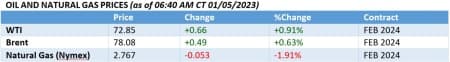

Crude prices are set to close out the first week of the new year with a small gain as tensions in the Middle East continue to provide support.

Friday, January 5, 2024

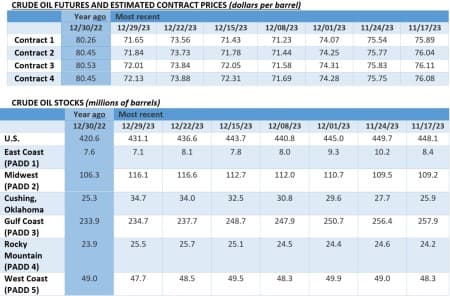

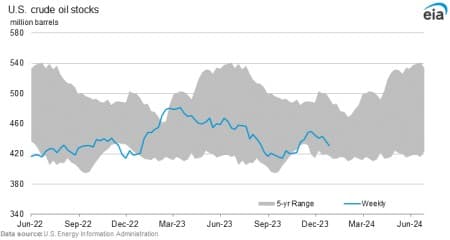

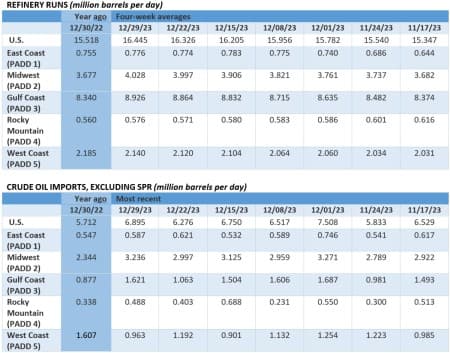

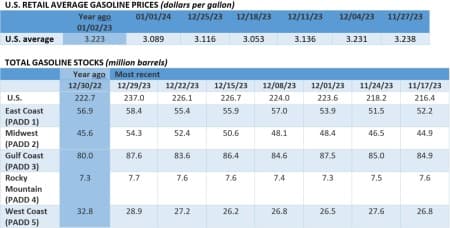

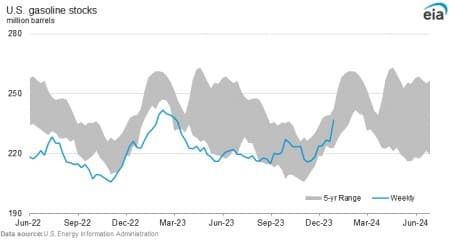

Oil prices are set to finish this week with a slight gain after Middle Eastern tensions helped recoup losses after US inventory data. Despite a hefty 5.5-million crude stock draw, believed to be the usual year-end clearing of inventory to minimize ad valorem inventory taxes, the immediate reaction was a slight downward correction after both gasoline and diesel posted huge stock builds. However, continued Houthi attacks in the Red Sea and a worsening Israel-Iran confrontation has limited the pricing downside, with Brent trading around $78 per barrel.

Protests Shut Down Libya’s Largest Oil Field. Libya’s largest oil field, the 300,000 b/d capacity El Sharara, has been shut down after protestors lamenting over poor government and inadequate infrastructure took over the field, for the second time in the past six months.

US Oil M&A Deals Still Not Over. US oil producer APA Corp (NASDAQ:APA) agreed to buy shale peer Callon Petroleum (NYSE:CPE) in an all-stock transaction valued at $4.5 billion including debt, adding some 145,000 acres in West Texas and New Mexico as APA boosts its US upstream operations. Related: Maersk Reroutes Ships Away from Red Sea after Latest Attack

Mexico Downplays New Refinery’s Impact. Following years of project overruns, Mexico’s national oil firm Pemex stated its long-awaited Olmeca refinery will process 243,000 b/d of crude in 2024, suggesting the 340,000 b/d plant built in AMLO’s hometown will only reach full capacity in 2025.

European Majors Eye Better US Wind Deals. Europe’s leading energy majors BP (NYSE:BP) and Equinor (NYSE:EQNR) cancelled their agreements with the state of New York to sell electricity from the Empire Wind 2 offshore wind farm, aiming to renegotiate their terms in a new round of solicitation.

Pirate Risk Worsens Red Sea Shipping Outlook. Apart from Houthi missile attacks, the Red Sea is increasingly posing a piracy risk for shippers after a Bahrain-bound bulk carrier was boarded by pirates off the coast of Somalia, a route used by tankers as they sail to the Cape of Good Hope.

Bangladesh Burns Record Amounts of Coal. Bangladesh tripled its coal-fired electricity generation in 2023 to ease power shortages and alleviate soaring generation costs, with a total of 21 billion KWh produced last year, lifting the market share of coal from 9% in 2022 to 14.2% in 2023.

US Becomes World’s Leading LNG Exporter. US LNG exports hit monthly and annual record highs in December, making the United States the world’s largest exporter of liquefied natural gas, as 8.6 million tonnes departed last month, taking the annual total to 88.9 million tonnes, up 15% from 2022.

OPEC+ to Meet Again in February. Without Angola but desperate to project an image of cohesion and unity, OPEC+ intends to hold its first ministerial meeting of 2024 on February 1, seeking to assess the implementation of voluntary production cuts totalling 2.2 million b/d.

China Restores Import Levies on Coal. The Chinese government has restored import duties on coal that were scrapped in May 2022 as commodity prices went into turmoil, slapping a rate of 6% on thermal coal and 3% on coking coal in a move that could threaten Russian coal suppliers.

Uranium Prices Hit Post-Fukushima High. The spot price of uranium soared to another post-Fukushima record this week, hitting $91 per pound amidst supply hiccups and looming Russia sanctions, with Morgan Stanley analysts expecting yellowcake futures to hit $95/lb by March.

India to Launch New Upstream Licensing Bid. India has offered 28 upstream oil and gas blocks in its 9th licensing round, almost evenly split between onshore, shallow-water and deepwater blocks, aiming to expand the list of bidders beyond ONGC, Reliance/BP and the state-controlled Oil India.

Russia Exports Record Gas Volumes to China. Russia’s state-owned natural gas firm Gazprom announced that it had set a new daily record for gas supplies to China through the Power of Siberia pipeline, taking the total of exports to 22.7 bcm in 2023, 50% more than the 15.4 bcm in 2022.

Exxon Signals Huge California Write-down. US oil major ExxonMobil signaled that its Q4 results (to be posted on February 2) would be adversely affected by a $2.5 billion impairment of assets in Southern California, citing a challenging regulatory environment from the state.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Very Large Product Builds Push Oil Lower Despite Crude Draw

- Average U.S. Natural Gas Prices Plunged by 62% in 2023

- APA Acquires Callon Petroleum in $4.5 Billion Permian Deal

Therefore, any escalation of tension in the region raises fears of wars, a closure of the chokepoints of theStraits of Hormuz and Bab Al-Mandeb and the Suez Canal and the prospect for a disastrous global energy crisis.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert