Taking a look at our proprietary ClipperData in recent days, there has been two trends that have jumped out: changing oil dynamics in the US, and changing flows in the Asian gasoline market.

First up, the U.S. market. The chart below shows how the API of monthly waterborne crude imports into the US Atlantic Coast has been getting progressively lighter.

As less crude by rail from Bakken has made its way to Atlantic Coast refiners in recent years due to unfavorable economics, the need for light, sweet crude has increasingly been met by West African (WAF) and North African (NAF) imports. Think: Nigeria, Angola, Algeria and Libya.

While Atlantic Coast waterborne imports rose by 6 percent in 2017, WAF and NAF grades increased by a rampant 32 percent. Just over three-quarters of WAF / NAF barrels delivered to the Atlantic Coast in 2017 had an API of 33 or higher (putting them into the 'light crude' bucket).

As illustrated below, crude imports into the Atlantic Coast had an average API of 30 for much of 2015, with a sulfur content of over 1 percent. Fast forward to 2017, and imports have become both lighter and sweeter. Imports saw an average monthly API as high as 37 last year, while sulfur content has halved to be much closer to 0.5 percent.

(Click to enlarge)

The second theme that has jumped out relates to the Asian gasoline market, and how it is becoming much more insular.

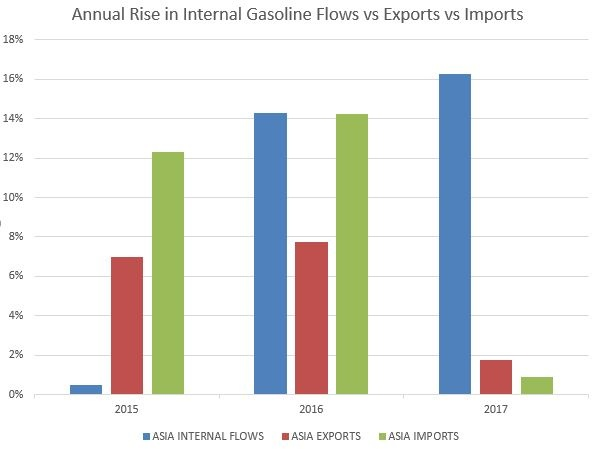

The chart below shows the rise in internal flows in Asia (i.e., domestic flows), as well as increasing gasoline imports and exports over the last three years.

While internal flows barely grew in 2015, waterborne imports were up over 12 percent. But in 2016, internal flows increased 14 percent, before rising by 16 percent last year. For the same two years, imports rose 14 percent in 2016, but only 1 percent last year, while the pace of rising exports also slowed from 8 percent in 2016 to just under 2 percent in 2017. Related: Azerbaijan: A Crucial Energy Hub

The key takeaway? Asia is increasingly meeting its own needs, using domestic production of gasoline to offset rising demand, dialing back on its exports in the process. With this transition underway, Asian nations are also seeing a lesser need to ramp up imports. Asia appears to be becoming more self-sufficient, at least from a gasoline perspective.

(Click to enlarge)

By Matt Smith

More Top Reads From Oilprice.com:

- Rig Count Shoots Up As Oil Nears $70

- T. Boone Pickens Shuts Down Oil Hedge Fund

- Shale Restraint Could Lift Oil To $80