Friday March 8, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oil market entering supply deficit

• The OPEC+ cuts have likely already tipped the oil market into a supply deficit, according to Barclays.

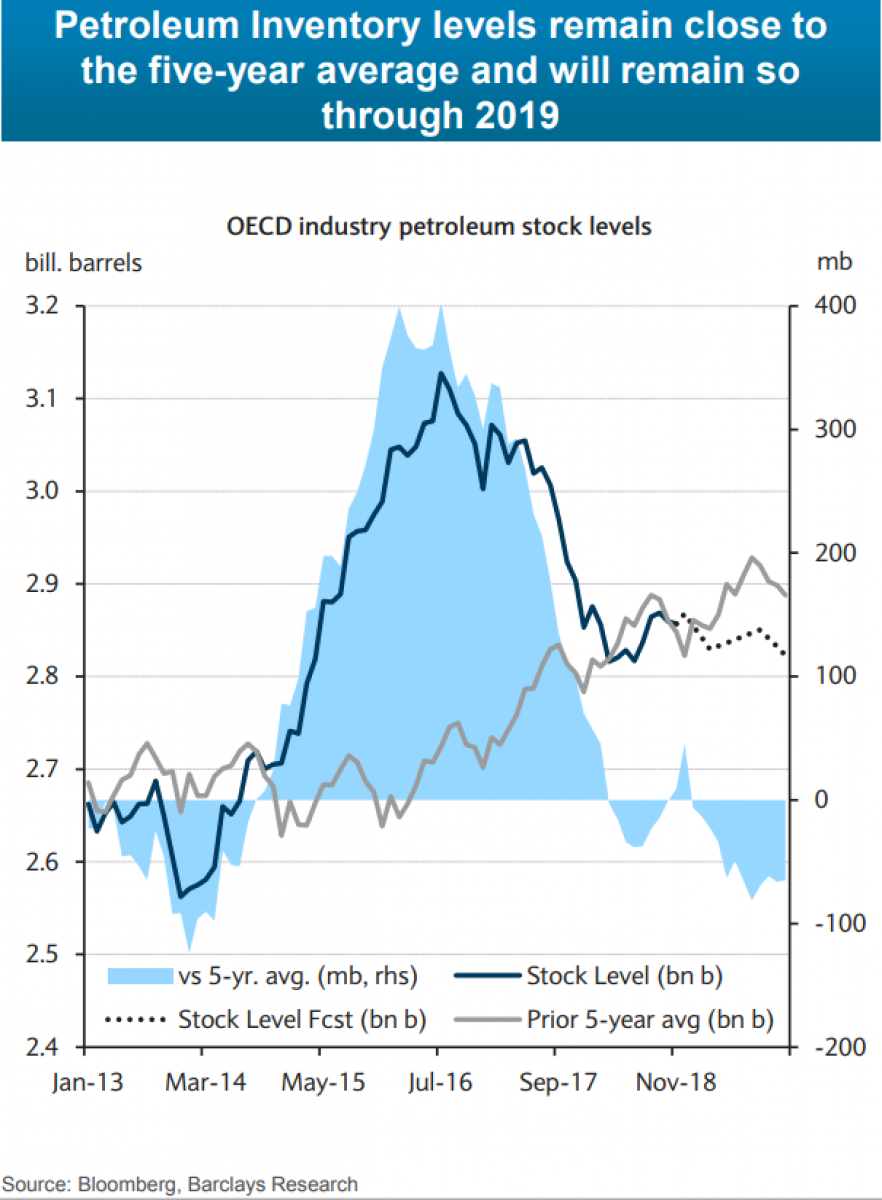

• OECD inventories fell dramatically over the past two years, and came back to the five-year average in 2018, where they have mostly remained.

• The OPEC+ cuts quickly headed off a renewed surplus, and will likely drain inventories over the course of this year. Inventories are set to fall below the five-year average.

• Still, Barclays says the market return to balance or even a small surplus in the second half of 2019.

2. China’s oil demand not collapsing

• Some of the more catastrophic oil forecasts for 2019 centered on a sharp slowdown in Chinese demand.

• China’s car sales actually contracted year-on-year over the last few months, and car sales could continue to fall this year.

• But China’s demand, while slowing relative to years past, is still expected to grow by 0.5 mb/d in 2019, according to Barclays, the same rate of expansion as 2018.

• Next year, however, China’s demand growth could slow a bit more, dipping below 0.4 mb/d, continuing a gradual deceleration in demand growth.

3. Cobalt oversupplied, but in high demand

• Kobold Metals, a startup backed by Bill Gates and Jeff Bezos, is hoping to build a “Google Maps for the earth’s crust,” according to Bloomberg.

• The company is building a database of geological data on cobalt, a metal that is often overlooked but is increasingly important to batteries in electric vehicles and the broader shift towards clean energy.

• More than two-thirds of the world’s cobalt supply comes from the Democratic Republic of Congo.

• Kobold plans to explore for Cobalt in North America.

