It may sound crazy to say this given where oil futures are trading, but in some ways, this has been the most positive week or so for crude for some time. The chart indicates that there is a good chance that the big move down is over, the slight bounce suggests that the next move will be a retracement, and when looked at in context, oil is actually performing well.

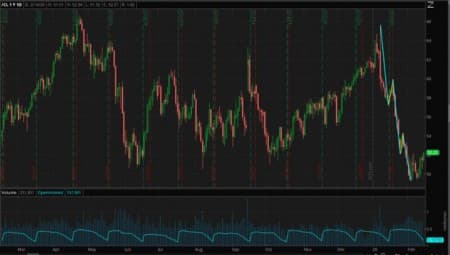

The chart above is for the main WTI futures contract, CL. As you can see, the big drop took the form of a pretty classic Elliott Wave pattern, marked in blue (Okay, Elliott purists, I know the fifth wave should be longer, but it is there and does look to have ended). Such patterns have five waves, three down and two up in a bear pattern like this. Once those are over, as they are here, the next move is considered to be independent of what came before.

After forming a pretty clear double bottom at the 49.30-40 level and then bouncing back above $52, the indications so far are that that next move will be upward. That impression is reinforced when you consider the environment in which that has taken place.

Everybody is still in a panic about coronavirus and given the impact of global growth disruptions on oil and the fact that the disease is concentrated in China, the world’s largest importer of oil, you would expect that to be reflected in crude futures. What we have seen this week, however, is a remarkable resilience to further bad news.

Evidently, while oil traders are perfectly happy to ride the wave down as panic spreads, they are too rational to fall victim to it themselves. Wuhan coronavirus has so far resulted in just over 1300 deaths, one of which has been in the U.S. For comparison, somewhere between 291,000 and 646,000 people die rom flu every year, with 80,000 flu-related deaths in the U.S. alone in the 2017-18 flu season. Coronavirus is disruptive, but it is far from a reason to panic.

That could be why, even on days that the major stock indices have fallen as reported cases and fatalities have increased over the last week or so, oil has continued to grind its way up from the lows.

Even more impressive in some ways is that one of the biggest jumps was on Wednesday, the day that OPEC cut their demand outlook in response to the virus. That “sell the rumor, buy the fact” pattern is a strong indication that at that point the bad news was fully priced in. As with the virus itself, clearly the fear was more significant than the reality.

Of course, none of this means that we can’t head lower. Coronavirus could continue to gain ground to where fears about the impact are legitimate. Or, more likely in many ways, there could be some other news that prompts a bearish response. What it does, though, given that bottom around $49.30, is set up a series of trades based on a potential bounce.

Those could be done using futures, although for me a stop $2 away is a bit pricy for that, or UWT, or by buying a couple of downtrodden energy stocks. However, you do it, a break below $49 or so would trigger a stop, with a target based on a 50% or so retracement to somewhere around $57. That is a decent risk/reward ratio, so positioning for an oil bounce based on the recent resiliency makes sense.