For better or for worse, oil is the lifeblood of the global economy, with the commodity being the single most important energy source. And while the developed economies are its biggest consumers, emerging market assets can end up being the biggest beneficiaries.

Crude oil prices have enjoyed a fantastic rally so far this year, and received fresh impetus after the United States recently announced an end to sanction exemptions for Iran oil buyers by May for China, Japan, India, Turkey, South Korea, and others.

As that rally rages on, investors would do well to keep a close eye on the MSCI EM Currency Index.

This index has been a notable winner, producing double-digit returns during each of the three largest oil rallies over the past two decades.

Source: Philstar

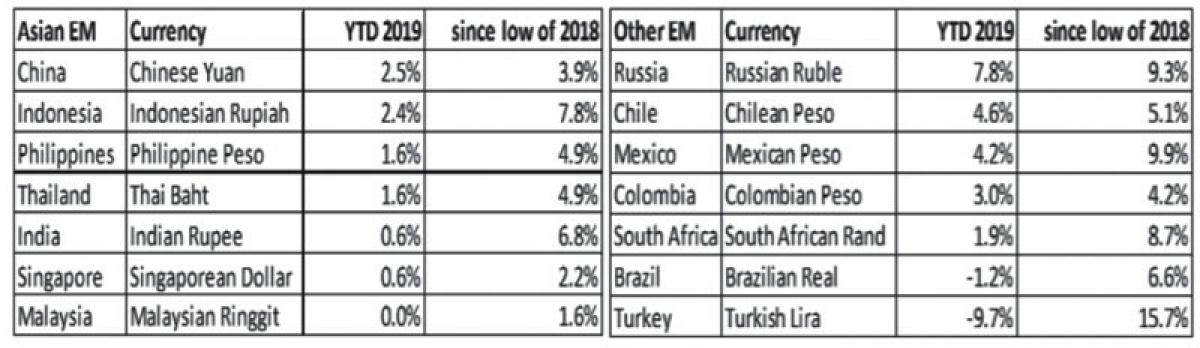

Let’s break it down by currency:

#1 Russian Ruble

YTD Change vs. Dollar: 7.8%

Source: X-Rates

As the world’s largest producer of natural gas, Russia’s economy is highly sensitive to O&G prices. It’s therefore hardly surprising that the Russian ruble is the biggest winner of the oil rally, with the currency having rallied 8.3 percent against the U.S. dollar so far this year.

The ruble has mostly recovered lost ground against the dollar after getting hammered last year due to the oil selloff and is now looking to replicate its world-beating gain of 21 percent from February 2016 to October 2018 during the last major oil rally. The leading EM currency has also been benefiting from record uptake of ruble-denominated debt and a robust current account surplus.

#2 Colombian Peso

YTD Change: 3.0%

Traders have been swooning over the Colombian Peso thanks to its qualities as a carry trade, higher oil prices, and a favorable political backdrop. Colombia’s relatively high interest rates make the currency a carry trade destination while a stable political and economic outlook are fueling enthusiasm for the country. Related: Saudi Oil Minister: We Won’t Ramp Up Oil Production Soon

After 50 years of conflict, the Colombian government finally struck a peace treaty with guerrilla group Revolutionary Armed Forces of Colombia, or FARC , and voted for a replacement for long-serving President Juan Manuel Santos.

#3 Brazilian Real

YTD Change: -1.2%

The real is a tricky bet because of the country’s planned pension overhaul.

Brazilian stocks recently hit 3-month lows on signs of political infighting as well as fears that President Jair Bolsonaro might not be fully committed to consensus-building necessary to get lawmakers to pass the pension reform bill.

The biggest positive driver for the currency right now is the fact that it has become cheap.

