Oil prices rose somewhat on Friday morning, but gains were capped by uncertainty about the U.S. China trade deal, a rising rig count and concerns about global economic growth.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Friday, January 25th, 2019

Oil was up in early trading on Friday and could close out the week with a slight gain, but benchmark prices were remarkably flat given the turmoil raging in in Venezuela.

Venezuela’s military backs Maduro. Venezuela has been rocked by turmoil this week, with the Maduro regime teetering on the brink of collapse. The U.S., clearly seeking regime change in Venezuela, recognized the head of the national assembly, Juan Guaidó, as the rightful president on Wednesday, which corresponded with massive nation-wide protests. However, by Thursday, the military stuck by President Maduro, which will provide the leader a lifeline. In the meantime, Venezuela’s oil production is expected to continue to decline. Guaidó has offered some details on new plans for the oil sector, including new picks to head up Citgo and PDVSA. He is trying to obtain control of the country’s oil assets, but with the military backing Maduro for now, there is no sign of an imminent downfall. Billions of dollars’ worth of investment from Russia and China are on the line.

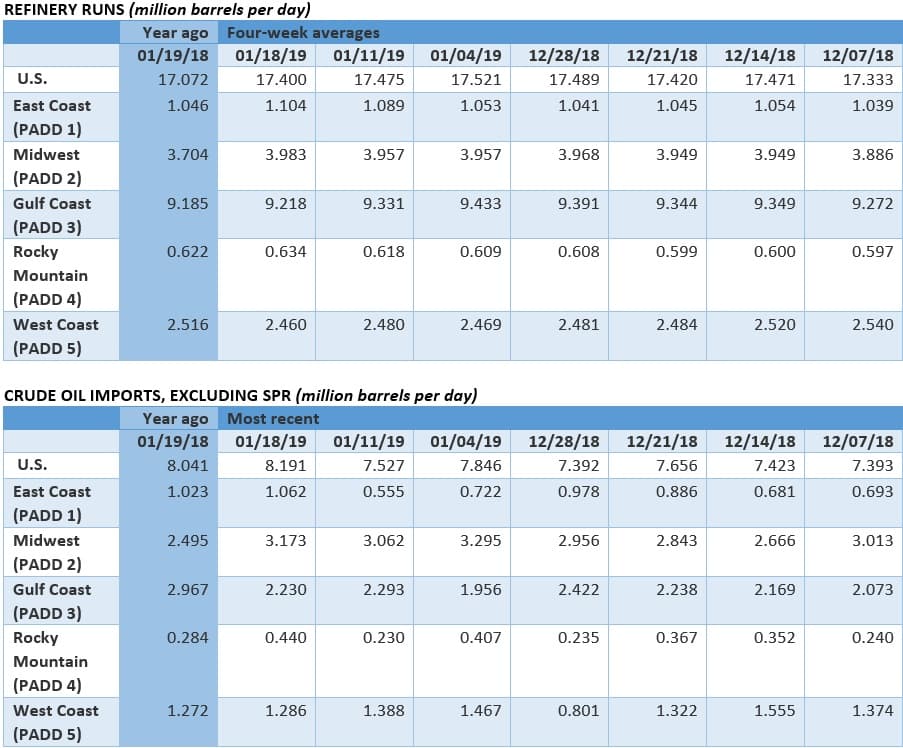

U.S. sanctions on Venezuela possible. News reports suggest that the Trump administration is mulling harsh sanctions targeting Venezuela’s oil sector. It is unclear if the administration will follow through, but if it did, sanctions would hit U.S. Gulf Coast refiners that depend on heavy oil from Venezuela, including Citgo, Valero (NYSE: VLO), Chevron (NYSE: CVX) and PBF Energy (NYSE: PBF).

China turning to Russia for oil. Russia was China’s largest oil supplier in 2018 for the third year in a row, cementing its top spot ahead of Saudi Arabia for. Russia sent 1.43 million barrels per day to China last year, up 19.7 percent from a year earlier. China’s private refineries stepped up processing, while at the same time, China had to turn to Russia to replace lost barrels from Iran and Venezuela. Related: Huge Backlog Could Trigger New Wave Of Shale Oil

Freight rates decline, sign of economic slowdown. Freight rates for dry-bulk container ships have declined sharply over the last six months, a sign of flagging trade and a broader global economic slowdown. The Baltic Dry Index, which measures ship transport costs, has fallen by 47 percent since mid-2018, according to Reuters. “The global economy and dry-bulk shipping market are showing us very real signs of distress,” said Jeffrey Landsberg, managing director of commodity consultancy Commodore Research.

