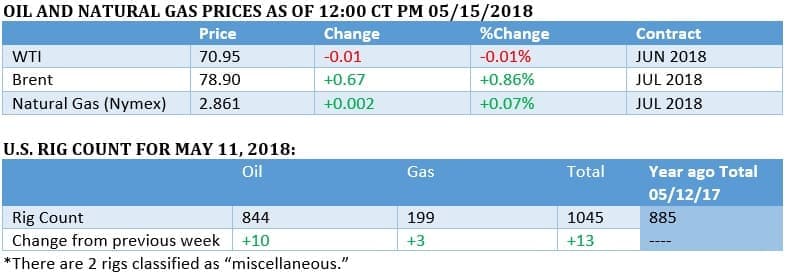

OPEC's efforts to cut global oil inventories are finally paying off, with Brent crude inching closer and closer to $80 per barrel.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

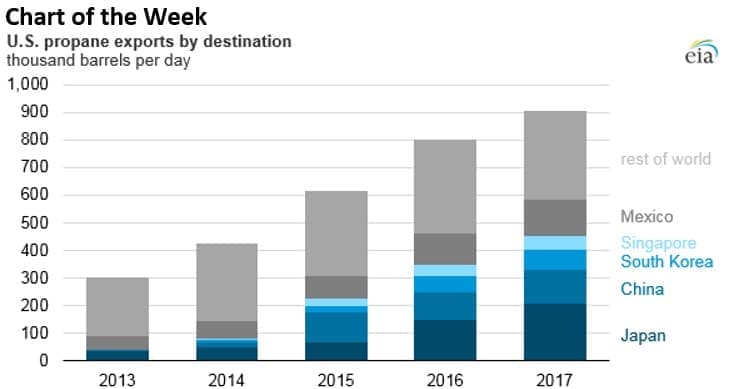

- The U.S. exported 905,000 bpd of propane in 2017, about half of which went to Asia to be used in petrochemical production.

- Surging demand in Asia for propane has supported investment in propane exports in the U.S.

- About half of U.S. propane production, and the vast majority of exports, occur along the Gulf Coast.

Market Movers

• The Atlantic Coast Pipeline received the go-ahead from U.S. FERC to begin construction in West Virginia. The natural gas pipeline, of which Dominion Energy (NYSE: D) owns 48 percent and Duke Energy (NYSE: DUK) owns 47 percent, will carry natural gas from the Marcellus Shale in Pennsylvania through West Virginia, Virginia and North Carolina, carrying shale gas to the U.S. South.

• Valero Energy (NYSE: VLO) agreed to acquire Pure Biofuels Del Peru for an undisclosed sum, the U.S. refiner’s first investment in South America.

• California’s new solar requirement for new residential construction could benefit solar manufacturers like SunPower (NASDAQ: SWPR) and First Solar (NASDAQ: FSLR) more than installers such as Sunrun (NASDAQ: RUN), according to Height Capital, because manufacturers might end up being able to sell to homebuilders directly.

Tuesday May 15, 2018

Brent topped $79 per barrel in early trading on Tuesday, closing in on the psychological threshold of $80 per barrel. However, benchmark prices posted modest losses by mid-morning. The oil market continues to tighten with OPEC keeping barrels off of the market and reducing inventories down to the five-year average. The near-term tension between bulls and bears will continue to be dominated by geopolitical risk, with fears of outages in Iran pushing prices up.

$100 oil not as painful as it used to be. Oil prices at $100 per barrel would reduce U.S. GDP by 0.4 percent in 2020 compared to if oil was priced at $75 per barrel, according to Bloomberg. But that economic hit is not as strong as it used to be because the U.S. economy has become less energy intensive and the U.S. also exports more oil than ever before. “$100 oil won’t feel like it did in 2011,” and could end up feeling “more like $79” per barrel, economists Jamie Murray, Ziad Daoud, Carl Riccadonna and Tom Orlik concluded. “With the U.S. still firing on close to all cylinders, the rest of the world would suffer less as well – global output would be down by 0.2 percent in 2020.” Related: OPEC: The Oil Glut Is Gone

EU seeks to rescue Iran nuclear deal. Germany, France and the UK are trying to rescue the Iran nuclear deal in order to shield EU companies from U.S. sanctions while also heading off another war in the Middle East. Foreign ministers from the European nations will meet with their Iranian counterpart on Tuesday. “There is no plan B,” French Foreign Minister Jean-Yves Le Drian told Le Parisien newspaper in an interview. “Plan B is war.”

Crumbling Venezuelan output tightens oil market. As Venezuela’s oil production and exports continue to fall off a cliff, the case for higher oil prices is strong. A decline in Iranian oil exports, which will occur alongside plunging output from Venezuela, would create the “perfect cocktail” for oil to hit $100 per barrel this year or next, according to PVM. At that point, OPEC would be under a great deal of pressure to lift the production limits. ConocoPhillips’ (NYSE: COP) seizure of PDVSA assets in the Caribbean threatens to accelerate production declines in Venezuela.

OPEC production up modestly, oil glut vanishes. OPEC said the oil supply surplus is virtually gone, with inventories standing just 9 million barrels above the five-year average in March, which means that by the time data is published for May, inventories will have already fallen below average levels. The OPEC report showed a slight increase in output, rising by 12,000 bpd, driven by higher output from Saudi Arabia but also revealing deep declines in Venezuela.

Hedge funds trim bullish bets. Oil prices are at three-year highs, and hedge funds and other money managers have pocketed some profits over the past week. For the week ending on May 8, investors cut their bullish bets. The positioning is still overwhelmingly on the long side, exposing the market to downside risk if sentiment sours

Related: The Most Underappreciated Story In The Oil Market

Trump admin to reduce biofuels waivers and count exports towards requirement. In an attempt to bridge the gap between oil refiners and the ethanol industries, the Trump administration is considering a plan that could be announced shortly. The idea would include cutting back on the number of waivers it issues to refiners to get out of the ethanol requirements, and redistributing any waived obligations to other refiners. That would assuage concerns of the ethanol industry. To please refiners, the Trump administration would allow exports of biofuels to count towards the blending requirement for refiners, reducing their burden. It is unclear if the administration will successfully thread the needle to satisfy both sides.

Trump admin wants single national fuel efficiency standard. After moving to rip up national fuel economy standards, President Trump met with automakers who have grown concerned that they are getting way more than they had wanted when they asked the administration to weaken fuel economy standards for cars and light trucks. In an unusual move, the auto industry has asked the Trump administration to dial back plans to weaken the rules, fearing a patchwork of state laws if the standards are weakened too much. Critical to the effort is California, and the Trump administration signaled after its meeting with automakers on Monday a willingness to negotiate with California in order to keep a national standard.

Saudi Aramco provides U.S. condensate to UAE. Saudi Aramco’s trading arm has shipped U.S. condensate to the UAE, according to Reuters. Aramco’s refinery in Texas, under the banner of Motiva Enterprises, provided the ultra-light condensate that made its way to the UAE. The shipment was a spot trade, unusual because most of Aramco’s shipments are done under long-term contracts. The strategy will allow Aramco to expand its trading business while diversifying supply outside of Saudi Arabia.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Iran Sanctions Threaten The Petrodollar

- Brent Crude Hits New High On Soaring Demand

- China Aims For 1 Million EV Sales In 2018