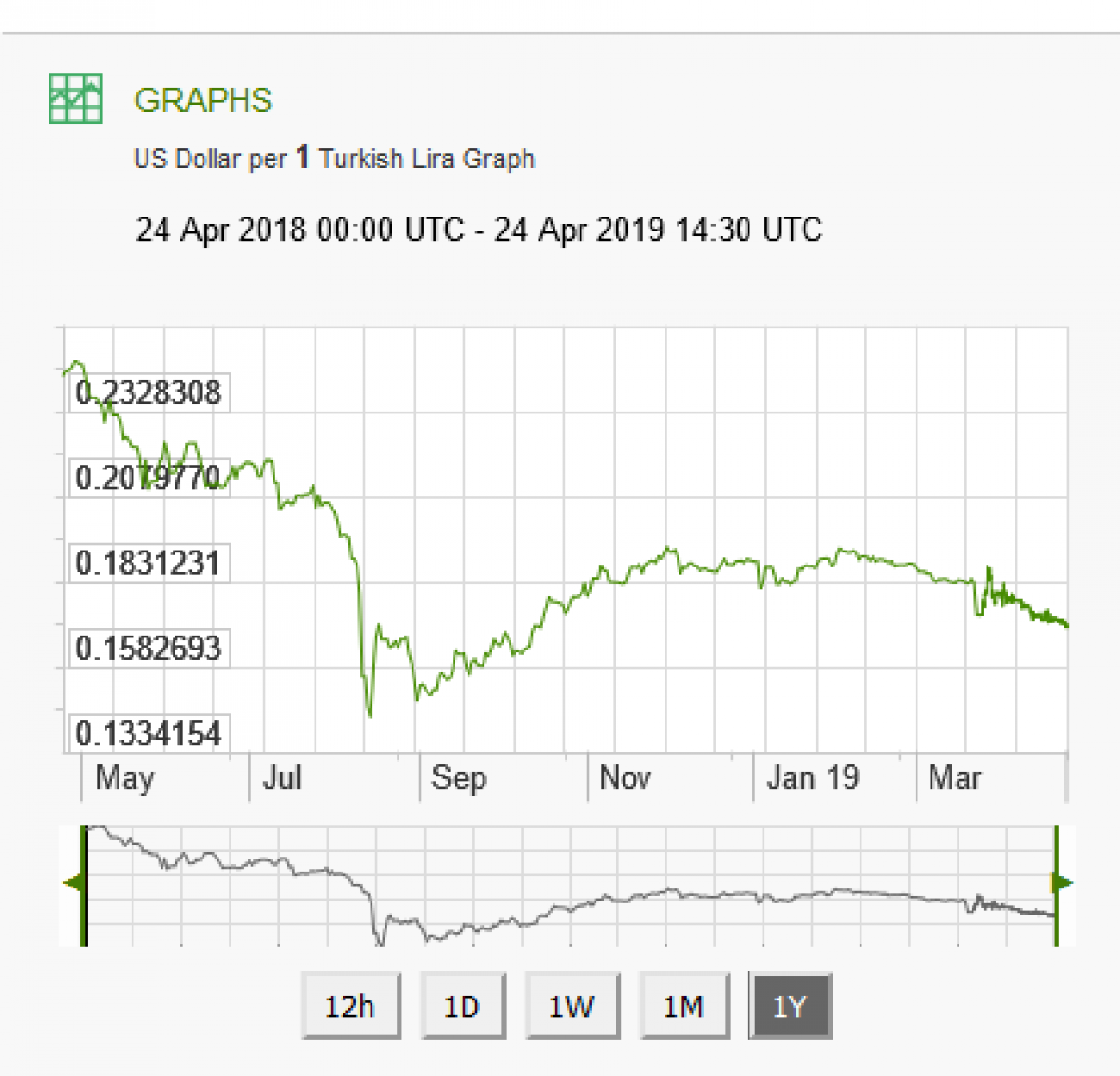

#4 Turking Lira

YTD Change: -9.7%

Source: X-Rates

Turkey imports most of its crude oil from Iran and is one of the countries facing waiver exemptions by the United States. The nation has often lagged its EM peers whenever oil prices climb, which, coupled with the unstable political backdrop, make the lira a potential weak link.

#5 Indian Rupee

YTD Change: 0.6%

Crude oil is India’s biggest import item, with nearly 15 percent of its GDP going to purchase the commodity. Indeed, India is the world’s third-largest oil importer and has posted trade deficits every month over the past five years. Consequently, the Indian rupee has been the most negatively correlated currency to crude prices over the past five years, essentially meaning that rising prices don’t bode well for the Indian economy.

Over the short-term, the trajectory of the ongoing elections is likely to drive investor sentiment.

#6 Philippine Peso

YTD Change: 1.6%

The peso was one of the worst performing EM currencies during the last oil rally. This time around, however, it seems to be holding up much better thanks to a more supportive domestic backdrop.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Is This A Gamechanger For The Lithium Industry?

- A New Middle East Mega-War Is Unfolding Right Before Our Eyes

- Saudi Arabia’s Dream Of $85 Oil Is Closer Than Ever