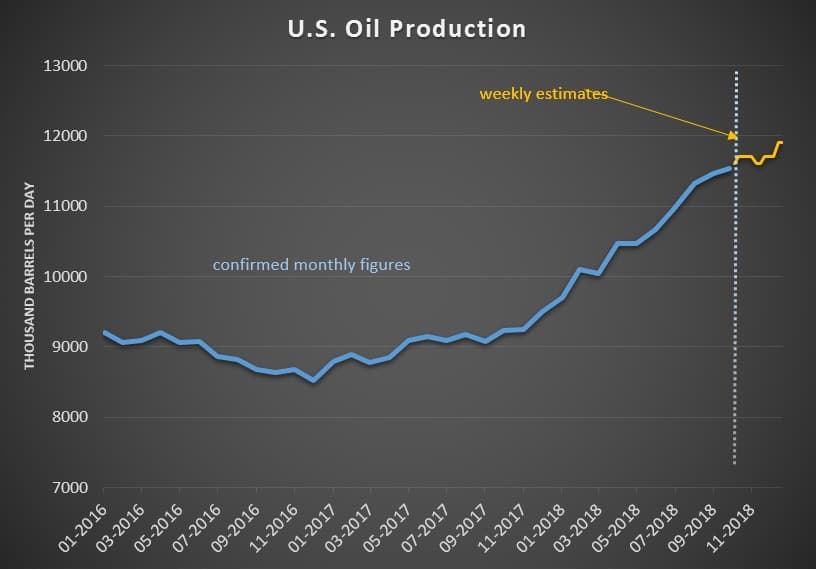

EIA: U.S. net energy exporter in 2020s. The EIA released its Annual Energy Outlook for 2019, which includes projections out to 2050. Some of the key takeaways include the projection that the U.S. will become a net energy exporter in the 2020s, due to surging natural gas and oil production. The U.S. has been a net energy importer since 1953.

CNOOC steps up spending and drilling. China’s state-owned CNOOC hiked spending this year to its highest level since 2014 in an effort to boost exploration and production. China’s aging fields have been declining for years.

EIA: U.S. shale to jump 63,000 bpd in February. The EIA’s latest Drilling Productivity Report projects shale growth of 63,000 bpd in February, a significant but smaller increase than in past months. The relatively slower growth rate suggests the shale industry is pulling back on drilling activity.

Russia wants to avoid price war with U.S. shale. A top Russian official said that his country should stick with the OPEC+ production cuts and avoid a price war with U.S. shale drillers. “For U.S. shale production to go down, you need oil prices at $40 per barrel and below. That is not healthy for the Russian economy,” Kirill Dmitriev, head of the state-backed Russian Direct Investment Fund, said at the World Economic Forum in Davos. “We should not take competitive action to destroy U.S. shale production.” Dmitriev was one of the original architects of the first coordinated production cut deal with OPEC several years ago.

Nigerian presidential candidate would rewrite oil deals. Atiku Abubakar, the leading opposition challenger to Nigeria’s president, said he would rewrite oil deals with foreign companies if elected in next month’s election. “I believe we need to review it to make it . . . more fair,” he said, according to the FT. Such contracts would include those with Royal Dutch Shell (NYSE: RDS.A), ExxonMobil (NYSE: XOM), and Chevron (NYSE: CVX). He also vowed to breakup Nigeria’s state-owned oil company, calling it a “mafia organization.”

BP CEO: Oil demand will remain steady. Despite fears of an economic slowdown, BP’s CEO Bob Dudley said that demand remains firm. "We're not actually seeing this worrying thought that it's all going to start falling," Dudley told CNBC in Davos. “We certainly don't see it yet in the numbers,” he added, referring to the IMF’s warning of a slowdown.

Related: Private Investment In Natural Resources Hits Record High

Aramco to spend billions on U.S. gas assets. Saudi Aramco is reportedly scouring the U.S. for natural gas assets, for which the company would pay “billions of dollars.” “We do have appetite for additional investments in the United States. Aramco’s international gas team has been given an open platform to look at gas acquisitions along the whole supply chain. They have been given significant financial firepower – in the billions of dollars,” Amin Nasser, Aramco’s CEO, told Reuters.

U.S. shale execs suggest slowdown is coming. U.S. shale executives said that the industry is set to slowdown this year. “I believe not as much money will be pouring into the Permian basin this time. I believe investors will hold companies accountable for returns and a lot of this didn’t happen previously,” Occidental (NYSE: OXY) CEO Vicki Hollub said in Davos. At a separate summit, hosted by Argus, Continental Resources’ (NYSE: CLR) Harold Hamm said that shale growth could drop by 50 percent this year. “Producers have become more disciplined in their approach to capex,” he said. “Several years back growth was a huge consideration. That consideration has been much less. The peak consideration now has been — are you overspending cash flow. Are you living within cash flow?”

