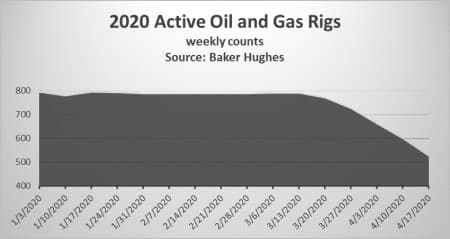

Baker Hughes reported on Friday that the number of oil and gas rigs in the US fell again this week by 73, falling to 529, with the total oil and gas rigs clocking in at 483 fewer than this time last year. It is the largest single-week drop in five years.

Over the last five weeks, oil and gas rigs combined have shed a total of 263 rigs.

The number of oil rigs decreased for the week by 66 rigs, according to Baker Hughes data, bringing the total to 438—a 387-rig loss year over year. It is the fewest number of active oil rigs since October 2016.

The total number of active gas rigs in the United States fell by 7 according to the report, to 89. This compares to 187 a year ago.

The number of active rigs taken offline over the last five weeks highlights the growing concern in the oil markets that not just low oil prices, but possibly even more importantly, a lack of storage space, has a ripple effect that is now settling into the number of rigs.

The EIA’s estimate for the week is that oil production in the United States fell to 12.3 million barrels of oil per day on average for week ending April 10, which is 700,O00 bpd off the all-time high and 100,000 bpd lower than the week prior. It is the lowest production level since August last year.

The Brent benchmark was trading at $18.44 (-7.20%)—down by $4 per barrel from last week’s levels.

Canada’s overall rig count decreased by 5 rigs as well this week, to a total of just 30 rigs. Oil and gas rigs in Canada are now down 36 year on year.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Saudi Arabia Slashes Asian Oil Exports By 2 Million Bpd

- The Big Shale Short: Twitter Traders Make Millions On The Oil Price Crash

- The Real Winner Of The OPEC+ Output Deal