Renewable energy stocks are having a hard time, even in the middle of Europe’s energy crisis. It seems that the sector needs central banks to take their foot off the gas in hiking interest rates, but it may have to wait a little longer.

The European Renewables Index has lost most of its summer outperformance over the wider Stoxx Europe 600 Index. Since a year-to-date peak in August, renewable stocks have fallen 20%, and only real estate has performed worse. They’ve recovered a bit since Oct. 12 thanks to expectations for a change in tone from central banks, but are again at risk of disappointing investors if the Federal Reserve remains hawkish with a jumbo rate hike this Wednesday.

“Overall, it is this conflict and divergence between the short-term pain of interest-rate worries versus the long-term gain from the policy side, and currently, the short-term pain is winning this battle,” says Credit Suisse equity analyst Jens Zimmermann.

Utilities could be particularly at risk, as higher rates will hurt the sector’s 2023 revenues the most, according to Citigroup strategists led by Beata Manthey. This week is heavy in earnings, with updates from the likes of Verbund, Vestas, Orsted and Scatec in coming days. Verbund, for example, is facing headwinds from rising rates, political intervention and falling power prices, according to Credit Suisse analyst Wanda Serwinowska. Infrastructure builders are also suffering challenges.

“Market expectations have already priced in a down year for onshore wind installations in 2023, and we see a US catalyst sooner than in the EU,” says Citigroup analyst Martin Wilkie, referring to tax credits in the US Inflation Reduction Act.

“We continue to believe that Vestas remains the key long term winner, but policy catalysts look to be end-fourth quarter at best, and possibly early 2023.”

While the longer-term policy outlook is supportive as governments look to meet targets to cut emissions, there’s speculation that energy windfall taxes could hit renewable equities in the near term. Germany’s plans would affect firms making electricity from lignite, nuclear, oil, renewables and waste, yet plants fed by gas or charcoal would be spared, fueling fund manager frustration.

“There has been no clear plan implemented to solve short, medium-term hurdles, this is also curtailing the growth of these companies,” says Maximilian Mahn, a portfolio manager at Bergos AG.

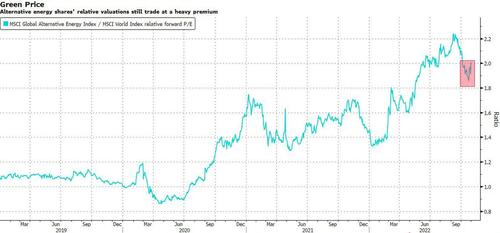

Others think the problems have been priced in, including windfall taxes, making these stocks’ valuations quite attractive. UBS analysts led by Sam Arie say a better-than-anticipated outlook for gas prices should provide an improved environment for the sector. Still, renewable stocks are not exactly cheap, with the sector still trading at a 90% premium to the broader market.

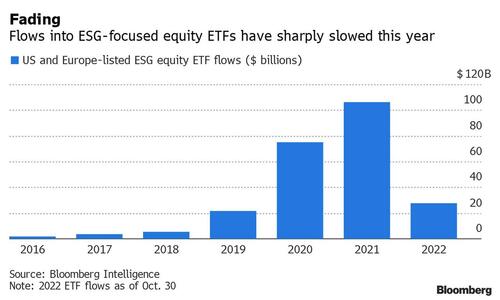

And there are plenty of other headwinds, from rising bond yields to slowing ESG money flows. The dividend yield advantage of renewables against bonds is fading away, a negative for stocks that have typically been good dividend payers, says Mahn.

The amount investors have been putting into ESG equity ETFs has retreated sharply this year, after rising to a record in 2021.

The dismal performance of ESG darlings such as tech stocks, combined with a rally in oil firms, has weighed on the attractiveness of such funds. A shift in the Fed’s narrative could start to change that.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Saudi Minister Says Sour Relations With The U.S. Will Improve

- Survey: 57% Of U.S. Voters Support SPR Releases To Lower Gasoline Prices

- Kazakhstan Looks To Lure Foreign Companies Fleeing Russia