Oil prices started the week slightly higher, but fell on Tuesday after U.S. Secretary of State Pompeo said that Washington is ready to negotiate the Iran missile program

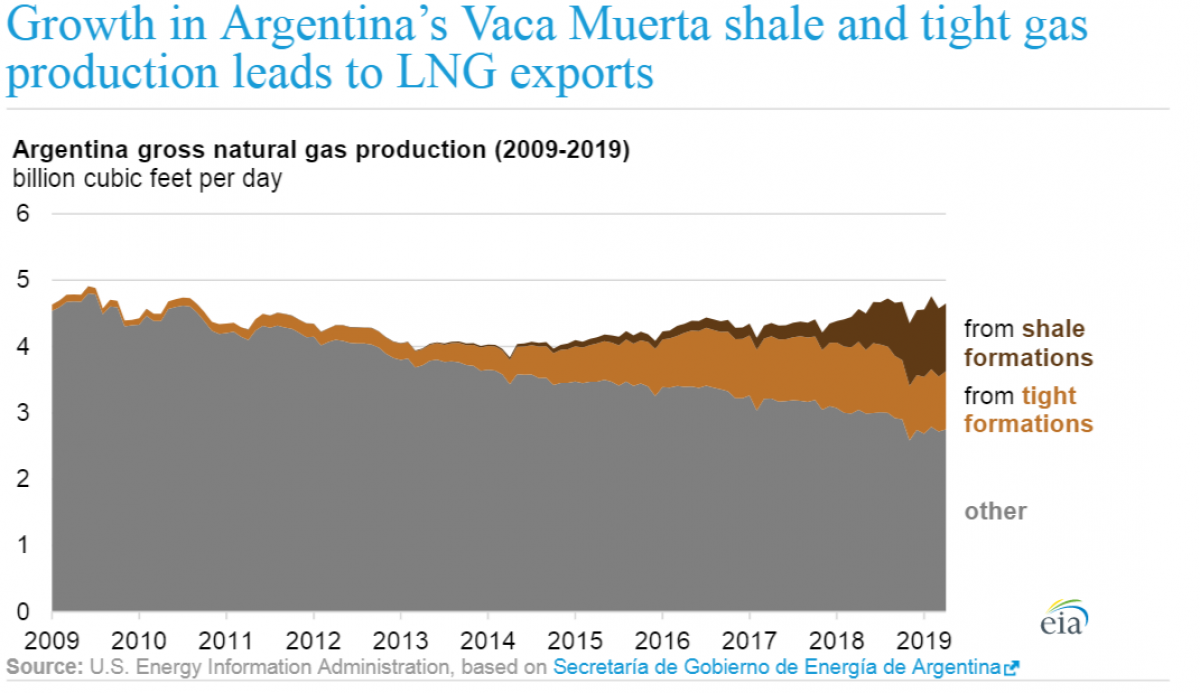

Argentina’s natural gas production from shale has climbed significantly in the last few years, driven by increased drilling in the Vaca Muerta shale.

Production from the Vaca Muerta surpassed 1 billion cubic feet per day (Bcf/d) at the end of 2018.

Higher production has allowed Argentina to resume gas exports. Argentina’s first LNG shipment departed in June.

Market Movers

Energy Transfer Partners (NYSE: ETP) is considering the sale of its 33 percent stake in the Rover Pipeline, which carries natural gas from the Marcellus shale to the U.S. Midwest. The sale could be worth as much as $2.5 billion.

Analysts and investors panned the Callon-Carrizo deal (more below). Callon Petroleum’s (NYSE: CPE) share price plunged by 15 percent on the news.

American Electric Power (NYSE: AEP) says it will buy three wind projects in Oklahoma at a cost of $2 billion. AEP says it will save ratepayers $3 billion.

Tuesday July 16, 2019

Oil prices started off the week on a quiet note, but retreated on Tuesday afternoon after Secretary of State Mike Pompeo said that Iran…

Oil prices started the week slightly higher, but fell on Tuesday after U.S. Secretary of State Pompeo said that Washington is ready to negotiate the Iran missile program

Chart of the Week

- Argentina’s natural gas production from shale has climbed significantly in the last few years, driven by increased drilling in the Vaca Muerta shale.

- Production from the Vaca Muerta surpassed 1 billion cubic feet per day (Bcf/d) at the end of 2018.

- Higher production has allowed Argentina to resume gas exports. Argentina’s first LNG shipment departed in June.

Market Movers

- Energy Transfer Partners (NYSE: ETP) is considering the sale of its 33 percent stake in the Rover Pipeline, which carries natural gas from the Marcellus shale to the U.S. Midwest. The sale could be worth as much as $2.5 billion.

- Analysts and investors panned the Callon-Carrizo deal (more below). Callon Petroleum’s (NYSE: CPE) share price plunged by 15 percent on the news.

- American Electric Power (NYSE: AEP) says it will buy three wind projects in Oklahoma at a cost of $2 billion. AEP says it will save ratepayers $3 billion.

Tuesday July 16, 2019

Oil prices started off the week on a quiet note, but retreated on Tuesday afternoon after Secretary of State Mike Pompeo said that Iran is ready to negotiate its missile program.

