Energy stocks in Europe saw their best daily performance in a month and shares in major U.S. and European oil corporations jumped in New York trade on Thursday as oil prices rallied in a market expecting OPEC+ to further ease their production cuts.

European stocks ultimately gained again Friday, running with the oil price rally, which only slightly slipped, and adding further momentum after the US monthly jobs report showing that the US labor market added 850,000 non-farm jobs in June, exceeding expectations.

Early on Friday at European trade open, shares in the largest Europe-based oil firms were slightly down, reflecting a 0.1-percent retreat in oil prices as market participants position their holdings expecting the OPEC+ group’s decision on supply in the afternoon Vienna time.

In Europe, energy indices and energy stocks settled more than 2 percent higher on Thursday, as oil prices jumped to levels last seen two and a half years ago.

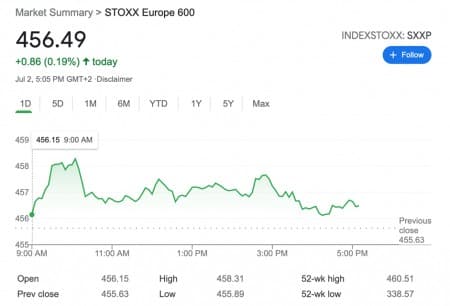

The STOXX Europe 600 (INDEXSTOXX: SXXP) index settled 0.62 percent higher on Thursday, driven by the best performance of energy stocks in the past month.

Again on Friday, SXXP closed up another 0.18%.

Thursday’s rally in energy stocks was fueled by the jump in crude oil prices, which saw Brent above $76 a barrel and WTI Crude exceeding $75/barrel on Thursday, after reports started to emerge that OPEC+ was considering a gradual cautious approach to further easing the cuts by the end of the year.

Not only Europe’s energy stocks benefited from the OPEC+ noise—U.S. oil stocks also jumped as WTI passed the $75 mark for the first time since October 2018. Shares in Occidental Petroleum Corporation jumped 5.08%, Continental Resources saw a 5.00% surge, Marathon Oil Corporation closed Thursday trade 4.04% higher, ConocoPhillips jumped 3.25%, EOG Resources rose by 3.06%, Pioneer Natural Resources shares increased 3.00%, and Chevron Corporation saw its stock close 1.40% higher.

The U.S.-traded shares of Royal Dutch Shell jumped 2.57%, BP’s stock rose 2.50%, and TotalEnergies shares closed 1.26% higher on Thursday.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Surges Past $75 As OPEC+ Discuses 2 Million Bpd Output Boost

- The Best Energy Dividend Stocks Of 2021

- Russia Is Ready To Open The Taps