Investor Alert: A new multi-trillion dollar space race is unfolding right before our eyes. Bezos, Branson, Musk, and even Gates are already in. And VCs are scrambling to catch up, dumping over $133 million EVERY MONTH in new interplanetary startups. Investors are making an absolute killing in this burgeoning new sector. And it’s not hard to see why.

Want to learn more about this exciting new opportunity? Click here for the full report.

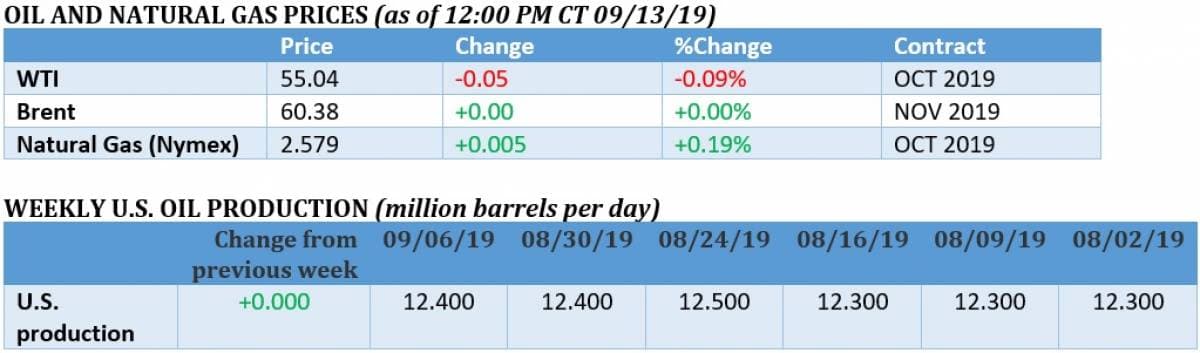

(Click to enlarge)

(Click to enlarge)

