Despite pipelines in the North Sea and Libya coming back online in 2018, oil has remained above $60 in the new year. These high prices have largely been driven by geopolitical fears across the globe.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

- 2017 was a year of record-breaking U.S crude oil exports. In 2016, the U.S. averaged crude exports of 520,000 bpd, but that figured more than doubled to 1.1 million barrels per day (mb/d) by February 2017, only to hit higher levels as the year wore on.

- Canada remained the top buyer of U.S. crude, as proximity and pipeline interconnections made it an obvious destination.

- But other buyers of American crude emerged in 2017, including the Netherlands, Curacao and China.

Market Movers

• BP (NYSE: BP) and Royal Dutch Shell (NYSE: RDS.A) have suggested that the U.S tax overhaul would be positive in the future, but would lead to one-time charges in the fourth quarter of 2017.

• The Forties pipeline is now fully operational. "All restrictions on the flow of oil and gas from platforms feeding into the pipeline system have been lifted and virtually all platforms are now on line," operator Ineos said in a statement on December 30.

• Rising oil prices would benefit shale companies that have relatively less hedging, exposing them to a more positive market. Cowen analysts singled out Anadarko Petroleum (NYSE:APC), EOG Resources (NYSE:EOG) and Continental Resources (NYSE:CLR) as potential winners.

Tuesday January 2, 2018

Oil prices started out the year with some bullish sentiment related to geopolitical flashpoints, while the market fundamentals looked less favorable with the restoration of some key pipelines.

Iran unrest pushes up oil prices. Oil prices remained at more than two-year highs as protests swept across multiple cities in Iran. Crowds of protestors, mainly young people, criticized the government for poor economic conditions. The demonstrations pushed crude prices up a bit, and both WTI and Brent opened above $60 per barrel for the first time in years. "Growing unrest in Iran set the table for a bullish start to 2018," the Schork Report said in a note to clients on Tuesday. Related: Russia’s Grip On European Gas Markets Is Tightening

Tension over North Korea. The saga over North Korea’s nuclear program continues to take new twists and turns. The latest disturbance comes after news that Russian oil tankers helped send oil to North Korea, which would be a violation of UN sanctions. The U.S. has also accused China of violating UN sanctions by shipping crude oil to the isolated North Korea regime.

Forties pipeline back online; Libya too. The return of the Forties pipeline to operation and the restoration of output from North Sea oilfields removed one of the recent bullish catalysts from the oil price equation. Libya’s pipeline outage also came to an end after the damaged pipeline was repaired. So far, the bearish news of resumed oil flows in the North Sea and Libya has been outweighed by the protests in Iran.

Venezuela to launch oil-backed cryptocurrency. The Venezuelan government has said that within days it will launch a new cryptocurrency backed by its 5.3 billion barrels of oil reserves. "Camp one of the Ayacucho block will form the initial backing of this cryptocurrency," Jorge Rodriguez, Venezuela’s communications minister told reporters, referring to a section of the country’s southern Orinoco Belt. "It contains 5.342 billion certified barrels of oil. We're talking about backing of $267 billion.” Few analysts think that Caracas can successfully stage a new cryptocurrency or that it would help the beleaguered government in any real way.

Midstream sector to invest billions in Permian pipelines. Surging oil and gas production from the Permian basin is leading to a flurry of investments in infrastructure able to move all of that product to market. Recently, Phillips 66 (NYSE: PSX) and Enbridge Inc. (NYSE: ENB) announced in a joint venture that they will build the Gray Oak Pipeline, which will have a capacity of 385,000 bpd. More projects are likely in the offing. “There will be billions spent, between natural gas, crude and natural gas liquids,” Aaron Blomquist, managing director, investment banking with Tudor, Pickering, Holt & Co., told the Midland Reporter-Telegram. “Each project will be about $1 billion, so it will be tens of billions. The Kinder Morgan natural gas pipeline (from West Texas to Corpus Christi) alone will cost $1.7 billion”

Drilling costs to rise in 2018. 90 percent of oil producers surveyed by Barclays say that they expect the cost of drilling and producing oil will rise this year. Nearly two-thirds expect the cost of oilfield services to rise by as much as 10 percent. And roughly half of the respondents expect cost inflation to eat away 75 percent of the efficiency gains that the industry has achieved in recent years. A growing number of companies also think that the efficiency gains are at least 25 to 50 percent structural, rather than cyclical. And finally, more than half of the respondents said that they expect to spend within their cash flow this year.

Saudi Arabia boosts gasoline prices. As part of the Kingdom’s wide-reaching economic reforms, the Saudi government has hiked gasoline prices at the start of the year, raising them from 0.75 riyals to 1.37 riyals per liter for Octane 91.

Bioplastics to take a bite out of oil demand. Bloomberg reports that the use of bioplastics derived from plant-based sources like sugar cane, corn and wood will rise by 50 percent over the next five years. The increase of plant-based plastics could dent the prospects of some heady projections for the growth of oil demand from the petrochemical sector. “Biochemicals and bioplastics could erode a portion of oil demand, much like recycling can erode overall virgin plastics demand,” said Pieterjan Van Uytvanck, a senior consultant at Wood Mackenzie. “It will become a larger portion of the supply.” Related: The Biggest Oil Story Of 2017

Russian gas production hits record high in 2017. Russian natural gas production rose by 7.9 percent last year to a record high, edging out the previous high set in 2011. Russia also has more projects in the works, which could allow it to continue to boost output and rival the U.S. for the top spot. New and planned LNG export terminals provide more outlets for Russian gas, while shipments via pipeline to Europe are also on the rise.

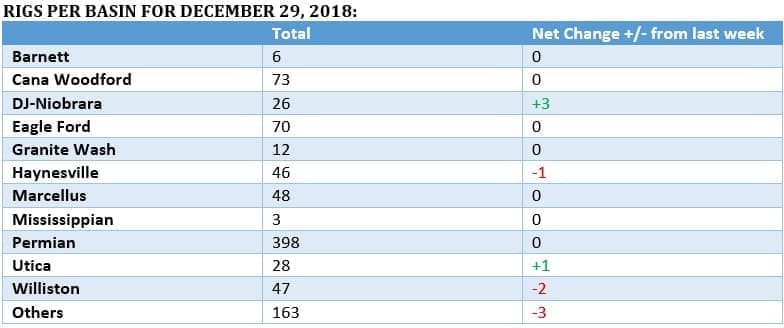

+$60 oil needed for new round of rig count additions. A survey from the Dallas Fed finds that oil executives believe that WTI will need to stay above $60 per barrel if the rig count is to continue to climb. The survey finds that the industry believes oil will need to trade between $61 and $65 per barrel if the rig additions are to rise significantly from current levels.

North Dakota oil production up, aided by pipeline. The WSJ notes that the beginning of operations at the Dakota Access pipeline has lowered the cost of shipping crude from the Bakken to the Gulf Coast, while also adding capacity. The early results are positive – North Dakota crude oil production hit a new peak in October at 1.185 mb/d, and output is up 135,000 bpd since the start of the pipeline.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Higher Oil Prices Slow China’s Crude Stockpiling

- U.S. Rig Count Falls Slightly As Canada’s Rig Count Tanks

- Russia Boosts 2017 Crude Oil Production To 30-Year High