The history of crude oil and natural gas is a history of technological innovation. Until recently the innovation supported crude oil and natural gas. Now, it challenges it, causing structural changes in the crude oil and natural gas markets.

Originally, crude oil was only used for lighting. This changed following the invention of the internal combustion engine, which outperformed steam engine in power, range and ease of operation and maintenance, and the invention of the conveyor belt, which made it possible to mass-produce the internal combustion engine at a price which was affordable to the masses. Not much later, crude oil became the transportation fuel of choice. The horse drawn carriage was replaced by the car; the locomotive by the diesel train; the steamship by the motor vessel; and the zeppelin by the airplane.

For a long time, natural gas was an unwanted by-product from crude oil production, and typically burned off (flared) at the production site. That was until, again, technological innovation made utilization of the benefits in natural gas possible. Improvements in pipeline technology made it possible to use natural gas as a feedstock for the chemicals industry, and as fuel for home heating, cooking and power generation. Later on, LNG technology improvements greatly expanded the market for natural gas and made it truly global.

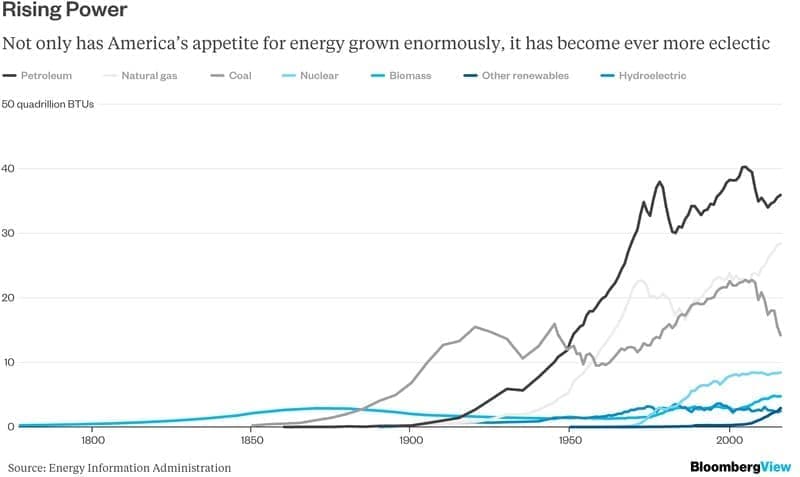

Technological innovation was therefore not only behind the first great energy revolution—from wood to coal—during the Industrial Revolution of the 18th and 19th century, but also behind the second great energy revolution—from coal to crude oil and natural gas—during the first half of the 20th century.

American Energy Consumption by Source, 1775-2012

(Click to enlarge)

Source: Energy Information Agency, via Bloomberg

Now, in 2017, crude oil and natural gas, the great beneficiaries of earlier technological innovation, find themselves challenged because of continued technological innovation. Innovation in (battery) technology has made the electric drivetrain a serious competitor for the internal combustion engine, leaving crude oil challenged by electricity while at the same time that natural gas is being challenged by solar and wind in electricity generation.

Related: New U.S. Sanctions Threaten Russian Oil Projects

This has led some to predict the imminent demise of the oil and gas industry. But is this the correct conclusion?

We must remember that both crude oil and natural gas are not solely used for transportation (crude oil) and electricity generation (natural gas). And some of the drivers of crude oil demand, such as heavy duty hauling and aviation, will remain unaffected by the electrification of transportation trend. The same goes for natural gas, which will remain the main source of chemicals and energy for the heavy-duty industries such as steel, aluminum, cement and paper.

Even if the current expectations around technological innovation materialize, it will still take time before crude oil is comprehensively outperformed by electricity in transportation and natural gas by solar and wind in electricity generation.

