Oil prices remained relatively flat on Tuesday following Monday’s sell-off in what appears to have been triggered by rising Russian crude production.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

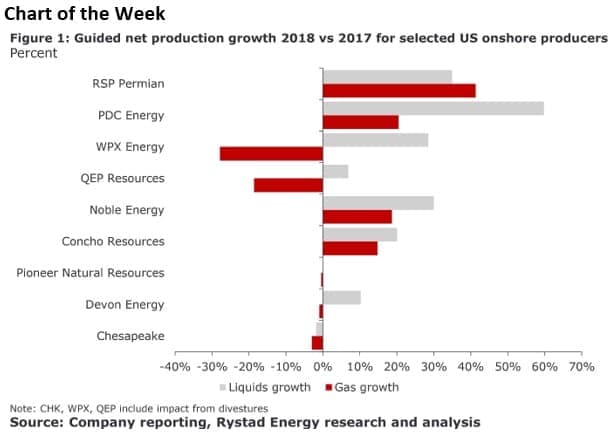

- Over the past few months, a long line of U.S. shale companies have begun a “spring cleaning” of their portfolios, according to Rystad Energy.

- U.S. onshore shale companies are hiking spending by about 20 percent, while also boosting production guidance.

- However, they are getting rid of assets that no longer make sense, focusing instead on “core” acreage. This “optimization” of portfolios, Rystad says, will allow them to grow production while still aiming for positive cash flow.

- In the chart above, it is clear that shale companies are disposing of some natural gas assets and focusing on liquids.

Market Movers

• ConocoPhillips (NYSE: COP) says it has entered into agreements for asset sales of about $250 million in the first quarter. COP also says it will expand its presence in the Austin Chalk paly in Louisiana.

• Energy Transfer Partners (NYSE: ETP) saidthat it shut down its Panhandle Eastern pipeline system after it was hit by a cyberattack.

• EOG Resources (NYSE: EOG) received support from the U.S. Securities and Exchange Commission to pre-emptively block a shareholder resolution on climate change, without a vote.

Tuesday April 3, 2018

Oil prices sold off along with everything else on Monday, falling despite the surprising decline of the U.S. rig count posted last week. The drop in prices appeared to have been triggered by rising Russian production and the record low levels of shorts in the market. Oil prices rebounded slightly on Tuesday.

Tesla’s bad streak continues. Tesla (NASDAQ: TSLA) raced against the clock last week to produce as many Model 3s as possible, just as the first quarter came to a close. Tesla has been under enormous pressure to hit key production metrics, after repeatedly coming up short. The tide seems to have turned against Elon Musk recently, with the company’s share price down by nearly 30 percent since mid-March. The company’s fortunes took another bad turn last week when a motorist was killed using the driver-assistance system Autopilot. Meanwhile, Moody’s also just downgraded Tesla’s credit rating deep into junk territory. Related: EV Revolution Could Cost Thousands Of Jobs

FirstEnergy Corp. puts power plants into bankruptcy. FirstEnergy (NYSE: FE) put a fleet of its power generation units into Chapter 11 bankruptcy, just days after it sent a plea to the U.S. government for a bailout. FirstEnergy’s coal and nuclear power plants are increasingly uncompetitive in a market of cheap natural gas and cheap renewable energy. Earlier this year U.S. FERC rejected a proposal that it intervene to prop up failing coal and nuclear plants. The latest request, which, if granted, would require the PJM grid to use the power from FirstEnergy’s aging fleet. The Energy Department says the request will be reviewed. But a decision won’t come in time to save FirstEnergy’s fleet.

Investment banks see rising oil prices. A Wall Street Journal survey of 15 investment bank points to higher oil prices. The average forecasted price for Brent and WTI for 2018 from the 15 banks came in at $63 and $59 per barrel, respectively. Both of those figures are up $1 per barrel from last month’s survey, an indication that falling crude oil inventories and rising geopolitical concerns are leading to a more bullish outlook.

China slaps tariffs on U.S. goods. China responded to U.S. tariffs on Monday by imposing $3 billion worth of tariffs on U.S. goods, including pork and recycled aluminum. The levies come as retaliation to President Trump’s steel and aluminum tariffs, which means that China could be preparing more retaliatory moves in response to the follow-up China-specific tariffs that the U.S. imposed more recently. The tit-for-tat risks a broader trade war, and that led to a global financial selloff, which dragged down oil prices and energy stocks on Monday.

Trump admin to hold offshore auction. The Trump administration announced last week that it would hold another offshore oil auction in August. The announcement comes shortly after the government held the largest offshore auction in history in March, which was met with scant interest. The August auction could slightly exceed the most recent offering in terms of size, with an estimated 77.3 million acres expected to be offered up. Meanwhile, the U.S. Congress is considering legislation that would gut the regulations on seismic surveys, a move that could make offshore oil exploration much easier. The regulations are in place to protect marine animals from seismic blasts.

EPA announces plan to scrap fuel efficiency. As expected, the EPA announced on Monday a proposal to roll back fuel efficiency standards for cars and light trucks. The agency said the standards, which the auto industry agreed to years ago, are too onerous. Undoing the standards will be a protracted process, and critical to the effort will be challenging California’s special waiver that it has, allowing it to set its own statewide fuel efficiency standards. Other states are allowed to adopt California standards. The EPA said that it would consider challenging California’s authority to set its own requirements.

Energy stocks could surge. Oil prices have rallied significantly over the past few quarters, but energy stocks have lagged behind the broader financial market. In the first quarter of 2018, energy stocks suffered their worst three-month stretch in three years. But, from here, things could look up, according to the WSJ. Energy companies reported the strongest corporate earnings growth of all 11 major sectors in the S&P 500 in the last reporting period, a streak that could continue. With energy share prices beaten down, there are good entry points and probably a lot more room to rally. “Those cash flow streams going out into the future are far more valuable, yet the stock prices haven’t kept in sync with that,” Michael Scanlon, a portfolio manager with Manulife Asset management, told the WSJ. “That’s an environment where oil can be held higher from here. Those stocks are very attractive.” Related: Are We Sleepwalking Into The Next Oil Crisis?

Bullish LNG market outlook. Up until recently, most analysts expected the LNG market to suffer from oversupply for years. The outlook is radically shifting, with more and more forecasts predicting a tight market in the 2020s. There is a lack of investment today because of low spot prices and a reluctance on the behalf of buyers to lock in to long-term contracts, which is preventing developers from moving forward with new supply. According to HSBC, the global market only added 12 million tons of LNG per annum (mtpa) in 2016-2017, while consumption increased by 27 mtpa.

Bahrain announces major oil discovery. Bahrain announced the largest oil discovery since it began producing oil back in the 1930s. The discovery is located off of the country’s west coast, and could “dwarf Bahrain’s current reserves,” according to Bahrain News Agency, although no figures were disclosed.

Iraq approves raising oil production capacity. The Iraqi cabinet approved a plan that would raise the country’s production capacity to 6.5 million barrels per day by 2022. In April, the government is expected to award oil and gas exploration and development contracts in new blocks. Current capacity, the government says, stands at about 5 mb/d. For now, Iraq is producing 4.4 mb/d, limiting output as part of the OPEC deal.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- The Bakken Is Booming Once Again

- Wall Street’s Favorite Shale Stocks

- Renewables Are Closing In On Fossil Fuels