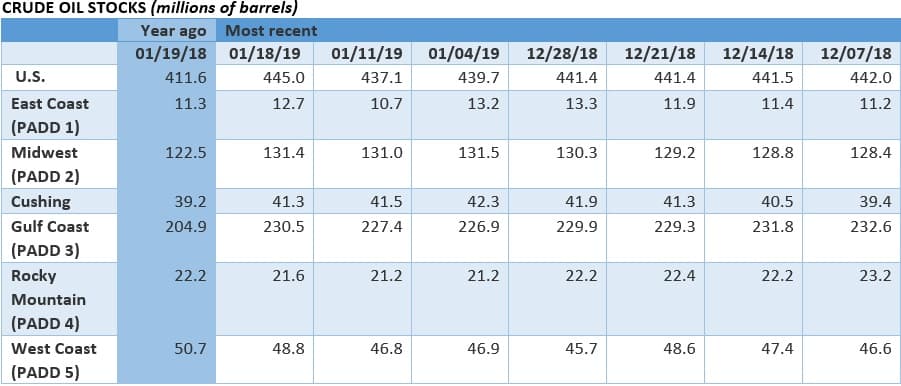

EIA, IEA and OPEC agree: OPEC+ cuts could balance market. Data from the top three energy forecasters – the EIA, IEA and OPEC – all agree that the OPEC+ production cuts will head off a supply surplus. The data varies a bit, but they share the overall conclusion that the OPEC+ cuts will succeed in draining the surplus.

Middle East instability top risk. Total’s (NYSE: TOT) CEO said that instability in the Middle East was his top worry, not Venezuela.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Energy Transition Will Upend Geopolitics

- India’s Crude Demand Growth Shows No Sign Of Slowing

- Aramco Ready To Pour Billions In U.S. Natural Gas

However, the recent events in Venezuela will hardly impact oil prices unless the country’s oil production which has been in steady decline for a while collapses completely as a result of a full-scale strike in PDVSA or a civil war in the country.

China and Russia who between them are owed more than $30 bn worth of investment will do everything possible to prevent a collapse of Venezuela’s economy.

US interference in Venezuela’s affairs and the threat by the Trump administration to impose sanctions on Venezuelan oil exports are exacerbating an already tense situation.

As for US shale oil, never a day passes nowadays without reports about a slowdown in US shale oil production.

So when a pioneer of the US shale oil industry like Continental Resources’ Harold Hamm speaks, the US Energy Information Administration (EIA) in cahoots with the International Energy Agency (IEA), the Financial Times, Rystad Energy and BP Statistical Review of World Energy should listen.

Harold Hamm’s suggestion that growth in US shale oil production could decline by as much as 50% this year compared to 2018 follows in the footsteps of a spate of recent reports about a slowdown of US sale oil production from the Wall Street Journal (WSJ), International oil service companies such as Schlumberger, Baker Hughes and Haliburton and other authoritative organizations including MIT, the Institute for Energy Economics and Financial Analysis (IEEFA) and Sightline Institute about declining well productivity, slowing drilling activity, plunging US rig count, a huge backlog of drilled but uncompleted wells (DUCs), rising drilling costs and also rising breakeven prices and therefore can’t be ignored.

The most recent report from the world’s largest oilfield services company ‘Schlumberger’ says that the slowdown in shale drilling activity is creating uncertain outlook for US shale oil output in 2019.

Perhaps the EIA and others in cahoots with it may reduce their excessive hyping the latest of which by the IEA and Rystad Energy is that the United States is set to produce more oil and liquids than Russia and Saudi Arabia combined by 2025 surpassing 24 mbd. Such a claim is not only ridiculous as can’t be substantiated in geological and economic terms but also smacks of an attempt to curry favour with the Americans.

Russia is right in saying that a price war with the US would hurt its economy. Such a discredited strategy has been tried before by Saudi Arabia in the aftermath of the 2014 oil price crash when Saudi Arabia prevailed upon OPEC and flooded the global oil market with the purpose of undermining US shale oil production. That strategy backfired miserably and inflicted heavy damage not only on Saudi and OPEC members’ economies but also on the economies of oil-producing nations around the world including Russia’s. What will eventually lead to the demise of US shale oil is not a price war but geology.

The Achilles heel of US Shale oil is that its wells suffer precipitous depletion rates estimated at 70%-90% soon after a well is completed. After an initial burst in output, wells see a rapid decline in production. This necessitate the drilling of more than 10,000 new wells every year at an estimated cost of $50 bn just to maintain production adding to their outstanding debts.

China is turning to Russia for more oil and gas supplies. Two factors favour Russia, namely having common borders with China and pipelines to transport its oil and gas shipments to China and a strategic partnership between the two countries. For the last three years Russia has been the largest crude oil supplier to China and is already the largest natural gas supplier. If Saudi Arabia wants to defend its market share in China, it may have to accept the petro-yuan as a method of payments for its oil shipments to China.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London