Bullish sentiment appears to have taken over oil markets in the wake of the OPEC+ decision to cut production by an additional 1.6 million bpd from May through to the end of the year. While some, including Morgan Stanley, are warning of significant demand problems going forward, it seems that oil bulls are very much in control.

Investor Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com's premium newsletter provides everything from geopolitical analysis to trading analysis, and all for less than a cup of coffee per week.

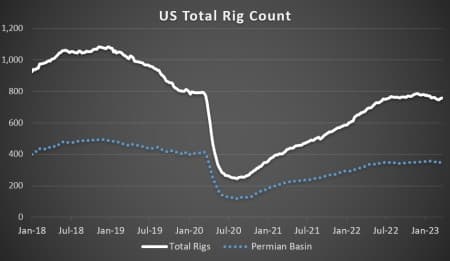

Chart of the Week

- US natural gas prices are at the lowest levels in almost 3 years as mild weather and the oil industry’s drilling spree have created a perfect storm, with associated gas accounting for roughly a third of natural gas output.

- After plunging below $2 per mmBtu in late March, prompt-month Henry Hub futures are trading around $2.1/mmBtu, with the futures curve all in contango, indicating the market anticipates supply cuts.

- The amount of US gas in storage is 21% higher than the 5-year average for this time of year, with stocks boosted by limited liquefaction from Freeport LNG, equivalent to 2% of the total gas supply back in the day.

- According to IEA forecasts, US natural gas production is expected to hit 100.67 BCF per day this year, up 3% compared to last year’s 98 BCF per day, even though some shale gas drillers have already curtailed production on low prices.

Market Movers

- US shale firm Ovintiv (NYSE:OVV) agreed to buy oil assets in the Permian Basin controlled by private equity company EnCap Investments for some $4.3 billion, sending its stock up 9% on Monday.

- The largest fertilizer firm globally, Norway’s Yara (OSL:YAR) will build its biggest-ever blue ammonia production plant in Corpus Christi, TX, teaming up with pipeline company Enbridge (TSO:ENB) for a cost of $2.9 billion.

- One of the most active firms in upstream M&A deals recently, Qatar’s NOC QatarEnergy agreed to buy a 40% stake in Shell’s (LON:SHEL) C-10 block located offshore Mauritania.

Tuesday, April 04, 2023

The surprise announcement of OPEC+ that the oil group would collectively cut production by 1.6 million b/d from May until December 2023 sent oil prices soaring, with the Monday trading session seeing the largest intraday increase since a previous OPEC+ production curb deal back in October 2022. With no major macroeconomic stories to tarnish the optimism of the bulls, a sustained oil price rally is looking increasingly likely.

OPEC+ Surprises Market with Cut. Setting oil prices ablaze, leading OPEC+ oil producers agreed on Sunday to cut production targets by a further 1.6 million b/d from May 2023 until the year-end, extending overall curbs to 3.66 million b/d or almost 4% of global crude demand.

Iraq Reaches Deal with Kurds. After almost two weeks of halted exports, exports of Kurdish oil from the Turkish port of Ceyhan will resume in a couple of days after the Iraqi federal government and the Kurdish regional authorities agreed on a revenue-sharing mechanism to be controlled by Baghdad.

Hedge Funds Cashed Out Before OPEC+ Shock. In the week preceding the OPEC+ cuts, hedge funds and money managers bought 61 million barrels in the six key futures and options contracts, with most of the buying coming from the closure of previous short positions (-48 million barrels).

Indonesia Overwhelmed by Oil Catastrophes. The third deadly incident to strike Indonesia’s oil industry in March after a fuel terminal fire and a tanker blast earlier this month, an explosion at Pertamina’s Dumai refinery on the island of Sumatra has seriously injured nine people.

North Sea Oil Strike Is On. With French strikes still ongoing, the UK trade union Unite announced the first strike of its North Sea contract workers starting April 5 as it demands better pay and work conditions, impacting output at platforms operated by Shell (LON:SHEL), Harbour Energy (LON:HBR), and APA (NASDAQ:APA).

Unsuccessfully, Glencore Seeks Takeover of Teck. Global trading and mining firm Glencore (LON:GLEN) offered $22.5 billion for Canadian copper and zinc miner Teck Resources (NYSE:TECK), a 20% premium to the company’s stock price, although the latter rejected the unsolicited offer.

Chinese Lithium Producers Set Price Floor. Concurrently with OPEC+’s attempts to establish a price floor for oil, China’s top producers of lithium carbonate have reportedly agreed on a floor price of 250,000 per tonne (36,000/mt) to slow the plunge in the price of the transition metal.

Freeport LNG Back to Normal Operation Rates. As feed gas nominations to the Freeport LNG liquefaction plant rose to 1.9 Bcf per day lately, utilizing more than 75% of pipeline capacity to the terminal, the US’ second-largest LNG export facility seems to be back to running at nameplate capacity.

Key US Gas Pipeline Stalled Again. The $6.6 billion Mountain Valley Pipeline (NYSE:ETRN) that is set to deliver shale gas from West Virginia to Virginia has suffered another setback after a US Court of Appeals vacated its water permits in West Virginia, making its H2 2023 startup almost impossible.

Shell Gets Bought Out of Sakhalin. The Russian government allowed LNG company Novatek (MCX:NVTK) to transfer $1.2 billion to UK-based energy major Shell (LON:SHEL) for its 27.5% stake in the Sakhalin-2 gas project, several months after the firm was transformed into a Russian legal entity.

UN Starts Taking Deep-Sea Mining Applications. The UN’s International Seabed Authority will start accepting offers this summer from mining companies that want to tap into the resource potential of seabeds, looking for polymetallic nodules that contain cobalt, copper, or nickel.

German Insurers Cover Nord Stream. German insurance companies Allianz (ETR:ALV) and Munich Re (XET:MUV) have renewed cover for the damaged Nord Stream 1 pipeline that was blown up last September, potentially hinting it might be repaired once geopolitical conditions are conducive.

Venezuela Oil Exports Rebound. As Venezuela’s new oil minister Pedro Tellechea continues the ongoing corruption probe into PDVSA, crude exports have bounced back to 774,420 barrels per day in March, the highest monthly figure since last August, mostly going to China.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- OPEC+ Cut Makes Oil Balance Look “Insanely Bullish” For Later This Year

- PetroChina Sees Chinese Fuel Demand Rising By 3% From Pre-Covid Levels

- Citi Doesn’t See $100 Oil Despite Shock OPEC+ Cuts