Callon Petroleum to buy Carrizo for $1.7 billion. Callon Petroleum (NYSE: CPE) agreed to purchase Carrizo Oil & Gas (NYSE: CRZO) for $1.7 billion, marking the latest sign of consolidation for the U.S. shale industry. With so many shale drillers failing to post profits, investors are increasingly pressuring companies to pursue consolidation deals. Carrizo’s decision to agree to be taken over at a low point for its share price is a sign that drillers have lost confidence in their ability to rebound.

China’s growth slows to 27-year low. New data shows that China’s GDP growth fell to just 6.2 percent in the second quarter, the worst performance in nearly three decades. In the first quarter, growth stood at 6.4 percent. “Economic conditions are still severe both at home and abroad, the global economic growth is slowing down, the external instabilities and uncertainties are increasing, the unbalanced and inadequate development at home is still acute, and the economy is under new downward pressure,” said Mao Shengyong, a spokesman for China’s National Bureau of Statistics, in a news conference.

European carbon prices could rise on Exxon court decision. The European Union’s Court of Justice ruled that a natural gas processing facility owned by ExxonMobil (NYSE: XOM) should be classified as an electricity generator, subjecting it to the carbon market. If that decision applies to some 3,000 factories that transfer heat or electricity to the public grid, it could bring in a lot more polluters, which could drive up the cost of carbon. Carbon prices are already at an 11-year high. “It’s backfiring not just on Exxon, but on many companies receiving free allowances for power stations located at factories,” Mark Lewis, global head of sustainability research at BNP Paribas SA’s asset management unit, told Bloomberg.

Investor Alert: Get your 30-day risk-free trial on Global Energy Alert now! - For just $1.51 per week, you’ll get trading ideas, energy sector analysis, and the geopolitical & technological developments shaping today’s energy market.

EIA: U.S. CO2 emissions to fall in 2019. The EIA expects U.S. energy-related carbon emissions to fall this year by 2.2 percent, largely due to the decline of coal-fired power plants. Last year emissions rose 2.7 percent compared to 2017 levels. Meanwhile, NASA said that the world just saw the hottest June on record.

Coal plant retirements continue. Power plant owners do not expect to alter their plans to shut coal plants in the years ahead, despite the Trump administration’s efforts to prop up the industry, according to S&P Global Platts.

Permian slowing down. Top U.S. shale basins may only add 49,000 bpd in August over a month earlier, according to the EIA, a slower-than-usual pace. As Bloomberg noted, one example of the slowdown is Parsley Energy (NYSE: PE), which slashed its 2019 growth rate by as much as 40 percentage points below its 2018 figures.

Fracklog declines as drillers cut costs. In an effort to slash costs, drillers are drawing down their inventory of drilled but uncompleted wells (DUCs). The so-called “fracklog” had steadily climbed for the better part of two years, but now, with investor scrutiny putting pressure on shale companies, the fracklog is declining. “They have already sunk their cash into the drilling portion,” Elisabeth Murphy, an analyst at ESAI Energy LLC, told Bloomberg. “Now it’s just a matter of completing rather than drilling new wells.”

Gulf of Mexico production begins to restart. Roughly 1.3 mb/d of oil production in the Gulf of Mexico, or 69 percent, was still offline as of Monday. Also, 1.7 Bcf/d of natural gas, or 61 percent, was not operating. But companies were beginning the process of restarting on Sunday.

Fossil fuels less efficient than previously thought. The energy return on investment (EROI) of oil and gas may be lower than was previously thought. The general consensus has been that the EROI for oil, gas and coal was 25:1, but a new study found that when including refining, the EROI drops to just 6:1. Because of its high energy content, fossil fuels are often considered to be superior to renewable energy, but the lower EROI puts them on level footing. “The transition from fossil fuels to renewables actually might not be as bad as people thought,” said Paul Brockway, a co-author of the study. Related: The Scary Truth About Canada's Energy Security

Refining margins shrink on weak economy. Weak distillate prices have cut into refining margins, due to slower demand and an economic deceleration. Up until only recently, the pending 2020 IMO regulations on maritime fuels were predicted to drive up distillate prices and cause major disruptions to refiners and to product markets.

Libya’s oil revenue plunges. Libya’s oil revenue fell 11.2 percent in the first half of the year. Production has not been severely affected thus far despite several months of civil war.

Chevron ordered to stop oil spill. Chevron (NYSE: CVX) has spilled as much as 800,000 gallons of crude oil and water in Kern County canyon in southern California since it began in May, and state regulators ordered the company to put a halt to the spill.

Secret recording of Russian-Italian deal. BuzzFeed News reported on a secret meeting between Russian and Italian officials, which unmasked the details of a scheme that would see Russian money funneled into the far-right Lega Party in Italy. According to BuzzFeed, a Russian oil company would sell fuel at a discount to Eni (NYSE: E), with the difference – roughly $65 million – secretly diverted into the coffers of the Lega Party.

California puts the brakes on fracking. After news surfaced that California had approved twice as many fracking permits in the first six months of this year compared to 2018, California Governor Gavin Newsome fired the top oil regulator. The reshuffling could slow the pace of permitting for drilling in the state and may present a serious headwind for the industry.

By Tom Kool of Oilprice.com

More Top Reads From Oilprice.com:

Seems like news to me anyways.