OPEC continues to be one of the main talking points for the oil industry. After the OPEC/OPEC+ agreement to prolong the supply cuts all the way through March 2020, it is now OPEC member countries’ compliance with the above deal that raises questions. Apart from the usual suspect Iraq which routinely reneges on its curtailment promises, Saudi Arabia and Nigeria have seen a tangible month-on-month increase, something which Thursday’s OPEC Report will confirm as per market anticipations. Apart from all matters OPEC, tensions around Iran kept analysts guessing after the UK’s seizure of the Grace I VLCC, Panamanian-flagged with no Iranian staff onboard (carrying Iranian crude towards Syria), introducing quite the precedent for future cargo confiscations.

Amidst industry reports of a substantial US commercial crude draw in the week to July 05 and a tropical storm threatening production in the Gulf of Mexico, global benchmark Brent quotes traded at $65.7-66 per barrel, whilst WTI was assessed at $59.1-59.4 per barrel as of Wednesday afternoon.

1. Saudi Arabia Drops Asia August OSPs, Slashes European Prices

• Saudi national oil company Saudi Aramco has cut drastically its August-loading official selling prices destined for Europe, whilst reducing most Asia-bound prices by 20-55 cents per barrel.

• The heavier the Asia-bound barrels the smaller is Aramco’s August discount – Arab Extra Light saw the biggest month-on-month drop, falling to a $2.65 per barrel premium against the Oman/Dubai average.

• The only Eurasian exception to Aramco’s price-cutting spree webre Asia-bound Arab Heavy prices, raised 10 cents per barrel from July’s $0.75 per barrel premium against Oman/Dubai.

Source: OilPrice data.

• Amidst Urals falling almost $2 per barrel from June to July, Saudi Aramco dropped month-on-month OSPs for cargoes bound for NW Europe by $1.5-2 per barrel, with Arab Extra Light seeing the biggest reduction.

Source: OilPrice data.

• Cognizant of the bitumen-season appeal of its crudes for US customers, Saudi Aramco hiked its Heavy and Medium grades by 20 and 10 cents per barrel, respectively, whilst committing to minor cuts on the Light and Extra Light streams.

Source: OilPrice data.

• Saudi Arabia’s June 2019 exports stood at 7.46mbpd, with 67 percent of supplies going to Asia, up 2.5 percent m-o-m from May’s 7.27mbpd.

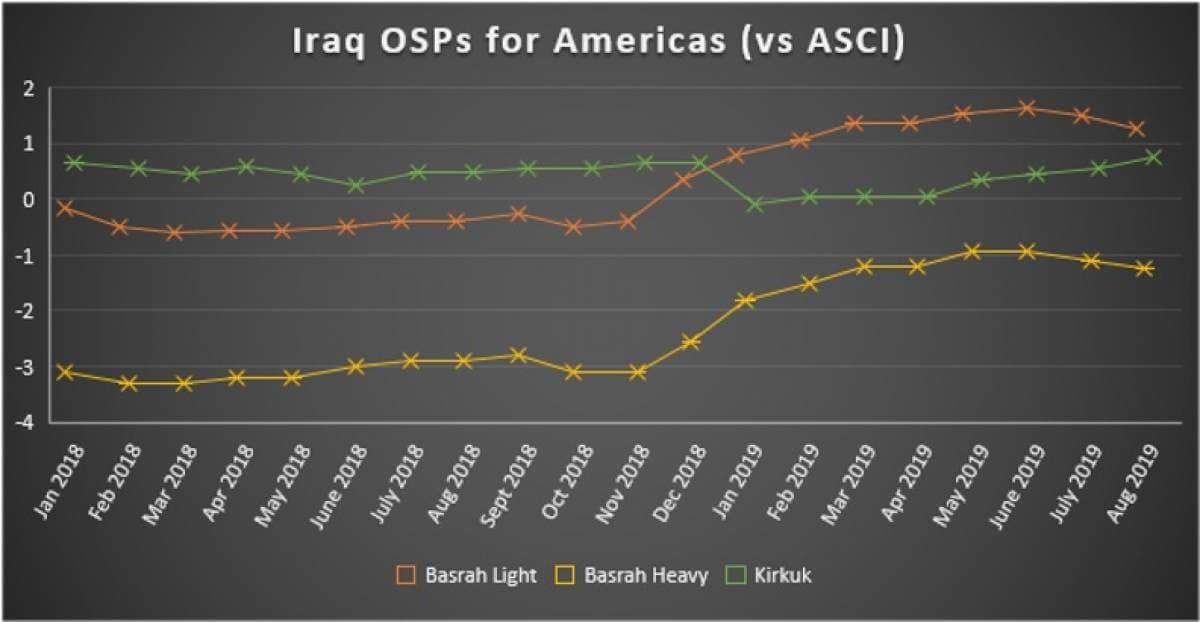

2. Iraqi SOMO Follows Aramco’s Suit

• Mirroring Saudi Aramco’s steps, Saudi state oil marketer SOMO decreased most of its August-loading official selling prices, whilst committing to minor increases on heavy barrels supplied to Asia.

