After having instructed Aramco to boost production to unseen levels, Saudi Arabia now plans to boost oil exports in May to a record 10 million barrels per day, causing oil prices to fall once again.

In order to achieve this level of exports, the Kingdom is trying to reduce its domestic consumption, which it expects to replace with natural gas from the Fadhili gas plant.

Saudi Arabia’s Energy Ministry issued a statement on Tuesday claiming that “Saudi Arabia will utilize the gas produced from the Fadhili gas plant to compensate for around 250,000 barrels a day of domestic oil consumption, which will enable the Kingdom to increase its crude exports during the coming few months to exceed 10 million barrels a day,”.

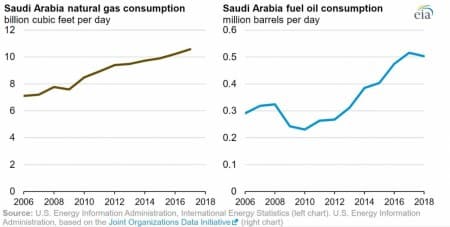

Saudi Arabia may struggle to free up more crude oil for exports in the next couple of months as power consumption is set to increase during the hottest months of the year in the country (May to September). According to the EIA, in 2018, Saudi Arabia reported burning an average of 0.4 million barrels per day (b/d) of crude oil for power generation, the lowest amount since at least 2009. Related: Is The Oil Price Crash Good For Renewable Energy?

In the meantime, natural gas consumption has been rising steadily since 2009, and is expected to rise this decade.

Riyadh has made a 180-degree turn in the last two weeks, after its proposal to deepen the OPEC+ output cut deal by 1.5 million bpd got rejected by Moscow, which despite the gloomy demand picture in oil markets saw no reason to make additional production cuts.

Saudi Arabia’s decision to flood an already woefully oversupplied market has effectively started an oil price war in which Riyadh is aiming to squeeze any competition out of core markets such as Europe and Asia. The Kingdom followed up on its threat to flood the markets with oil by chartering as many as 31 supertankers to ship the extra crude.

In the last couple of days, Aramco has offered their Arab Light and Arab Heavy blends for between $25 and $28 dollar per barrel in Europe, and today’s announcement to increase exports to 10 million bpd could send prices even lower.

This scorched earth tactic from Saudi Arabia is quite surprising, given the fact that the Kingdom has consistently overcomplied with its OPEC+ production quota, which saw its total crude exports fall below 7 million barrels per day in January/February.

As the pain for oil exporters continues to increase, it is unlikely that Saudi Arabia nor Russia will unilaterally take action to once again cut production, as neither of them will want to be seen to have lost the oil price war.

Bob McNally, former energy advisor for President George W. Bush and founder of Rapidan Group was quoted by CNBC as saying that “National prestige is involved here, honor is involved and political power is involved. And political leaders will suffer costs in a war if they believe they are pursuing a greater and more important aim,”.

With none of the parties planning to return to the negotiating table, what is next for oil?

Related: Is $10 Oil On The Horizon?

Most likely, prices are set to fall further until most high-cost producers are squeezed out of the market, or at least until either Riyadh or Moscow can claim some sort of victory by inflicting sufficient damage to opponents.

In the short term, this will likely mean that both Saudi Arabia and Russia and even the UAE will continue to flood the market, or even talk them down in case they cannot free up more oil for exports and that oil prices will fall into the lower $20s, or below.

In its second price forecast in less than two weeks, investment bank Goldman Sachs slashed its price outlook for WTI to just $22 per barrel in Q2, while cutting its outlook for Brent oil to just $20 per barrel.

Goldman cited the combination of the Covid-19 oil demand shock and the price war as the reason for its lower forecast. The bank also believes that oil is likely to stay lower for longer as it will take a long time for inventories to come down again.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Saudi Arabia’s Oil War Could Bankrupt The Kingdom

- Largest Oil Glut In History Could Force Crude Prices Even Lower

- The Great U.S. Shale Decline Has Already Begun