Along with battery innovation, the electrification of transport also requires the development of recharging infrastructure. In areas where most houses have garages this is less of an issue, as their electric cars could be charged overnight at home. And since overnight charging means charging during off-peak hours, this wouldn’t be an immediate issue for most existing power grids. In areas with many homes without garages, however, a publically accessible charging network will need to be established. The most sensible solution for such areas is to equip public parking and office parking spaces with chargers (a fantastic business opportunity for utility companies!), but this requires collaboration between city planners, real estate developers and entrepreneurs, all of whom, barring a few exceptions, have only just begun thinking through the implications of electric transportation. Thus, it will most likely take years—possibly even decades—for many areas around the world to become truly supportive of the electric transportation trend.

The shift from coal- and gas-powered electricity generation to wind and solar faces similar practical hurdles in many parts of the world. In wealthier countries, funds will be available to finance a relatively fast transition, which will include early retirement of coal and gas plants. In countries where the grid is immature and investment is necessary, this investment can quite easily be directed toward solar and wind and away from coal and gas, leading such countries to skip the coal and gas age and move straight into the renewables era. Countries with existing coal- and/or gas-based electricity grids—whether poor or faced with competing priorities (growth or sustainability?)—will be more inclined to leverage the existing infrastructure as long as possible, however, ensuring continuation of at least part of current natural gas demand for electricity generation for a long time to come.

So even under the most optimistic forecasts for technological innovation, usage of—and thus, demand—for crude oil and natural gas will likely remain well into the future, but could soon reach a peak.

That doesn’t mean that the oil and gas industry will stay the same and has nothing to worry about. The mentioned technological trends will definitely create a completely different market dynamic. Managing profitability and growth in a flatlining or even shrinking market is completely different from managing them in a growing market, after all.

Related: Trump’s China Trip To Reap Billions In Energy Deals

Natural decline will demand continued investment in crude oil and natural gas resources to be able to continue to meet demand, under both kinds of market conditions. However, in a growing market natural decline is a much bigger challenge than in a flatlining or shrinking market, as in the former more than the natural decline will have to be added to production, while in the latter less will already suffice.

In a flatlining or shrinking market for crude oil and natural gas, oversupply will therefore be a continuous threat, making the kind of pressure on the price that the oil and gas industry has experienced over the last few years a permanent reality—think “lower forever” instead of “lower for longer”. In this environment, competitive advantage is in the lowest cost resources and operations. In the former, the NOCs have the edge over the IOCs; in the latter, however, most NOCs remain outperformed by their international counterparts.

Also, in a flatlining or shrinking market, growth can only be achieved through consolidation. Only the very best performing IOCs will be granted access to the resources of the not-so-well performing NOCs, while the IOCs with anything less than stellar performance will exit the market, as the low-price environment will push many NOCs to upgrade their own capabilities to ensure continued profitability.

This exit from the market by the IOCs with less than stellar performance will either be through bankruptcy or diversification into a new market with continued growth potential. Thus, there can be no doubt that diversification is now an urgent must for all IOCs to ensure long term growth and hedge against the risk of eventual obsolescence.

By Andreas de Vries for Oilprice.com

More Top Reads From Oilprice.com:

- BP Boosts The Bullish Case For Oil

- The Remarkable Oil Major Recovery

- Is This The Cure To Saudi Arabia’s Oil Curse?

Edwin Drake was funded by Boston bankers to see if he could find a way to extract more oil from the earth than was seeping to the surface over in Western Pennsylvania. Boston was a whaling town at that time, so the bankers were seeking to invest in a plentiful replacement.

They found it.....and then some.

“ until battery technology takes a amazing leap oil and gas is the only viable energy source “.

Secondly an EV is not powered by electricity it is powered by coal or gas or nuclear .

We purchase COO's (Certificates Of Origin) for wind, so it is possible to ensure the the equal amount of electricity you consume is produced by a certain type of energy source. SO basically we run our Ioniq on windenergy.

The demand for natural gas and oil is going to be on the rise for long and the prices too. Solar, wind energy or electrical cars are OK in some unique countries or places.

"Secondly an EV is not powered by electricity it is powered by coal or gas or nuclear ."

Or wind or solar or hydro.