Oil prices jumped on Monday as a disruption to Kurdistan's oil exports refocused the market on fundamentals. As oil prices continue to recover from the sentiment-driven crash a couple of weeks ago, there are plenty of catalysts ahead that could push prices higher.

Investor Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com's premium newsletter provides everything from geopolitical analysis to trading analysis, and all for less than a cup of coffee per week.

Chart of the Week

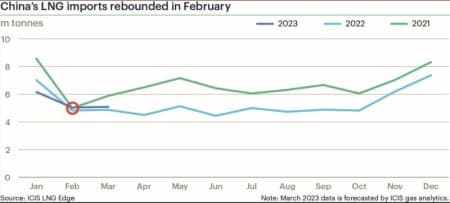

- Even though 2023 was touted to be the year China returned to LNG markets after a whopping COVID-driven decline of 20 mtpa in demand, readings from Q1 indicate that is not happening.

- Spot LNG prices in Asia have dropped to the lowest since July 2021 with the prompt-month contract of May trading below $13 per mmBtu, and it was assumed a lower price would incentivize Chinese buyers to stock up.

- However, the slower-than-expected pickup in industrial activity has capped demand for liquefied gas, bringing trucked LNG prices across the country to half of what they were a year ago, around ¥4,000 per metric tonne ($580/mt).

- According to Kpler data, China’s LNG imports in January-March 2023 total 16.31 million tonnes LNG, a 3% decline compared to Q1 2022, with Australia and Qatar leading the pack of suppliers.

Market Movers

- Colombia’s state-controlled oil producer Ecopetrol (NYSE:EC) will keep its current COO Alberto Consuegra as its interim CEO until a successor is named, easing fears of a radical shake-up.

- US midstream firm Energy Transfer (NYSE:ET) announced it is buying Lotus Midstream, a pipeline operator in the Permian Basin, in a $1.45 billion cash-and-stock deal to boost its shale presence.

- US lithium major Albemarle (NYSE:ALB) is set to build a $1.3 billion lithium processing plant in Chester County, SC, doubling its Li-processing capacity on the back of IRA-provided incentives.

Tuesday, March 28, 2023

The halting of Kurdish oil exports, keeping some 400,000 b/d of crude from the oil markets, helped to lift oil prices on Monday, with ICE Brent edging closer to the $80 per barrel mark. By Tuesday morning that oil price rally had largely fizzled out, although prices remained in the green. With an OPEC+ meeting coming up on April 03, Middle Eastern nations might be tempted to casually bring up the prospect of a production cut, adding some impetus to the price recovery. There's plenty of opportunity for bullish sentiment to increase in the coming week.

Saudi Aramco to Build New Refinery in China. One of the most eagerly anticipated new projects in Asia is set to begin. Saudi Aramco (TADAWUL:2222) intends to build a $10 billion greenfield refinery in Panjin, China with a capacity of 300,000 b/d, securing exclusive supply rights to 70% of the refinery’s needs.

Turkey Halts Kurdish Exports. After the International Chamber of Commerce ruled in favor of Iraq in its long-standing arbitration with Turkey, the port of Ceyhan stopped shipments of 450,000 b/d of Kurdish oil that Baghdad claims is exported illegally, without the approval of the federal government.

French Refining Close to a Collapse. As four French refineries halted production and the remaining two in Feyzin and Lavera are operating at reduced rates, France’s fuel shortage problems are getting out of hand with half of the petrol stations in western regions missing gasoline or diesel.

Renewable Investments Must Quadruple to Meet Targets. The International Renewable Energy Agency (IRENA) said that global investments into energy transition technologies should quadruple to 5 trillion annually to meet the Paris accord’s target of capping temperature increase to 1.5° C.

White House Ties Willow to Leasing Ban. US President Joe Biden said he reluctantly gave a go-ahead for ConocoPhillips’ (NYSE:COP) $8 billion Willow project in Alaska, arguably the last non-shale megaproject, linking the decision to the simultaneous banning of future oil and gas leasing in Alaska’s offshore zone.

Venezuela Names Corruption Ringleader. As Venezuela’s PDVSA has been cracking down on corruption within the company, the country’s attorney general has pointed to the NOC’s now-arrested vice president of trade and supply Antonio Perez Suarez as the ringleader.

ADNOC Eyes IPO of Logistics Arm. Buoyed by the recent success of the IPO of ADNOC Gas, the national oil company of the UAE is now looking to float its marine and logistics subsidiary ADNOC Logistics & Services, the fifth unit of the Emirati NOC to be listed in the past five years.

Can Brussels Make Nuclear Great Again? Members of the European Union are split on whether to include nuclear energy in their renewable energy targets, as promoted by France, potentially delaying the decision as negotiators meet for the final round of talks Wednesday.

Investors Drop Copper on Financial Woes. Despite the robust start to 2023, investors have turned net short on the CME copper contract for the first time since last October, implying that even though copper inventories are set for an all-time high soon, short-term plays on falling copper are on the rise.

Oman Offers Onshore Exploration Blocks. The Middle Eastern sultanate of Oman launched a new upstream licensing round, the first in 2023, putting three massive onshore oil and gas blocks on offer, with all prospective areas having been explored before to varying degrees of success.

Libya Wants a Second Refinery. Libya’s state oil company NOC contracted US engineering company Honeywell (NASDAQ:HON) to design a 30,000 b/d oil refinery that would be located near the oasis town of Ubari, in the country’s arid southwest and presumably cost some $600 million.

US Slaps New Sanctions on Myanmar. Accusing Myanmar’s military of indiscriminate air strikes and military shelling against its own population, the US Treasury Department slapped sanctions on several entities connected to the import, storage, and distribution of jet fuel to the junta.

Shell Secures Mexican LNG Volumes. UK-based energy major Shell (LON:SHEL) agreed to offtake an additional 1.1 mtpa of LNG coming from Mexico Pacific’s Saguaro Energia export terminal on a FOB basis for a term of 20 years, adding to a 2.6 mtpa PSA deal with the same company signed last July

More Top Reads From Oilprice.com:

- North American LNG Projects Plagued By Price Volatility

- Latin America’s Bid To Challenge China’s Dominance In The Lithium Market

- Kurdistan’s 400,000-Bpd Oil Exports Still Shut-In As Talks With Iraq Fail