• The Asia-Pacific OSP for August-loading Basrah Light has been cut by 35 cents per barrel to a $1.7 per barrel premium against the Oman/Dubai average, whilst Basrah Heavy was hiked 10 cents m-o-m (to $-0.6 to Oman/Dubai).

Source: OilPrice data.

• SOMO cut the Europe-bound August OSPs for Europe by $1.3-1.75 per barrel, with Basrah Light seeing the biggest month-on-month cut, dropping to a $-4.05 per barrel discount to Dated Brent.

Source: OilPrice data.

• SOMO has decreased both Basrah Light and Basrah Heavy August OSPs for US customers by 25 and 15 cents per barrel respectively, whilst hiking Kirkuk prices by 20 cents to a $0.75 premium against ASCI.

Source: OilPrice data.

• The Iraqi oil minister Thamer Ghadhban, whilst committing to the OPEC/OPEC+ supply cut prolongation, stated that oil prices of $70 per barrel or above would be acceptable for Baghdad.

3. ADNOC’s Upper Zakum Narrows In On Other UAE Grades

• UAE’s flagship state oil company ADNOC has set its retroactive official selling prices for June, making only insignificant to its grades’ monthly premium to Dubai.

• Upper Zakum saw the most significant month-on-month change, rising to a $2.09 per barrel premium against front-month Dubai, the highest in more than 5 years.

• This was widely expected as Upper Zakum, in demand amongst Chinese and Japanese refiners, has been trading at a 10-20 cent per barrel premium over the May OSP as of recently.

Source: OilPrice data.

• ADNOC’s most recent addition to its portfolio, Umm Lulu, was retroactively set at $64.96 per barrel, equivalent to a $3.19 per barrel premium over the Oman/Dubai average.

• UAE crude exports averaged 3.258mbpd in June 2019, with July loading fixtures indicating a sharp month-on-month increase to some 3.7mbpd in July 2019.

4. SK Energy Expands Scope by Buying Into Sinopec’s Refinery Complex

• South Korean refiner SK Energy acquired 35 percent in Sinopec’s 170kbpd Wuhan Refinery in the province of Hubei, creating a joint venture with the Chinese firm that would operate under the name of Sinopec-SK Wuhan Petrochemical.

• The second Chinese refinery to see foreign investment trickling in, Wuhan’s future will tilt heavily towards developing its petrochemical segment, with a $0.5 billion investment agreed this week by the new JV board.

• The expansion of the Wuhan Refinery will result in China boosting its product portfolio by further 300ktpa of ethylene, 300ktpa of polyethylene and 300ktpa of polypropylene.

(Click to enlarge)

Source: OilPrice data.

• South Korea’s refinery runs have been largely stagnant (3.03mbpd in 2017 against 3.02mbpd in 2018), whilst China’s refinery runs have soared by more than 1.5mbpd in 2017-2019 to 13.1mbpd in June 2019.

5. ExxonMobil Returns to Greece after More than 40 Years

• The outgoing Syriza government in Greece has granted two exploration licenses to oil majors ExxonMobil and Total, substantially elevating Greece’s hydrocarbon development profile.

• This marks the arrival of two oil and gas heavyweights onto a market which not seen any exploratory well in the past years (only seismic surveys) and averages a crude output of 5kbpd.

• The two unassessed offshore blocks, to be developed jointly with national oil company Hellenic Petroleum, are located to the south and southwest to the island of Crete.

Source: Hellenic Petroleum.

• If the accretionary prisms and mud flow volcanoes around Crete are genuine signs of hydrocarbon systems and the Greek academic community’s claims are proven correct, new producing fields might provide a great boost to the notoriously import-dependent Greek crude industry.

• As things seem today the Mediterranean Ridge along Crete is most likely a gas-bearing province.

Source: OilPrice data.

• ExxonMobil’s return is of particular notice, following series of unsuccessful drilling attempts in the 1970s when the NW Peloponnese and the Ionian Islands were in the spotlight of attention.

