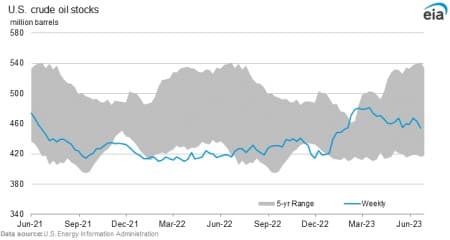

A significant decline in U.S. oil inventories provided a firm floor for oil prices this week, but economic concerns are capping any significant rise.

Oilprice Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com's premium newsletter provides everything from geopolitical analysis to trading analysis, and all for less than a cup of coffee per week.

Friday, June 30th, 2023

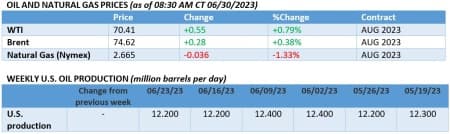

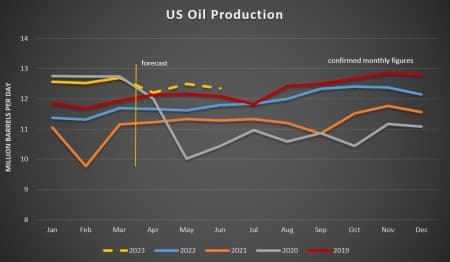

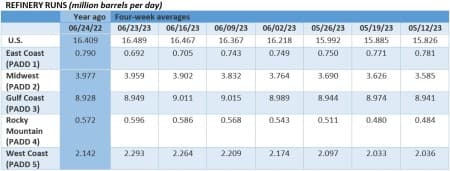

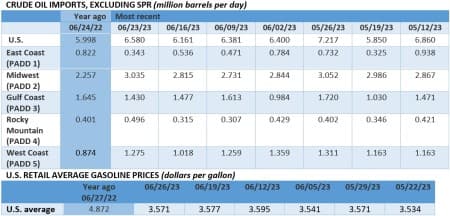

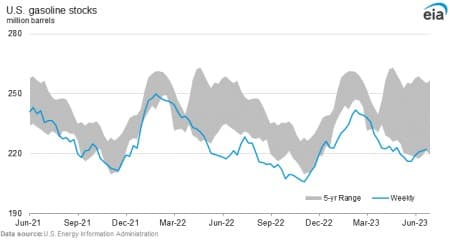

The almost 10-million-barrel US stock decline has provided a firm pricing floor for oil prices this week, but the upside remains limited as a string of macroeconomic news – most notably a still very robust US labor market – seem to be pushing the Federal Reserve to keep on hiking interest rates. As medium sour Mars is now trading a solid $1 per barrel above WTI, things look quite bleak for the US benchmark as it is weak at a time when it historically should be showing strength, prime summer driving season.

As OPEC Meets Again, Not Everyone Is Welcome. As OPEC members will be gathering in Vienna next week for a two-day deliberative forum called the OPEC Seminar, the organization has banned Thomson Reuters, Bloomberg, and the Wall Street Journal from attending the event.

The Netherlands Doubles Down on Nuclear. The Dutch government is reportedly in talks with Westinghouse (NYSE:BBU), France’s EDF, and South Korea’s KHNP (KRX:015760) to build two new nuclear plants in the country, seeing nuclear as a key base power source in its 2040 carbon neutrality goal.

Permian Is Ripe for Another M&A Deal. Privately owned TRP Enery is reportedly considering a sale of oil and gas assets in the Permian Basin, seeking to fetch at least $1.5 billion from the transaction as it currently holds some 15,000 net acres in the Midland basin and produces 25,000 boepd.

Miners Warn of Dire Consequences If Projects Stalled. Repeating the plea of several other mining companies, the CEO of gold miner Newcrest (AUX:NCM) said regulators need to urgently fast-track approvals for mines of key transition metals, adding we need 17 new Escondidas (the world’s largest copper mine) to meet demand by 2050.

ExxonMobil Ramps Up Exposure in Lithium Industry. US oil major ExxonMobil (NYSE:XOM) signed a deal with services company Tetra Technologies (NYSE:TTI) to develop a 6,100-acre area in Arkansas that contains salty brine deposits rich in lithium, marking the second such deal from Exxon in 2023.

US Major Remains Last Hope of Offshore Canadian Drilling. After BP’s dry Ephesus exploration well and Equinor’s delayed Bay du Nord commissioning, US oil major ExxonMobil could save oil activity in eastern Canada’s offshore zone, drilling the Gale prospect some 400km off the Newfoundland coast.

Israel Pulls the Brakes on Gas Export Bonanza. Amidst several projects that seek to connect East Med gas fields to European buyers, Israel’s Finance Ministry called for an assessment of how much gas the country should export (now it’s up to 40% of production), citing energy security concerns.

Norway Approves $18 Billion Worth of New Investments. Norway’s government gave the green light for oil companies to develop 19 new oil and gas fields with investments exceeding $18.5 billion, with almost half of them being developed by Aker BP (OSL:AKRBP), a joint venture between BP and Aker ASA.

Chinese Private Firms Eye Indonesia Refinery. A Chinese JV comprising petrochemical firms Tongkun and Xinfengming is planning to build an $8.6 billion greenfield refinery in north Kalimantan, Indonesia, aiming for a throughput capacity of 320,000 b/d and a 5.2 mtpa paraxylene unit there.

Russia Now Wants a Venezuela Deal, Too. Russia’s Roszarubezhneft, a state-owned entity that bought the Venezuelan assets of oil major Rosneft (MCX:ROSN) in 2020, has asked PDVSA to market the crude and fuel oil that is produced by its JV with the Venezuelan NOC, seeking to replicate the latter’s Chevron deal.

TotalEnergies In Trouble Again Over Its Africa Plans. French oil major TotalEnergies (NYSE:TTE) has been sued by five activist groups spearheaded by Friends of the Earth, the second coordinated litigation against it for allegedly failing to assess risks at its Tilenga oil field in Uganda and the $3.5 billion East African Crude Oil Pipeline.

BHP Is Lobbying for Australia’s Nuclear Revival. The largest mining company in the world, Australia’s BHP Group (NYSE:BHP) has called upon the Australian government to lift its nuclear embargo in place since the 1990s and reach net-zero through a quick build-out of nuclear plants.

Namibia Mulls Joining OPEC. Namibia’s petroleum commissioner Maggy Shino said that if the country’s supergiant oil discoveries of the past two years proceed as planned, with multi-billion discoveries Venus and Graff blazing the trail for the “new Guyana”, the African country would seek to join OPEC.

Chinese Authorities Release Sanctioned Oil. Authorities in China’s Shandong province will start releasing some 10 million barrels of Iranian and Venezuelan oil that has been waiting at ports for weeks, as Beijing suspected the buyers of mislabelling the crude as bitumen or bitumen mixtures in an attempt to bypass import quotas.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Battery Storage is King in China’s $7T New Energy Industry

- Sanctioned Goods Are Sneaking Into Russia Through Kazakhstan

- Europe To Face Offshore Wind Tower Deficit By 2028

Long $ibm International Business Machines

Strong buy