Oil prices continue to trade in a very narrow bandwidth with ICE Brent still hovering around the $83 per barrel mark, with traders anticipating potentially impactful US economy data coming in later this week – first the US personal consumption expenditures readings, followed up by European inflation figures and Chinese PMI developments reflecting the Chinese Lunar New Year.

Ukraine’s Drone Strikes Bring Russian Refining Down

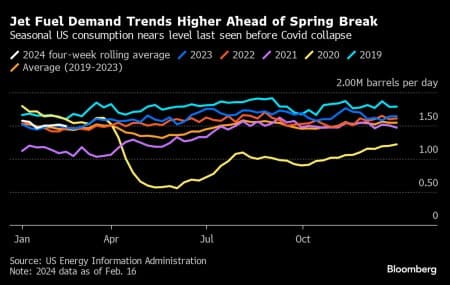

- As the United States edges closer to this year’s spring break, usually a high-demand season for jet fuel consumption as airline mobility increases, the four-week rolling average of US jet demand has been the highest in post-pandemic years.

- Simultaneously, jet fuel prices have been trending lower in recent weeks, with FOB spot prices in the Gulf Coast dropping to $2.6 per US gallon, down from $2.8 per gallon earlier this month.

- This year’s jet fuel consumption is set to surpass pre-pandemic 2019 levels, having already been the fastest-growing product in recent months, with 2024 growth coming in at 2% and demand hitting 7.35 million b/d.

- India is becoming the largest contributor to global jet fuel demand growth, becoming the third-largest market after China and the United States, as Indian airlines have purchased more than 1,200 aircraft in 2023.

Market Movers - Global trading giant Glencore (LON:GLEN) posted 2023 core earnings of $17.1 billion, half of its 2022 results, slashing its dividend to 1.6 billion and not announcing any new share buybacks for the first time in several years.

- US oil major ExxonMobil (NYSE:XOM) is reportedly considering selling its oil and gas assets in the Vaca Muerta shale play of Argentina, worth some $1 billion, with Vista Energy indicating it might be interested.

- UK oil major BP (NYSE:BP) is facing increasing investor pressure to roll back its energy transition plans, with activist investors such as Bluebell Capital calling on the new CEO to embrace a Shell-style return to oil publicly.

Tuesday, February 27, 2024

Exxon Wants to Preempt Chevron’s Guyana Takeover. US oil major ExxonMobil (NYSE:XOM) announced it may pre-empt Chevron’s takeover of a 30% stake in the Stabroek block, up until now owned by Hess Energy, claiming it has the right of first refusal on any sale in the licensed area.

Qatar Doubles Down on Gas Expansion. Qatar announced a new expansion of its LNG production from the supergiant North field, adding a further 16 million tonnes per year (or two new trains) to existing expansion plans, bringing total future capacity to 142 million tonnes LNG per year.

White House Targets Russia’s Top Shipper. The US Treasury’s Office of Foreign Asset Control has imposed sanctions on Russia’s state-controlled shipping company Sovcomflot (SCF), whilst also designating 14 crude oil tankers as property in which SCF has an interest.

Russia Bans Gasoline Exports for Six Months. The Russian government announced a six-month ban on gasoline exports from March 1 to guarantee deliveries to domestic consumers after nationwide supply was hampered by an explosion at the Nizhny Novgorod refinery last month.

Venezuela Loading Backlog Gets Increasingly Worse. A queue of 19 supertankers has piled up in Venezuela’s territorial waters as national oil firm PDVSA struggles to deliver cargoes on time, claiming that it does not have enough transportable stocks for lack of crude diluents.

Cause of Leaking US Gulf Pipeline Still Unknown. US federal authorities are still investigating the leak source on the Main Pass Oil Gathering pipeline in the Gulf of Mexico, even though the subsea connector in the pipe system is currently undergoing repairs, still keeping 61,000 b/d of output shut.

Fuel Oil Tanker Still Leaking in the Caribbean. The government of Trinidad and Tobago confirmed that a smaller tanker carrying more than 35,000 barrels of fuel oil that capsized off the islands’ coast on February 7 continues to be leaking, staining the coastline for more than three weeks.

Hedge Funds Short Natural Gas Futures. As US natural gas prices have fallen to their lowest level in real terms since trading began in 1990, hedge funds have sold the equivalent of 399 Bcf over the seven days ending February 20, reducing their combined position to a hefty net short of 1,675 Bcf.

CNOOC Steps Up the Game in Offshore Exploration. China’s state-owned offshore producer CNOOC (HKG:XXX) announced an additional discovery at its Bozhong field in the country’s Bohai Sea, lifting its total gas reserves to 7.1 TCf and reputedly making it the largest metamorphic gas field in the world.

EU Carbon Border Efficiency Questioned. A study carried out by the Asian Development Bank found that the European Union’s plans to impose tariffs on high-carbon imports are unlikely to trigger any sizable reduction in greenhouse gas emissions, albeit stymieing Asian exports to Europe.

Pakistan Approves Construction of Iran Gas Pipeline. Pakistan’s Ministry of Energy greenlighted the first phase of the long-delayed Iran-Pakistan gas pipeline, designed to bring natural gas from the South Pars gas field to Gwadar with a nameplate capacity of 1 billion cubic feet per day.

Libyan Protests Called Off, Avoiding Supply Scare. Libya’s Petroleum Facilities Guard, tasked with safeguarding the country’s oil and gas assets, sealed off the Wafa field and the al-Zawiyah port, shutting down production and exports over salary grievances, however lifted the blockade after the government intervened.

Saudi Arabia Boosts Gas Reserves. Saudi Aramco (TADAWUL:2222) added some 15 TCf of natural gas to the reserve tally of the giant Jafurah gas field, boosting Saudi Arabia’s gas portfolio as now the field is expected to reach peak production capacity of 2 BCf per day by 2030.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Texas Bitcoin Miners File Lawsuit Against Government Over Energy Data Collection

- New Expansion Project Could Give Qatar 25% Share of Global LNG Supply

- Pakistan Considers Iran Gas Pipeline Restart Despite U.S. Sanctions