Oil prices rebounded from last week's Iran deal optimism-inspired rout, as a new potential "snag" emerged in reviving the 2015 Iran nuclear deal that could add more oil supply, even as Goldman Sachs said last night that the case for higher prices remains intact even with increased Iran exports.

Brent crude oil futures for July rose $1.06, or 1.8%, to $67.50 a barrel West Texas Intermediate for July was at $64.73 a barrel, up $1.15, or 1.8%.

Oil prices fell almost 3% last week after Iran's president, Hassan Rouhani, said the United States was ready to lift sanctions on his country's oil, banking and shipping sectors. However, as we reported over the weekend, the speaker of Iran's parliament said on Sunday a three-month monitoring deal between Iran and the U.N. nuclear watchdog had expired and that the country would block inspectors from accessing nuclear site images.

However, offsetting some of the tension, on Monday morning - and as expected - a one-month extension to the monitoring agreement has been announced.

And yet, the mood soured further after Secretary of State Blinken said that there was no sign yet that Iran is willing to comply with nuclear commitments needed to lift sanctions, when asked if a decision was made to lift sanctions on Iran.

European diplomats said last week that failure to agree an extension of the monitoring deal would plunge wider, indirect talks between Washington and Tehran on reviving the 2015 Iran nuclear deal into crisis. Those talks are due to resume in Vienna this week.

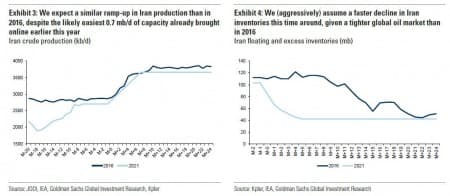

"All in all, it seems to be only a matter of time before the sides involved put pen to paper on a new nuclear accord," said Stephen Brennock of oil broker PVM. "Investors are bracing for a fresh wave of what will surely be heavily discounted Iranian crude ... yet for all this alarmism, an aggressive ramp up in Iranian production and exports is unlikely to stall the drawdown in global oil stocks".

Meanwhile, even with a potential restart of Iran exports, the case for higher oil prices remains intact due to a vaccine-driven increase in global demand, Goldman Sachs commodity analyst Damien Couravlin said in a note published on Sunday (and discussed here).

"Even aggressively assuming a restart in July, we estimate that Brent prices would still reach $80 per barrel in fourth quarter, 2021, with our new base case for an October restart still supporting our $80 per barrel forecast for this summer," Goldman said.

By Zerohedge.com

More Top Reads From Oilprice.com:

Iran insists on a lifting of the sanctions first before it agrees to negotiate directly with the United States on the nuclear deal. On the other hand, the United States wouldn’t lift the sanctions or even ease them without an agreement on imposing strict limitations on Iran’s nuclear and ballistic missile development programmes which Iran will never ever accede to.

The recent claim by Iranian President Hassan Rouhani that the United States was ready to lift oil and banking sector sanctions was a ploy to rally his supporters to do well in the 18th of June presidential elections. The reason is that he knows that supporters of the Islamic Revolutionary Guard Corps (IRGC) are going to have a landslide victory in the presidential elections.

Furthermore, the IRGC and its supporters will do their very utmost to derail negotiations with the United States or get a deal on their own terms.

If in the very unthinkable possibility the sanctions were lifted, Iran could only bring 650,000 additional barrels a day (b/d) to the market. The reason is that Iran has been managing with help from China to export 1.5 million barrels a day (mbd) or 71% of its pre-sanction exports of 2.125 mbd. A global economy projected by the IMF to grow this year by 6.3% could easily absorb the 650,000 extra Iranian barrels without any impact on oil prices.

Brent crude oil price is projected to hit $70-$80 a barrel in the third quarter of this year and average $65-$67 for the year with global oil demand returning to pre-pandemic level of 101.0 mbd by the middle of this year.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London