Breaking News:

The West Aims to Rebuild Influence in Middle East Energy Hub with LNG Deals

The last few days have…

Kazakhstan, Azerbaijan, and Uzbekistan Forge Green Energy Export Alliance

Kazakhstan, Azerbaijan, and Uzbekistan join…

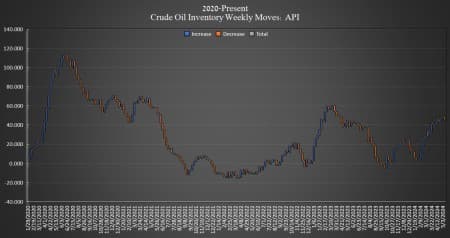

U.S. Crude Oil Inventories See Surprise Draw

Crude oil inventories in the United States fell this week by 3.104 million barrels for the week ending May 3, according to The American Petroleum Institute (API). Analysts had expected a 1 million barrel build.

For the week prior, the API reported a 509,000 barrel build in crude inventories.

On Tuesday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 0.6 million barrels as of May 10. Inventories are now at 367.8 million barrels—the highest point since last April, but well below the 656 million barrels in inventory in June 2020.

Oil prices were trading down ahead of the API data release on Tuesday, pushed down by a market that is nervousabout the possibility of interest rates staying high.

At 4:00 pm ET, Brent crude was trading down $0.93 on the day at $82.43—down nearly $1 per barrel from this time last week. The U.S. benchmark WTI was also trading on the day at 1.31% to $78.08—down roughly $50 per barrel from this time last week.

Gasoline inventories fell this week by 1.269 million barrels, countering last week’s 1.46 million barrel build. As of last week, gasoline inventories were about 2% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories rose this week by 349,000 barrels, compared to last week’s 1.713-million-barrel build. Distillates were 7% below the five-year average for the week ending May 3, the latest EIA data shows.

Cushing inventories saw a draw this week, according to API data, falling 601,000 barrels after increasing by 1.339 million barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- BP Hints That Its Goal to Cut Oil and Gas Output Could Be Flexible

- Oil Risk Premium Wanes

- OPEC Resolves Compensation Plans for Overproducing Members

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

There are very few new big oil-streams coming online. Yet the price is where it was during the worst months in the 2009 crisis, inflation-adjusted in dollars. Isnt that VERY strange?

$50 a barrel?

Maybe 0.50 cents