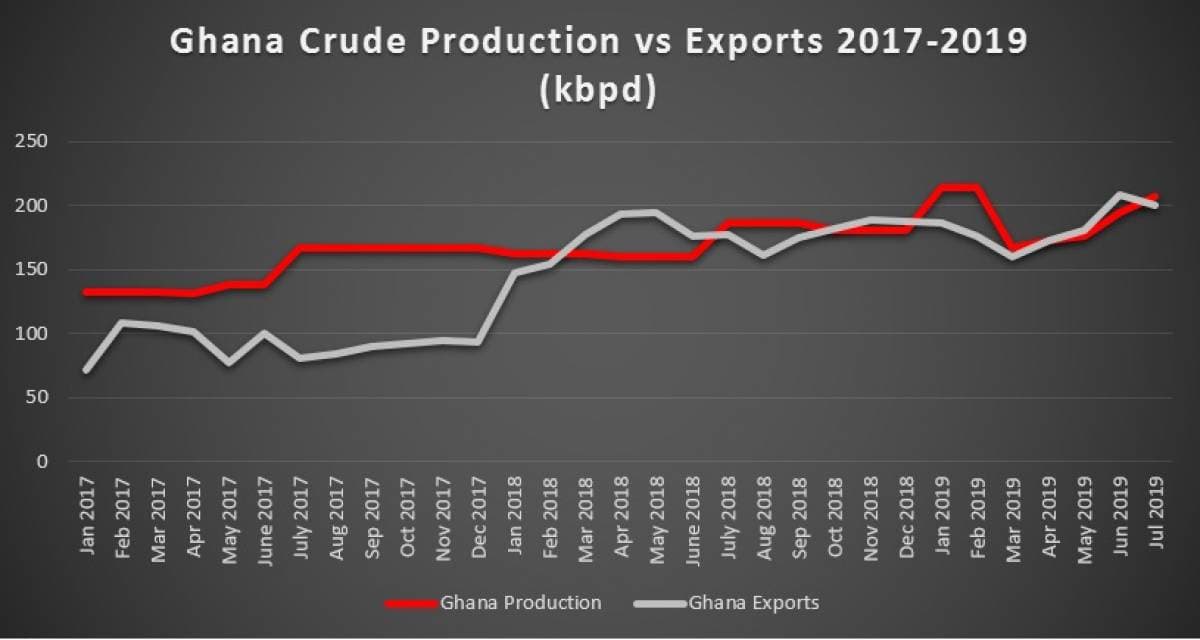

6. Ghana Awards Block 03 to ENI-Vitol consortium

• Italian oil and gas major ENI and leading energy tradinghouse Vitol have been awarded the WB03 Block in Ghana’s offshore Western Basin, the first fruit of Ghana’s oil and gas licensing round.

• Block 03 is located 50km to the southeast of the John Agyekum Kufuor FPSO, which collects crude from the Offshore Cape Three Points (OCTP) block, also operated by ENI.

• ENI, designated as operator of Block 03, already produces 70kbpdoe in Ghana, is the largest producer in the country despite not participating in the 100kbpd Jubilee field, source to half of Ghana’s output.

(Click to enlarge)

Source: OilPrice data.

• ENI/Vitol already hold rights over the adjacent Block 04, which yielded a gas discovery this May – as with all OCTP volumes the gas will be shipped onshore and used domestically.

7. Turkey Embarks On Risky Drilling off Cyprus Coast

• A Turkish drillship has entered Cyprus’ territorial waters, defying calls from the Cypriot government and the European Union not to escalate the extraction rights fissure.

• The Yavuz vessel, breaching into Cypriot territorial waters on Sunday night, is not the first one to be anchored in the country’s EEZ – the Fatih drillship has been anchored there since last November.

• With no international maritime frontier demarcation resolution between the two sides (something the Cypriots claim Turkey steadfastly rejects), Greek Cypriots are having a hard time rebuking Turkish maritime advances.

(Click to enlarge)

Source: Cyprus Mail.

• The Turkish Republic of Northern Cyprus, the result of Turkey’s 1974 invasion of Cyprus, claims that any gas finds in Cyprus’ territorial waters appertain in equal measure to inhabitants of the island’s northern part.

• Heretofore Cyprus’ gas discoveries, including the ENI-operated Calypso and the ExxonMobil-led Glaucus find, were to the south of the island adjacent to the Egyptian maritime border.

So much for the Numbers Report. We will see you next week with a new portion of fresh energy insights.