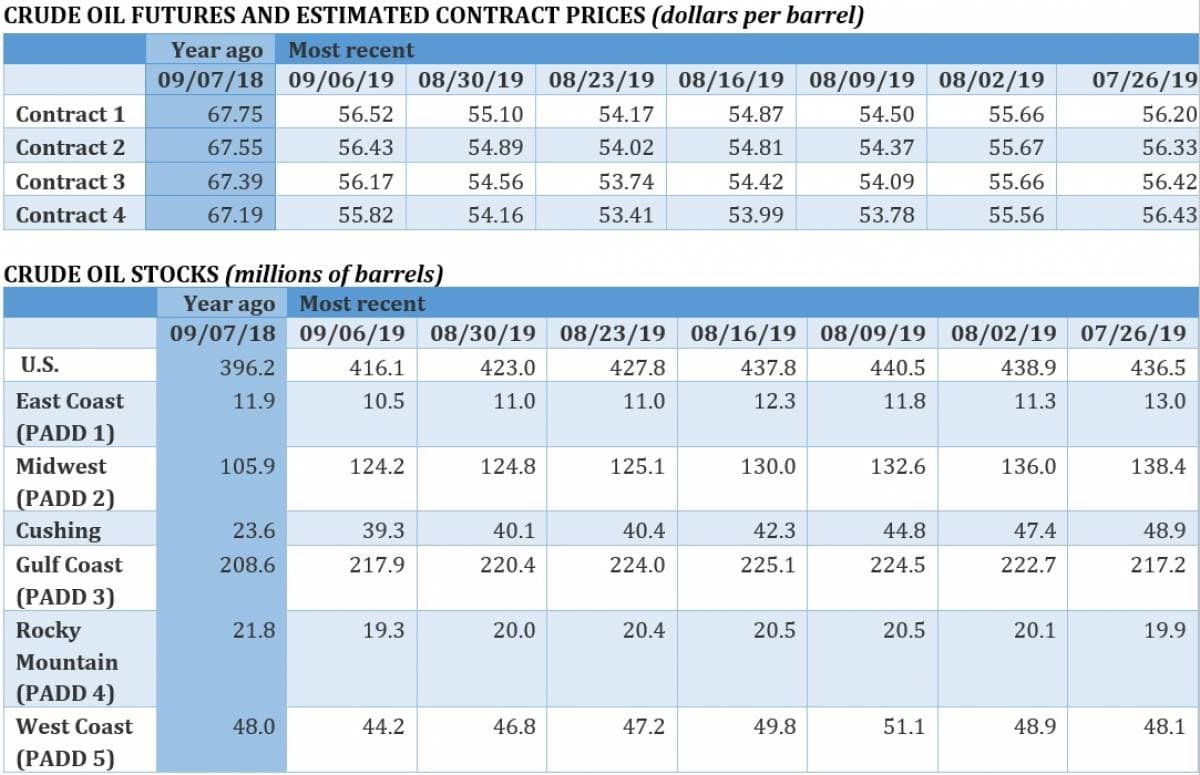

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Friday, September 13th, 2019

Trade overtures boost markets. A series of back-and-forth good will gestures between Washington and Beijing has boosted market sentiment. On Thursday, Chinese firms bought 10 shipments of U.S. soybeans in another effort to build confidence ahead of October trade talks. Politico reports that the Trump team is trying to find an “escape hatch” to get out of the trade war that the President started. With pain clearly deepening for both sides, there is a growing eagerness to head off trade escalation. Still, a breakthrough in negotiations is a big ask.

IEA: Oil tight now, surplus in 2020. The IEA said this week that the market will see inventory drawdowns of 0.8 mb/d in the second half of 2019, but that a surplus would return in 2020. The “call on OPEC” is set to decline by 1.4 mb/d next year, presenting a serious challenge to the cartel.

Saudi oil minister wants to rebuild OPEC ties. After several years in which the Saudi-Russian relationship seemed to take a higher priority over cohesion within OPEC, the new Saudi oil minister wants to rebuild trust within the group. “The new minister likes decisions to be unanimous instead of being presented as just Saudi-Russian agreements,” a source told Reuters. “He wants us to be a united front.” In an early sign of success, several OPEC members vowed to boost compliance with the cuts.

Related: Oil Markets Face Serious Risk Of New Supply Crunch

Pemex issued new bonds to pay old ones. Pemex issued $7.5 billion in new longer-dated bonds, easing the near-term path on bond payments for the world’s most indebted oil company. The move may also reduce the risk of a credit downgrade. In addition, the Mexican government is injecting another $5 billion into the company.

GE to give up control of Baker Hughes. GE (NYSE: GE) has decided to give up majority control of Baker Hughes (NYSE: BHGE) by winding down their stake in the company. The move is expected to raise nearly $3 billion for GE and take its stake below 40 percent. GE acquired a 62.5 percent stake in Baker Hughes in 2017.

Netherlands to halt Groningen gas by 2022. The Dutch government said it would halt production of the massive Groningen field – Europe’s largest onshore gas field – by 2022, eight years earlier than planned. The increasing frequency and severity of earthquakes in the Netherlands, with an especially large one earlier last year, has accelerated the shutdown plans

Colombian court upholds fracking ban. Colombia’s high court upheld a temporary ban on fracking, a decision denounced by the oil industry but celebrated by environmentalists. According to Argus Media and Ecopetrol data, Colombia’s Middle Magdalena Valley basin holds between 4 and 7 billion barrels of oil equivalent.

U.S. natural gas production hits new record. U.S. natural gas production rose to 91 Bcf/d in August, an all-time monthly high. The increase came despite low prices.

“Electric fracking” cuts costs, threatens services companies. As Reuters reports, a growing number of U.S. shale companies are turning to “electric fracking,” which uses natural gas to power fracking operations rather than costly diesel. E-frac, as the technology is called, could reduce the cost of a $6 million-$8 million shale well by $350,000. But while they save money for producers, they threaten the business model of oilfield services companies like Halliburton (NYSE: HAL), which have tens of billions of dollars tied up in older technologies. Halliburton said it would be too costly to make the switch.

