Oil prices continue to trade sideways this week, with supply shocks being counteracted by continued macroeconomic pessimism.

Chart of the Week

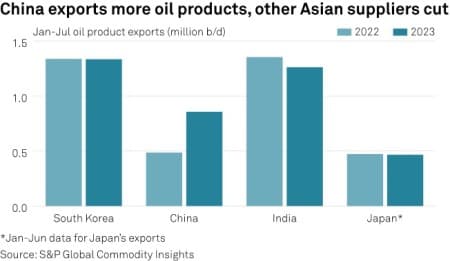

- China has at last issued product export quotas that would enable Chinese refiners to ship their surplus barrels overseas, with state-owned Sinopec getting the highest quota share of all.

- According to market sources, China will export around 3.5 million tonnes of oil products in September, with almost half of it coming from jet fuel, a 10% month-on-month increase compared to August allocations.

- Just as Asian refining margins soared to $15 per barrel, the highest in 2023 to date, China’s total annual export quota is set to rise to 41 million tonnes, almost 4 million tonnes higher than in 2022.

- China’s monthly product exports are still yet to surpass their annual peak in February when 1 million b/d was exported, with exporters struggling to regain market share in Singapore and forced to rely more on demand from Malaysia and Hong Kong.

Market Movers

- Brazil’s national oil firm Petrobras (NYSE:PBR) signed a strategic cooperation agreement with China’s CNOOC (HKG:0883) on refining, oilfield services, green energy, and oil trading, paving the way for more Chinese investment into the Latin American country.

- Norway’s oil major Equinor (NYSE:EQNR) has acquired a 25% stake in the Bayou bend carbon capture storage project in southeast Texas, joining Talos Energy and Chevron in the project.

- China’s national oil company Sinopec (SHA:600028) refuted claims that it seeks to buy Shell’s Singapore refinery, announcing that it would instead invest in Saudi Aramco’s Jafurah natural gas project.

Tuesday, August 29, 2023

Oil prices continue to struggle for direction this week after upward momentum created by the Garyville refinery explosion and rising transportation fuel cracks was toned down by the same old macroeconomic woes from China. Hurricane Idalia might have provided upward support for oil prices, but its movement towards Florida will most probably limit potential damage to US Gulf Coast production. With US PCE and non-farm payrolls issued later this week, it seems macro forces will be the driving factor behind oil prices this week.

Hurricane Idalia Threatens Florida, Avoiding Gulf Coast. Tropical Storm Idalia is expected to strengthen into a major hurricane, the first of its kind in 2023, and make landfall in Florida which doesn’t have a refinery, largely avoiding key oil and gas infrastructure in Texas and Louisiana.

Chevron Workers Approve Strikes. Unions representing workers of Chevron’s (NYSE:CVX) two major LNG complexes in Australia, Wheatstone and Gorgon, have officially announced they will take industrial action from September 07 after counting ballots, putting at risk 5% of global LNG supply.

US Gulf Coast Sees First Offshore Wind Lease. The Biden administration is holding the first-ever offshore wind auction in the Gulf of Mexico, with green hydrogen production most probably a key target as Texas has no renewable mandates, low power prices, and slower winds than the Northeast.

Blaze Halts Operations at Louisiana Megarefinery. A huge blaze at the naphtha tank farm of Marathon Petroleum’s (NYSE:MPC) 596,000 b/d Garyville, Louisiana refinery prompted a swift refinery shutdown, buoying diesel cracks even further as NYMEX ULSD soared to a 7-month high last Friday.

Cyprus Hinders Chevron’s Gas Plans. US oil major Chevron (NYSE:CVX) has once again failed to have its development plan for the 124 BCm Aphrodite field offshore Cyprus approved by Cyprus’s government, probably due to its insistence on a subsea pipeline to Egypt rather than a standalone FPSO.

UN Voices Saudi Aramco Discontent. UN experts sent a letter of concern to Saudi national oil company Saudi Aramco (TADAWUL:2222), arguing its expansion of fossil fuel production and ongoing exploration have negative effects on human rights to a healthy environment and undermine the 2015 Paris Agreement.

Booming Iran Exports Might be Capped by Leak. According to Iranian reports, a transmission pipeline linking the export terminals at Kharg Island to the mainland port of Genaveh was halted due to an oil leak, without specifying the magnitude of the maritime spill.

China Is Ramping Up Coal Imports. Confronted with drought-induced hydropower problems and renewed coal mine safety checks after the most recent mine explosion in Shaanxi, Chinese power generators boosted their monthly coal imports to 29 million tonnes in August, the second highest of 2023.

Nigeria Eyes Full Refining Revamp. Despite having no operational refinery right now, the Nigerian government pledged to have all four of its idled refiners restarted by end-2024, with the 210,000 b/d Port Harcourt refinery revamped by Italy’s Tecnimont reportedly ready to resume refining by this December.

Ivory Coast Sees First Oil. Italy’s oil major ENI (BIT:ENI) has started oil and gas production at the supergiant Baleine field in offshore Ivory Coast, the largest find of 2021 globally, less than 2 years after discovery, with the first phase of production ramping up output to 15,000 b/d and 25 Mscf/d.

Toyota Manufacturing Collapses. Japanese carmaker Toyota Motor Corp (TYO:7203), the world’s largest car producer by sales, is suspending operations at all of its assembly plants in Japan due to a system collapse, saying the cause is not a cyberattack but that further investigation is still needed.

Drillers Claim Tremendous Potential in Offshore Cuba. Melbana Energy, an Australian independent upstream driller, claims to have appraised a "tremendous” oil discovery in offshore Cuba as the Alameda prospect, containing heavy oil at 19° API in Block 9, co-owned by Angola’s Sonatrach.

Chinese Miner Eyes European Copper. China’s mining giant Zijin Mining (SHA:601899) is seeking to expand operations at its fully-owned Cukaru Peki copper mine in Serbia, spending $3.8 billion to build new infrastructure that would allow it to tap into deeper deposits holding 2.2 million tons of copper.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Natural Gas Prices Rise As Supply Risks Persist

- Is Norway's Love For EVs Enough To Put A Dent In Fuel Demand?

- Athens Summit Hints At Future EU Expansion Challenges