After years of budget cuts, oil and gas companies are finally stepping up their exploration game. Several wildcat wells planned for 2019 have the potential to be “elephant” finds, according to Rystad Energy.

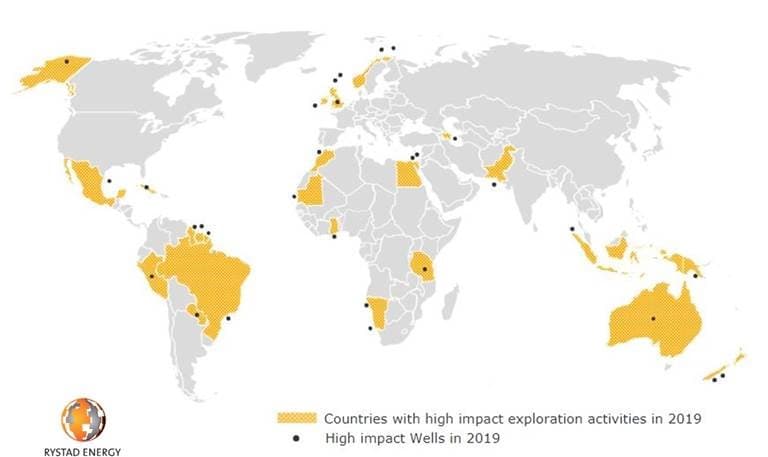

Improved market conditions and lower well costs have led E&P players to ramp up their 2019 exploration activities in all parts of the world, but driven in particular by rising investments in South America and Africa.

“Renewed optimism in exploration activities is anticipated in 2019, with operators from various segments aiming for multiple high-impact campaigns – both onshore and offshore – in essentially all corners of the world,” said Rystad Energy senior analyst Rohit Patel. “These include wells targeting large prospects, play openers, wells in frontier and emerging basins, and operator communicated high impact wells.”

To keep track of the world’s most intriguing exploration campaigns, Rystad Energy has launched a new product – the High Impact Wells Report – which pinpoints the top wildcats to watch in the coming year.

Here are some of the wells Rystad Energy’s analysts are following most closely:

Off the coast of Papua New Guinea, the Mailu-1 well will target a giant carbonate oil prospect which could open a new ultra-deep offshore play.

In Pakistan, Eni is gunning for a potential 1.5 billion barrel prize with its Kekra-1 wildcat, the first ultra-deepwater well in the country in more than 10 years.

In the Mediterranean, Dana Gas plans to make its debut as an offshore operator with the Merak deepwater well in Egyptian waters. To the west, Chariot Oil & Gas will attempt to unlock 637 million boe in potential resources with the Moh-B well off the coast of Morocco.

In Ghana, the Central Tano-1 well is classified as a large prospective resource with an estimated potential of up to 2.3 billion barrels of oil.

Off the coast of Namibia, Total aims to drill the Venus prospect with the deepest well ever drilled in Africa. Venus, which is also considered to be the largest prospect ever in Namibia, is located in a giant basin floor fan of the Orange Basin. Related: How Trump And Kim Jong Un Could Boost Vietnam's Energy Sector

In the Barents Sea, north of Norway, Lundin could open up a new play with its Setter-Pointer well. Farther to the east, Equinor is targeting an estimated 764 million boe with the Gjokasen well.

In British waters, Hurricane Energy will drill a deep-water well west of the Shetland Islands. The pre-drill estimate stands at 935 million boe, and the company has indicated a 77% chance of success.

The Dunquin South well off the coast of Ireland is expected to target the lower cretaceous-aged carbonate reservoirs at water depths of 1,500 meters. The pre-drill estimate is up to 1.4 billion barrels of oil.

In the Gulf of Mexico, Total will target the ultra-deepwater Etzil prospect, which has a whopping 2.7 billion boe pre-drill resource estimate.

Farther south, Total will invest an estimated $114 million to drill the Nasua-1 ultra-deepwater well off French Guiana. Pre-drill resource estimates are as high a 1 billion boe.

In Brazil, Shell will drill the Gato do Mato pre-salt prospect, which it successfully bid for in the second pre-salt bidding round in 2017.

“In 2018 we saw that the decline in offshore exploration activity came to an end. The total number of offshore exploration wells last year was 325, compared to around 335 in 2017. For 2019 we expect that around 400 offshore exploration wells will be drilled. Many of them could be the next elephant – a discovery holding a billion barrels or more,” Patel remarked.

By Rystad Energy

More Top Reads From Oilprice.com:

- ‘’Lower Your Costs, Or Die’’ Big Oil’s New Mantra

- Saudi Arabia Boosts Pakistan Energy Relations With $20 Billion Pledge

- Oil Prices Near Three-Month High As Market Tightens