Norway increases North Sea production. Equinor (NYSE: EQNR) started up production from the Mariner field in mid-August, and is aiming to begin production from the Johan Sverdrup field in October. Together, the fields could add almost a half million barrels per day of production by 2020.

Interior: Drilling in ANWR would have little impact. The Interior Department said that drilling in the Artic National Wildlife Refuge (ANWR) would have a negligible environmental impact, paving the way for a lease offering later this year. Meanwhile, the U.S. House of Representatives passed a bill reversing the law that allowed drilling in ANWR, although it is set to go nowhere with the Republican-controlled Senate. Related: Is OPEC’s No.2 Finally Cutting Production?

Trump to move forward on stripping California of fuel economy authority. The Trump administration has decided to move forward on an attempt to strip California of its unique authority to set stricter fuel economy rules, according to Bloomberg.

Alta Mesa files for bankruptcy. Alta Mesa (NASDAQ: AMR) became the latest shale driller to file for bankruptcy, while an SEC investigation into potential fraud continues. As the Houston Chronicle notes, the shale company, led by a former Anadarko Petroleum chief executive, was valued at as much as $3 billion in early 2018, but has collapsed to just $30 million with its share price trading at less than 8 cents per share.

Greenpeace partially shuts Houston Ship Channel. Activists with Greenpeace partially shut the Houston Ship Channel on Thursday, repelling down a bridge to block shipping traffic in an effort to put a spotlight on the climate crisis ahead of the Democratic debate, which was held in Houston on the same day.

Banks step up efforts to track and report carbon. Major banks see risks to fossil fuel assets from climate change, and are increasing their efforts to track and report their involvement in carbon emissions, according to Bloomberg Businessweek. Roughly 45 global financial institutions have signed up for voluntary commitments to lower their emissions profiles in their lending.

Trump admin urges biofuels groups to accept compromise. In a closed-door meeting on Thursday, the White House urged U.S. biofuels companies to accept a 5 percent increase in blending requirements for 2020, according to Reuters. Biofuels groups want assurances that the move is not a one-off. The Trump administration has struggled to please both oil refiners and the biofuels industry, a conflict that escalated after an August decision to give 31 blending waivers to refiners.

IHS Markit report predicts low natural gas prices for years. According to IHS Markit, U.S. natural gas prices could average below $2/MMBtu next year, the lowest price in real terms since the 1970s. Demand is rising, but not by enough to absorb oversupply. “It is simply too much too fast,” Sam Andrus, executive director of IHS Markit, said in a statement. “Drillers are now able to increase supply faster than domestic or global markets can consume it. Before market forces can correct the imbalance, here comes a fresh surge of supply from somewhere else.”

BP to sell some oil projects to comply with Paris agreement. BP’s (NYSE: BP) CEO Bob Dudley said that the company would sell some oil projects in order to align its business with the Paris Climate Agreement. One idea would be to exit the most carbon-intensive projects, although BP declined to specify those. The consideration is a sign that oil majors are coming under pressure to make strategic decisions to plan for a low-carbon future.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Weakening Shale Productivity “VERY Bullish” For Oil Prices

- Iran Has Perfected The Art Of Hiding Its Oil Tankers

- Oil Flashcrashes After Trump Fires Security Advisor Bolton

As far as any substantial changes in their long range plans, it won't happen. They might agree to do this, or that, until they catch up in high technology in computer chips, jet engines, and airliner construction. But as they have been doing for the last 19 years, they will DO whatever they like, because they know that no unified group of countries big enough to force them to change will ever materialize. Capitalists, who actually control the world's democracies, are too greedy to resist the Chinese market, and the Chinese know it. The South China Sea should give people a hint of what is coming in another decade or so.

So use whatever documents they might sign to light your fireplace. On that, I would bet a lot of money.