Oil prices were trading up over 1% on Thursday afternoon, the latest development in the current oil market that can’t decide whether oil prices should be up or down.

Today’s major catalysts include the day-ago signed truce to the US-China trade deal that promised—perhaps overly optimistically so—to see China purchase tens of billions of dollars wroth of US energy exports, along with today’s approval by the US Senate of the US-Mexico-Canada trade deal known as the USMCA, which should also provide a boost to US oil exports.

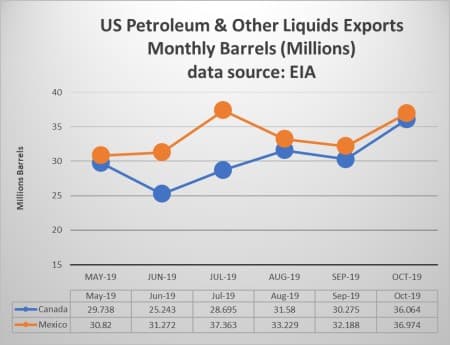

Mexico and Canada are by far the largest importers of US crude oil and oil products, according to the EIA, taking more than 36 million barrels each per month, according to the latest data available. The next largest importer of US crude oil and products is South Korea, at 19.4 million barrels. Canada and Mexico have increased their take of US crude oil and products over the previous six-month period, from May to October 2019.

US crude oil production has continued to steadily increase over the course of 2019, in line with those exports, before reaching 13 million barrels per day last week, according to weekly EIA data.

This extra production and deal with both China (who imports between 1 million and 9 million barrels a month in crude and products from the United States) and the USMCA comes not only as the US continues to increase its production, but as it alleviates previous pipeline bottlenecks that have depressed prices somewhat.

Three new pipelines launched last year between the prolific Permian basin and the US Gulf Coast, adding nearly 2.5 million bpd in takeaway capacity. New offshore oil ports, too, are set to come online over the next couple of years.

WTI crude was trading at $58.61, up $0.80 (+1.38%) on Thursday afternoon, while Brent crude was trading at $64.82, up $0.82 (+1.28%) on the day.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- How Vulnerable Is Iraqi Oil Production?

- How China Could Restart The U.S. Oil Export Boom

- Florida To Buy Part Of Everglades To Protect Them From Oil Drilling