An uncertain supply picture has oil markets on edge, with disruptions and geopolitical risks being counterbalanced by rising production in Norway and Libya. Economic uncertainty is adding downward pressure to oil prices.

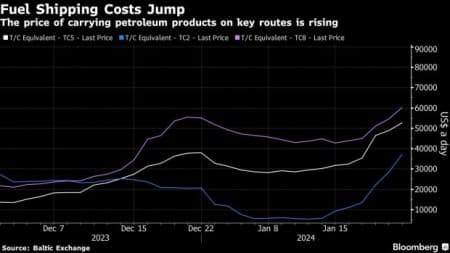

Chart of the Week

- The continued rerouting of ships from Asia to Europe has been greatly reducing the availability of spot tankers that could be chartered, lifting the price of shipping, especially when it comes to clean products.

- As Bloomberg reports, the day rate for shipping a cargo of gasoline from northwest Europe to the US East Coast has tripled since the start of the year, nearing $38,000 per day this week.

- US and UK forces conducted strikes on eight Houthi targets late Monday, making it even more likely that Red Sea disruptions will be longer than expected as the previous attack on January 11 had triggered a round of retaliatory strikes.

- Routing tankers carrying refined products through the Cape adds $1 million to freight costs, equivalent to a $1.5/bbl premium, despite the fact there is no canal passing along the way (the Suez Canal has just hiked its 2024 prices to roughly $500-600,000 per passage).

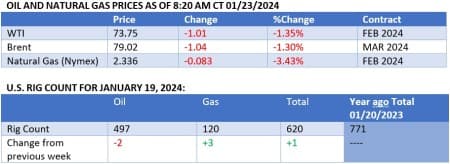

Market Movers

- US oil major Chevron (NYSE:CVX) has reportedly put its natural gas business in Canada’s Duvernay shale for sale, expecting up to $900 million for the 40,000 boed of oil and gas production there.

- PE-backed Norwegian oil producer Sval Energi, producing 70,000 b/d from stakes in 15 fields, is believed to be up for grabs as owner HitecVision intends to generate $300-400 million from its sale.

- Brazil’s national oil firm Petrobras (NYSE:PBR) said it will seek to start buying stakes in domestic onshore wind and solar projects in 2024 already, aiming to build a 2 GW portfolio.

Tuesday, January 23, 2024

The slow recovery of North Dakotan oil output, US strikes on the Houthis in the Red Sea, and drone attacks on Russia sent Brent oil prices up above $80 per barrel early on Tuesday, but new supply from Norway and Libya soon sent prices falling again. Macroeconomic factors are adding to the headwinds for oil prices, with China posting Q4 GDP figures below expectations and the US set to see a cooling in growth. Friday might be the most entertaining day this week as US inflation data might swing pricing dynamics either way.

ExxonMobil Takes Activist Investors to Court. US oil major ExxonMobil (NYSE:XOM) filed a complaint in a Texas court against an "extreme” climate proposal by activist investors Arjuna Capital and Follow This, seeking to block it before the company’s shareholder meeting in May.

Libya’s Key Field Restarts After Protests. Libya’s largest oil field, the 300,000 b/d Sharara, has restarted production after a three-week shutdown that was prompted by large-scale protests demanding affordable fuel prices and better public services in the country.

US Buys 3 Million SPR Barrels in April. In its latest monthly SPR replenishment plan, the US Department of Energy bought 3.2 million barrels of crude totaling $243 million, with ExxonMobil (NYSE:XOM) supplying 1.4 MMbbls, with BP, Macquarie, Phillips 66 and Sunoco joining, too.

Ukraine Strikes Shut Russian Terminal. Russia’s energy major Novatek has been forced to suspend operations at its Baltic Sea export terminal in Ust Luga due to a fire after a Ukrainian drone attack, shutting in a third of the country’s naphtha exports for at least several weeks of repairs.

Bakken Output Will Take Time to Recover. The North Dakota Pipeline Authority warned that it might take another month until Bakken production recovers to 1.24 million b/d after halving on the back of the cold snap, requiring several more weeks to repair frozen wells and clean up oil spills.

Uranium Continues to Soar on a Buying Frenzy. Uranium prices continued their surge and reached $106 per pound this week, the highest since November 2007, as supply disruptions from Kazatomprom (FRA:0ZQ) and Cameco (NYSE:CCJ) lowered the 2024 production outlook.

Citgo Claim Auction Tops $20.8 Billion. A Delaware court approved claims by 17 Venezuela-linked creditors including ConocoPhillips and Kock Industries for proceeds from the upcoming auction of US refiner Citgo Petroleum, owned by Venezuela, with the scope of claims moving up to $20.8 billion.

Bosphorus Scare Keeps Black Sea Tankers Waiting. Transit through the Bosphorus Strait was restricted over the weekend after the Liberia-flagged oil tanker Peria self-discharged its anchor due to bad weather, carrying Russian Urals to one of the Turkish refiners in Aliaga.

Pipeline Leak Mars Tests Shell’s Nigeria Departure. As Shell (LON:SHEL) saw its strategic decision to sell all onshore assets in Nigeria approved by the government, an investigation into a pipeline leak along the Bonny Light-carrying Obolo-Ogale pipeline in the southern Rivers State might derail that process again.

Congo In Metals Megadeal Talks with China. China and the Democratic Republic of Congo are discussing a $7 billion financing deal as part of a renegotiated minerals-for-infrastructure covenant, with re-elected President Felix Tshisekedi mentioning the talks in his inaugural address.

Shares of Grain Major Collapse on Probe News. Shares of Archer-Daniels-Midland (NYSE:ADM) plunged by 23% Monday after CFO Vikram Luthar was placed on administrative leave and Q4 results were delayed due to an investigation into accounting practices, as flagged by the SEC.

US Govt Launches Inquiry into CrownRock Deal. The US Federal Trade Commission (FTC) has asked for more information into Occidental Petroleum’s $12 billion takeover of Permian shale producer CrownRock, having already sought more data on the Exxon-Pioneer deal.

Angola’s Licensing Round Disappoints. Angola announced the results of its 2023 onshore licensing round, having received successful bids on four out of the 12 blocks on offer, unable to attract international players and allotting the blocks to local Angolan firms.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Official Says Iran Is “Very Directly Involved” in Houthi Attacks

- Canada's Uranium Is Fueling the World's Nuclear Energy Boom

- AI's Massive Power Consumption Demands Innovative Energy Solutions