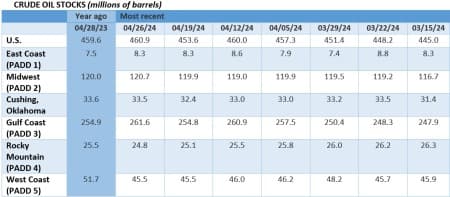

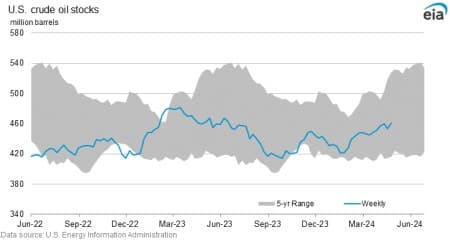

Bearish sentiment is building in oil markets after the latest U.S. economic data sparked concerns over demand. Rising oil inventories and a potential cooling in geopolitical tensions only added to the downward pressure on oil prices.

Friday, April 3rd 2024

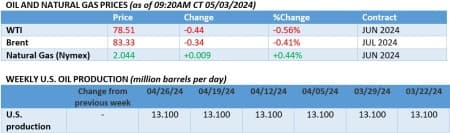

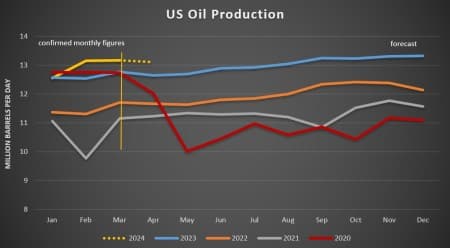

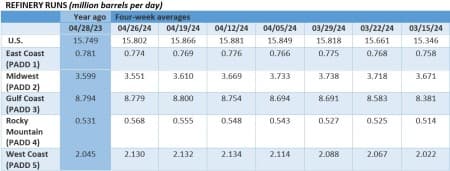

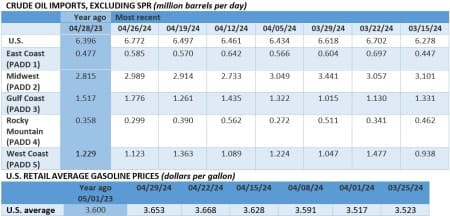

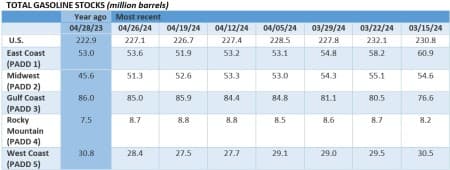

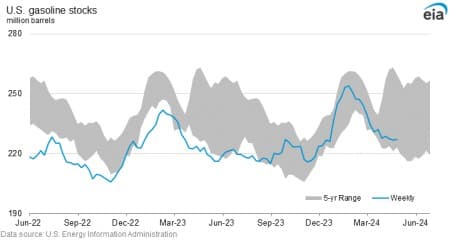

The disappointment of the money markets with yet another hotter-than-expected set of US inflation data, aggravated by higher crude inventories and slackening geopolitical risk, has triggered a notable drop in oil prices, with both WTI and Brent shedding more than $5 per barrel since last week. Falling middle distillate and gasoline cracks have not boosted the sentiment either, so only a high-impact supply disruption could break the current bearish streak.

Exxon-Pioneer Deal Approved as FTC Bans Former CEO. The US Federal Trade Commission issued a consent order that hinted at the greenlighting of the $59.5 billion ExxonMobil-Pioneer deal, provided former CEO Scott Sheffield doesn’t join Exxon’s board over his alleged “collusion” with OPEC.

ADNOC Boosts Crude Production Capacity. The national oil company of the United Arab Emirates, ADNOC, announced that it had increased its crude production capacity to 4.85 million b/d, 200,000 b/d higher than previously, getting one step closer to its 2027 target of 5 million b/d.

TMX Starts Commercial Operations. After 12 years of waiting, Canada’s $23 billion Trans Mountain Expansion pipeline started operations this week, with the first-ever cargo to load at the Westridge Terminal in two weeks and deliver a Western Access Blend cargo to China.

Russia’s Gazprom Posts Hefty Loss in 2023. Russia’s state-controlled pipeline gas monopoly Gazprom (MCX:GAZP) posted its first annual loss since 1999 as gas shipments to Europe dwindled, burning though $6.9 billion, whilst the gas giant builds a new major pipeline to China.

Anglo American Worth Than BHP’s First Offer. A new report published by researchers at CreditSights indicates just the copper assets alone of global miner Anglo American (LON:AAL) are worth at least $35 billion, almost the size of BHP’s initial offer, suggesting an improved bid is necessary.

EPA Rules Threaten US Power Grid Reliability. Peabody Energy (NYSE:BTU), the US’ largest producer of coal, warned that the EPA has overstepped its authority with its target of cutting GHG emissions from coal by 90% by 2039, shortly after some power plants mulled a federal lawsuit.

Venezuela Exports Crack Under Pressure. Venezuela’s oil exports plunged a whopping 38% month-over-month to 545,000 b/d as demand subsided for the country’s heavy barrels on the heels of US sanctions, prompting at least six VLCCs to leave Venezuela empty in recent weeks.

US Senate Bans Russian Uranium Imports. The US Senate unanimously passed a bill banning the imports of Russian uranium, sending spot U308 uranium prices to $92 per pound again, also unlocking $2.7 billion in government support for domestic uranium mining in the United States.

ADVERTISEMENT

Exxon to Take FID on Mozambique LNG by Year-End. US oil major ExxonMobil (NYSE:XOM) is reportedly looking to take a final investment decision over the delayed Rovuma LNG project by the end of this year, seeing the project’s capacity upgraded to 18 million tonnes per year.

Shell Brushes Off NYSE Relisting. Shell’s (LON:SHEL) chief executive Wael Sawan brushed off the issue of relisting the company at the New York Stock Exchange, saying that the company is not actively looking into it despite Shell shares trading below “fair market value” right now.

Afghanistan Wants to Become an Oil Marketplace. The Taliban in Afghanistan have been working with neighboring countries of Turkmenistan and Kazakhstan to create a regional trading hub that would link Russian crude oil flows to buyers in India and Pakistan via an onshore pipeline.

Cyprus Rejects Chevron’s Gas Plan. The launch of Chevron’s (NYSE:CVX) Cyprus offshore gas fields ran into another delay as the Cypriot government rejected the US major’s plan to develop the 3.5 TCf Aphrodite field discovered in 2011, giving it six months to meet its requirements.

Baltimore Bridge Repair to Cost $2 Billion. The Maryland Department of Transportation said the state expects the rebuild of the Francis Scott Key Bridge, wrecked after the Dali cargo ship crashed into it on March 26, to cost $1.7-1.9 billion, with completion anticipated by fall 2028.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Large Crude Inventory Build Rocks Oil Prices

- WTI Finds Support After Sell Off Suddenly Halts

- ExxonMobil Underwhelms With Q1 Earnings