Bearish sentiment has continued to build in oil markets this week despite OPEC boosting its outlook for Chinese demand and the Biden administration hinting that they may soon refill the SPR.

Friday, May 12th, 2023

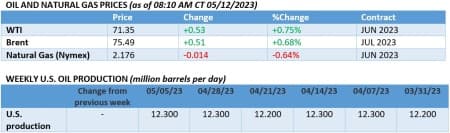

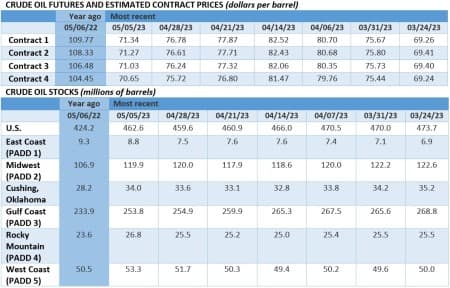

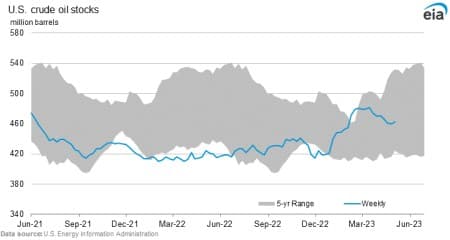

The oil price slide has continued this week as recessionary fears have been aggravated by a reversal in crude inventory draws, even the carefully worded DOE announcement that they might start refilling SPRs failed to spark a sustainable price recovery. OPEC tried to intervene with its monthly report, hiking Chinese demand growth this year to 800,000 b/d, but these attempts at altering the broader narrative are failing to break into the market.

US Could Start Buying SPRs Again. US Energy Secretary Jennifer Granholm told Congress that her department could start repurchasing crude for the Strategic Petroleum Reserve as soon as the congressionally mandated sales, currently ongoing, finish.

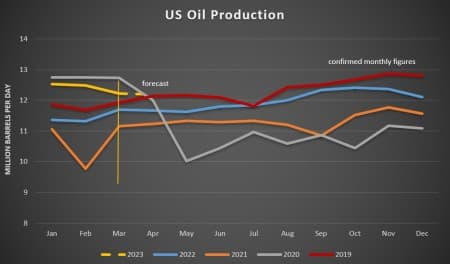

EIA Lowers US Supply Forecast. The US Energy Information Administration expects domestic crude production to rise 5% this year to 12.53 million b/d and slightly more than 1% to average 12.69 million b/d in 2024, with consumption increasing by an annual 1-1.5% to 20.8 million b/d next year.

Nigerian Production Plummets to 7-Month Low. Figures released by the Nigerian Upstream Petroleum Regulatory Commission show that the country’s oil production last month fell to 998,602 b/d, down 300,000 b/d compared to previous months, as strikes at ExxonMobil (NYSE:XOM) assets hit output.

Saudi Aramco Sees Weaker Demand. According to media reports, Saudi Aramco will supply full volumes of crude oil nominated for June loading to its Asian customers, though requests from Chinese refiners might have dropped some 5 million barrels compared to May, signaling demand weakness in China.

UAE to Sell 15% of ADNOC Logistics. Following up on a string of successful IPOs, the national oil company of the UAE is planning to sell 15% of its shares in its maritime logistics unit in an offering set to take place on June 1, seeking to garner some 5-8 billion from the listing.

Lithium Miners Merge to Create Major. Lithium companies Livent (NYSE:LTHM) and Allkem (AUX:AKE) agreed to merge in an all-stock $10.6 billion transaction to create the world’s third-largest producer, with the deal expected to close by end-2023 and the new US-based entity to be listed on the NYSE.

Texas Natural Gas Prices Turn Negative. For the first time in almost three years, next-day natural gas prices at the Waha hub in Texas settled in negative territory this week, at -$0.35 per mmBtu, on the back of robust production of associated gas in the Permian basin as well as mild weather and pipeline maintenance.

Shell Wins Court Case on Nigeria Oil Spill. The UK Supreme Court ruled that it was too late for Nigerian claimants to sue oil major Shell (LON:SHEL) over a 2011 offshore oil spill that leaked 40,000 barrels from the Bonga oil field and that the ongoing consequences do not constitute a continuing nuisance.

Pakistan to Pay for Russian Oil with Yuan. Pakistan has placed an order for its first-ever cargo of Russian oil and the delivery should happen within a month, with the country’s energy ministry saying it would seek to clinch a long-term deal that would be priced in Chinese yuan.

Norway Delays Wind Power Tax. The Norwegian government postponed its plans to introduce taxes for onshore wind power operating companies by a year to 2024 as the renewable energy industry lambasted the timing of the proposal, arguing it would lower investment and bankrupt older wind farms.

Ecopetrol Wants Drilling Ban Overhaul. A close political ally of Colombia’s left-leaning President Gustavo Petro, the new CEO of the country’s national oil company Ecopetrol (NYSE:EP) has nevertheless reiterated calls for the government to drop its opposition to new oil exploration and launch new licensing rounds.

Glencore to Build Europe’s Largest Battery Recycler. Mining giant Glencore (LON:GLEN) is teaming up with Li-Cycle Holdings to refurbish its shuttered Portovesme lead refinery in Sardinia, Italy, and build Europe’s largest battery recycling plant that could process up to 70,000 tons per year of lithium and nickel black mass.

French Nuclear Output Recovers. Marred by forced outages caused by nuclear plants’ stress corrosion and recurring labor strikes, French nuclear power generation is finally rebounding as its April performance marked a 15% year-on-year increase to 25 TWh.

US Power Grid at Risk of Summer Disruptions. The U.S. electricity monitoring agency NERC warned that in case summer will see extreme air conditioning demand, several regions in the Midwest but also California, Texas, and New England may experience power shortfalls and rotating outages.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Texas Natural Gas Prices Turn Negative

- The Brent Oil Benchmark Is About To Change Forever

- China Is Coming Out Of The Shadows To Defend Its Oil Interests

opec cometh.

summer driver and airplane passengers cometh.

New movie coming:

Planes, Trains and Automobiles 2

and everything else.