The International Energy Agency projects that the U.S. is set to become the world’s leading oil and natural gas production superpower. Is that realistic?

Last week I had articles published in both Forbes and the Wall Street Journal (WSJ) addressing a recent report from the International Energy Agency (IEA).

The IEA made headlines when it projected in its World Energy Outlook 2017 that the U.S. would be a net exporter of oil within a decade. The IEA also projected that the U.S. is set to become the world’s dominant oil and gas production leader for decades.

In a pair of articles that risk making peak oilers’ heads explode, I argued that “Yes, the U.S. could achieve energy independence.” However, it depends on how we define energy independence, and there are several important caveats.

Instead of republishing the articles here, I will simply link to them and hit the key points. The Wall Street Journal article is:

Is the U.S. On Track for Energy Independence?

That Forbes article is more focused on numbers and trends:

Is U.S. Energy Independence In Sight?

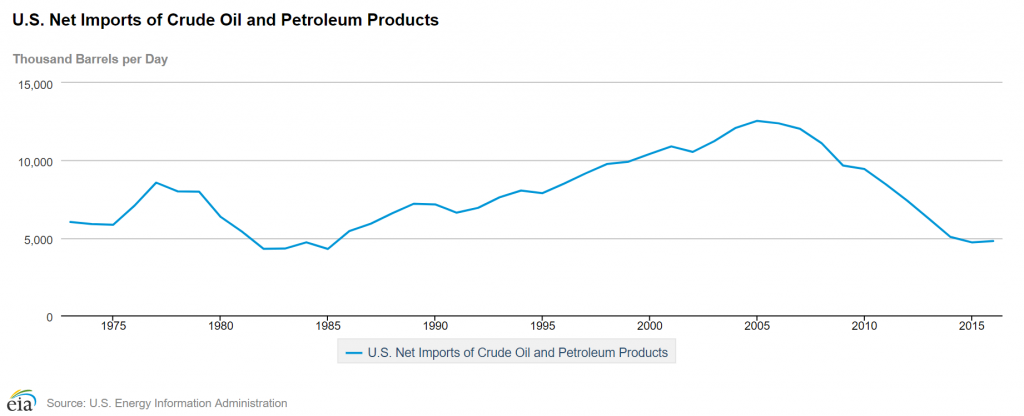

Here is the key point. I was asked in 2005 whether the U.S. could achieve energy independence. I essentially answered that there was a near zero percent chance of that. At that time, U.S. net imports of crude oil and finished products like gasoline had reached a record 12.5 million barrels per day (BPD).

I then proceeded to watch U.S. shale oil ramp up, U.S. refineries start exporting finished products, and U.S. net imports fall by nearly 8 million BPD. My certainty began to waver. In fact, prior to the oil price crash of 2014, the U.S. was on a trajectory to reach zero net imports by 2019:

(Click to enlarge)

Net imports of crude oil and finished products plummeted from 2005 to 2015. Related: Oil Price Drop Imminent If Moscow Says “No” To Extension

I would venture to say that virtually 100% of the peak oil camp would have been like me and deemed such a decline impossible in 2005. So, I have learned to be careful about what I declare to be impossible.

However, there are important caveats. One is the timing of peak shale oil production. I don’t have a good feel for that. It was climbing at a rate of a million BPD each year leading up to the price crash. How long could that last? I don’t really know. It’s possible it could have peaked before 2019, but the price crash made it a moot point.

Energy independence is likely influenced by oil prices. Imagine that oil prices are $150/bbl. That is going to destroy demand, and at the same time spur marginal oil production. Both of those factors would push the U.S. in the direction of energy independence, albeit at the potential cost of wrecking the economy. Related: Are Autonomous Cars Ready To Ditch The Backup Driver?

Second, even if we do achieve energy independence, it will likely be fleeting. In other words, had we reached zero net imports by 2019, we would still be facing a shale oil peak at some point. Then, the U.S. would once again start to become dependent on foreign producers for our oil.

That is unless demand can be curbed. I mentioned this near the end of the WSJ article.

So, those are the high points. I discuss definitions and caveats in those articles. But one thing the last decade has taught me. Be careful about saying “never.”

By Robert Rapier

More Top Reads From Oilprice.com:

I would say that this history of the US oil & gas business will show you that is never the case.

Ever.