• Prices for cobalt quadrupled between 2016 and 2018, but have since crashed by 64 percent.

4. A big bet on plastics

• The surge of U.S. oil and gas production has led to a huge increase in the availability of natural gas liquids (NGLs), including cheap ethane, which can be processed into the building blocks of plastic.

• Tens of billions of dollars of investment have flowed into ethane cracking, resulting in a vast buildup in polyethylene production capacity. Between 2016 and 2022, U.S. polyethylene capacity will expand by 60 percent.

• The idea is to export these plastic pellets to China, where demand has been soaring.

• However, prices have weakened recently because of the enormous increase in ethane cracking investment, as well as a slowdown in polyethylene demand in China.

• Polyethylene prices are down by 20 percent since last year, made worse by the U.S.-China trade war.

5. Copper prices show some life

• Copper prices collapsed last year, but have rebounded since the start of 2019.

• “Risk-on sentiment, supply disruptions and the downtrend in inventories has underpinned recent price gains,” Standard Chartered wrote in a note. “LME inventories now total 118.6 thousand tonnes (kt) – their lowest level since May 2008.”

• Copper futures are also in a state of backwardation, a sign of market tightness.

• Standard Chartered sees prices moving higher over the course of this year. China’s stimulus measures – tax cuts and spending on infrastructure – is a tailwind helping prices move higher.

6. Gold prices heavily influenced by economy

• Historically, the U.S. dollar and gold prices trade in opposite directions. That relationship has broken down in the last few months with gold prices shooting up while the U.S. dollar has not lost ground to other currencies.

• Even more recently, gold prices have fallen back a bit without major movements in the greenback.

• Instead, the movements in gold prices over the last few months likely have more to do with expectations about the global economy. As sentiment soured in late 2018 and early 2019, gold prices soared.

• Over the last few weeks, the markets have become less concerned about global growth, and gold prices have fallen back below $1,300/ounce.

• “[W]e believe that the main factor weighing on gold is the good sentiment among market participants, as evidenced among other things by rising stock markets,” Commerzbank wrote in a note on Monday. “A possible trade deal between the US and China and the possibility of an eleventh-hour Brexit deal are currently reducing demand for gold as a safe haven.”

7. Bad times for refiners

• Margins for gasoline have collapsed amid oversupply. In January, crack spreads briefly went negative, which meant that refiners were losing money on their gasoline sales. The spreads have been among the lowest on record.

• Gasoline inventories have been high and production has climbed amid soaring output of light sweet oil from U.S. shale, which tends to produce relatively more gasoline than distillates.

• At the same time, cracks for distillates have held up well. Demand for diesel remains strong and will only grow later this year as the IMO regulations on marine fuels draw near, which will see more middle distillates move into the marine fuel sector.

• “Refineries earn their largest earnings shares from middle distillates (Gasoil/Diesel/Jet) and light products (gasoline, naphtha, etc.),” said Bjarne Schieldrop, chief commodities analyst at SEB. Heavy end products are often loss-making.

• But because gasoline margins have now crashed to zero, “middle distillate cracks will need to carry the entire refinery margin,” Schieldrop said.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.

Examples abound. This article is talking about the oil market entering a supply deficit this year as a result of the OPEC+ cuts. Yet, authors contributing to the oilprice.com have been projecting prices in 2019 to range from $60-$67 a barrel or even lower. A sample of such sentiment is the latest article titled:” Why Oil Markets Can’t Find a Solid Footing” posted by Tim Daiss on March 9.

Another example is the claim that China’s economy and oil demand are slowing down. Yet, China’s oil demand is projected to hit 14 million barrels a day (mbd) this year with oil imports projected to reach 11 mbd. This is not a sign of collapsing oil demand and imports or slowing down economy.

The global economy and also the global oil market are both being buoyed by strong indications of an imminent end to the trade war between the US and China, hence the recent fall in gold prices below $1,300/ounce.

I have never ever wavered once in my projections about oil prices. Despite stiff opposition from bearish elements in the global oil market, bullish influences will eventually prevail with oil prices surging beyond $80 a barrel this year and the years after.

My reasoning has always been underpinned by three important premises. The first premise is that there will never be a post-oil era throughout the 21st century and far beyond. The reason is that it is very doubtful that an alternative as versatile and practicable as oil, particularly in transport, could totally replace oil in the next 100 years and beyond. Oil will continue to reign supreme throughout the 21st century and far beyond.

The second premise is that there will never be a peak oil demand either. Global oil demand will never peak because electric vehicles (EVs) will never be able to replace oil in global transport. They will only decelerate the growth of global demand for oil.

The third premise is that it is a valid economic principle that oil producers and investors should always aim to maximize the return on their assets and investments respectively. If there will be neither a post-oil era nor a peak oil demand, it follows that investors will look for opportunities in the most profitable outlets in the world. The global oil industry is and will continue to be the most profitable industry for the foreseeable future. It also follows that OPEC will continue to be in a position not only to play a major role in determining the oil price but also to stabilize the global oil market and prices as well.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London